PayPal is one of the largest payment platforms on the market. However, there are several PayPal alternatives you should consider using, too. While PayPal facilitates payments for more than 28 million businesses, some of these alternatives might better fit your business needs.

Your business needs might include:

- Seller protection for digital goods

- Lower fees for chargebacks

- Faster turnaround for withdrawn PayPal funds (PayPal can take up to four business days to show up in your account)

- A more hands-on customer success team

Luckily, we've gathered the top PayPal alternatives listed below. From Bitcoin-friendly to global-ready — find a solution that works for you, your business, and your customers.

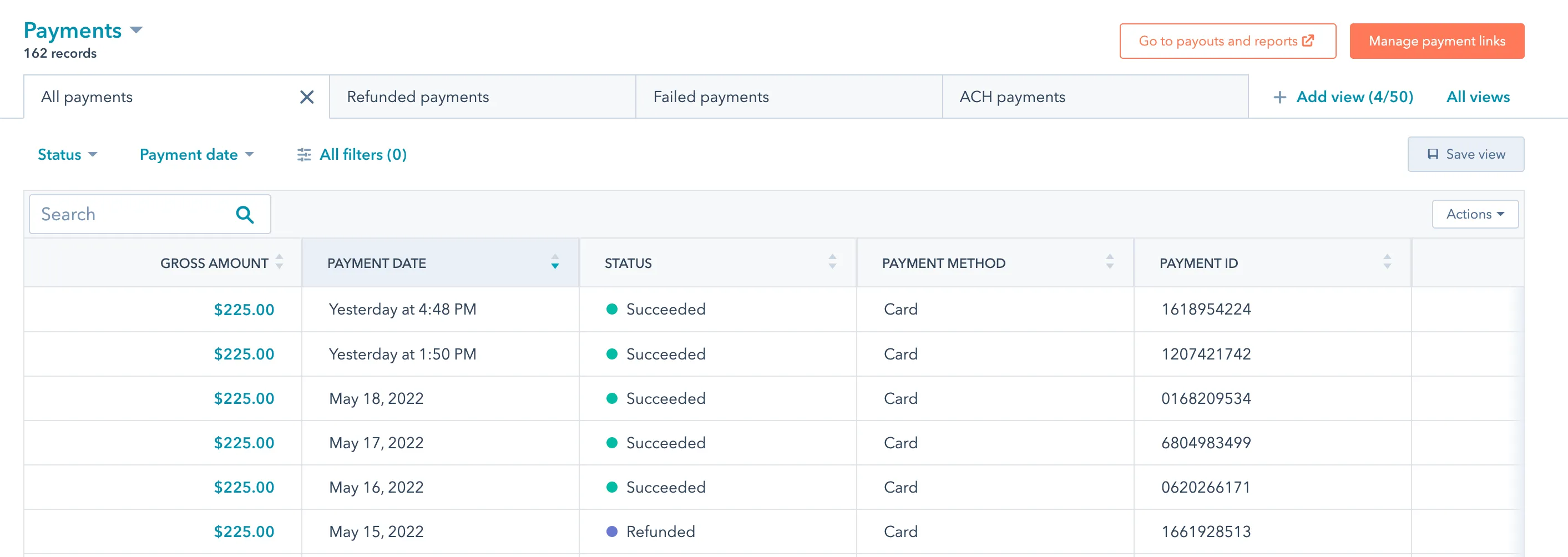

1. HubSpot Payments

Get started with HubSpot’s Payments tool.

If you’re already using a HubSpot CRM, it only makes sense to incorporate HubSpot Payments. HubSpot Payments easily streamlines payment processing, making it easier to receive your funds.

Your sales team can create payment links that do not require an access code — meaning you can place payment links anywhere you can embed a link, such as in meetings, quotes, forms, invoices, etc.

- Pricing: There are no monthly fees or minimums to use Payments. However, you must have a Starter+ HubSpot account.

- ACP payments: (0.5%) of the transaction amount, up to $10.

- Cards: 2.9% per transaction

Get started streamlining your payment processes with HubSpot’s Payment tool.

2. Google Pay

Your customers can pay in-app, in-store, or on your website. Google Pay allows businesses to enable shopping across all devices, reducing the frequency of forgotten passwords and missed conversions. You can also deliver custom mobile offers and recommendations to your customers, share loyalty and gift cards, and reduce the need for ticketing.

- Implementation: Developer documentation

- Price: Free

- Apps: Android | iOS

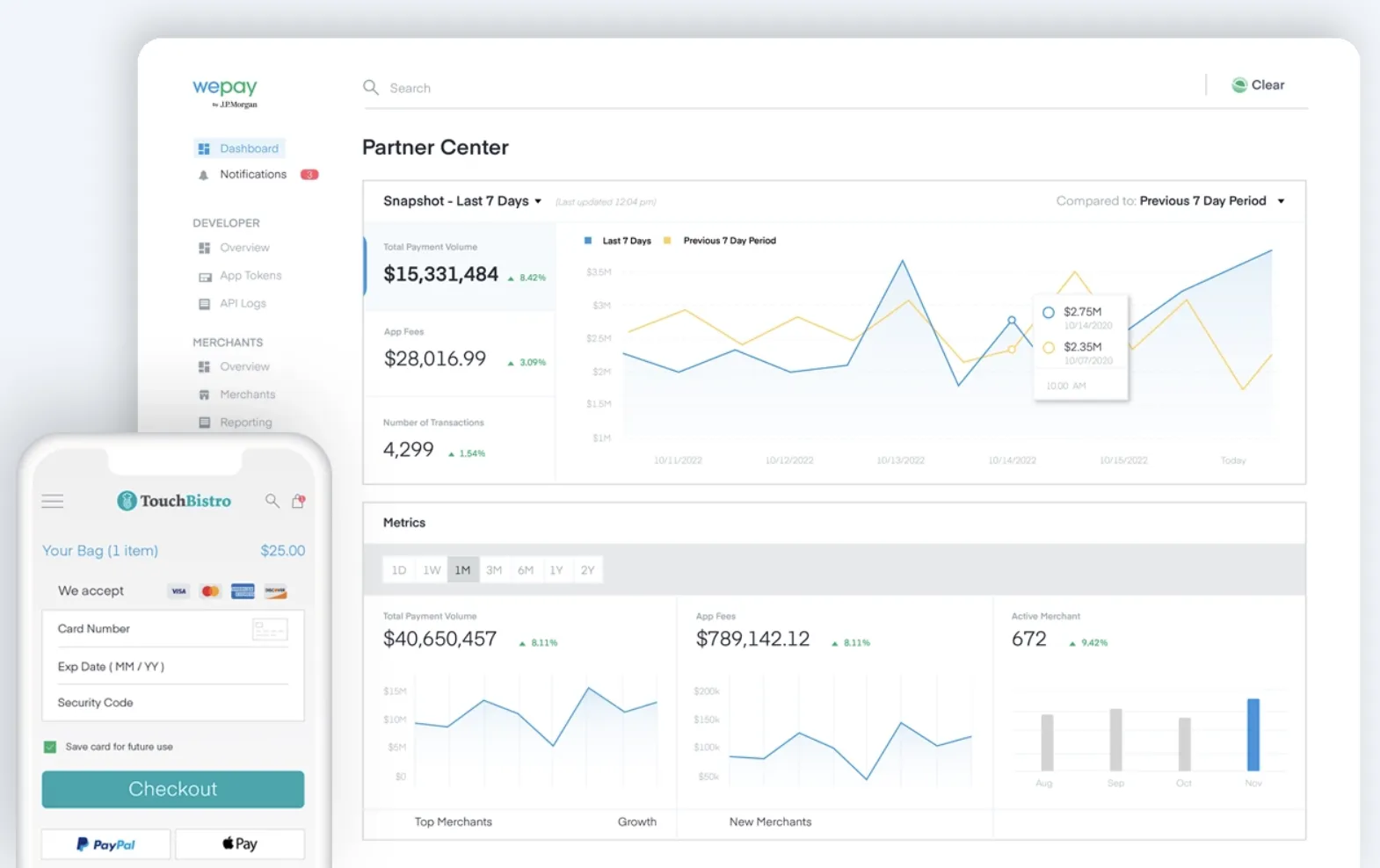

3. WePay

WePay offers integrated payments for platforms. It’s built to enable instant onboarding and processing “with the scale of JPMorgan Chase.” Specializing in unique online, POS, and omnichannel software platforms, WePay enables businesses to embed transaction and payout capability with a single integration.

- Implementation: Developer documentation

- Pricing: Available upon request

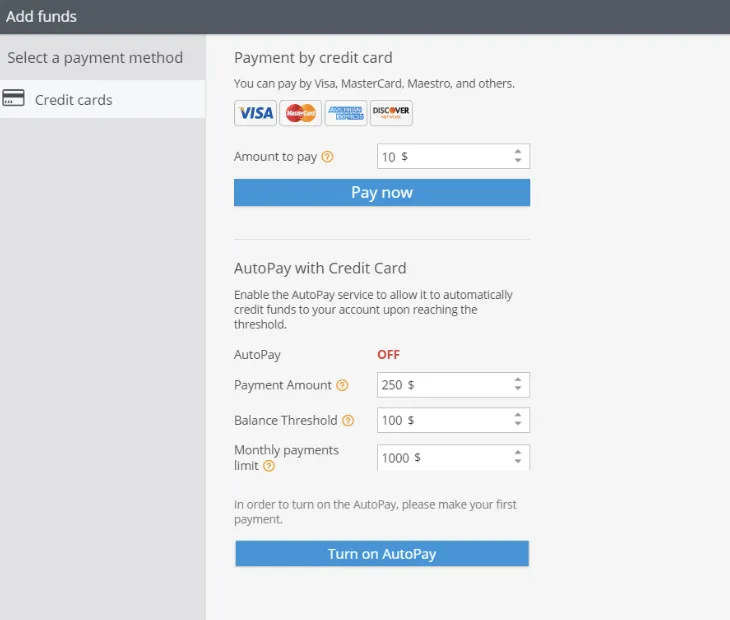

4. 2CheckOut

Looking for a global option? Consider 2CheckOut, which offers eight payment types, 15 languages, and 87 currency options in more than 200 global markets. The platform provides a mobile-friendly experience with branding customized to your business.

Plus, you’ll enjoy 300 fraud rules per transaction, higher PCI compliance, and easy integration with more than 100 online carts and extensive documentation.

- Implementation: Developer documentation

- Pricing: Varies by plan

- 2SELL, 3.5% + $0.35 per successful sale

- 2SUBSCRIBE, 4.5% + $0.45 per successful sales

- 2MONETIZE, 6.0% + $0.60 per successful sale

5. Authorize.Net

Accept electronic and credit card payments in-person, online, or over the phone with this payment gateway service. Working with small businesses since 1996, Authorize.Net has more than 43,000 merchants, handles more than one billion transactions, and facilitates $149 billion in payments every year.

It’s a subsidiary of Visa and sold through resellers, including Independent Sales Organizations, Merchant Service Providers, and financial institutions. You’ll receive free, 24/7 support and an award-winning API integration.

They also integrate easily with PayPal, Apple Pay, and Visa Checkout, allowing you to accept customer payments worldwide — as long as your business is based in the United States, Canada, United Kingdom, Europe, or Australia.

- Implementation: Developer documentation

- Pricing: Varies by plan

- All-in-One: no setup fee, $25monthly gateway, 2.9% + $0.30 per transaction

- Payment Gateway Only: no setup fee, monthly gateway $25, $0.10 + a daily batch fee of $0.10

- Enterprise Solution: tailored pricing, data migration assistance, interchange plus options

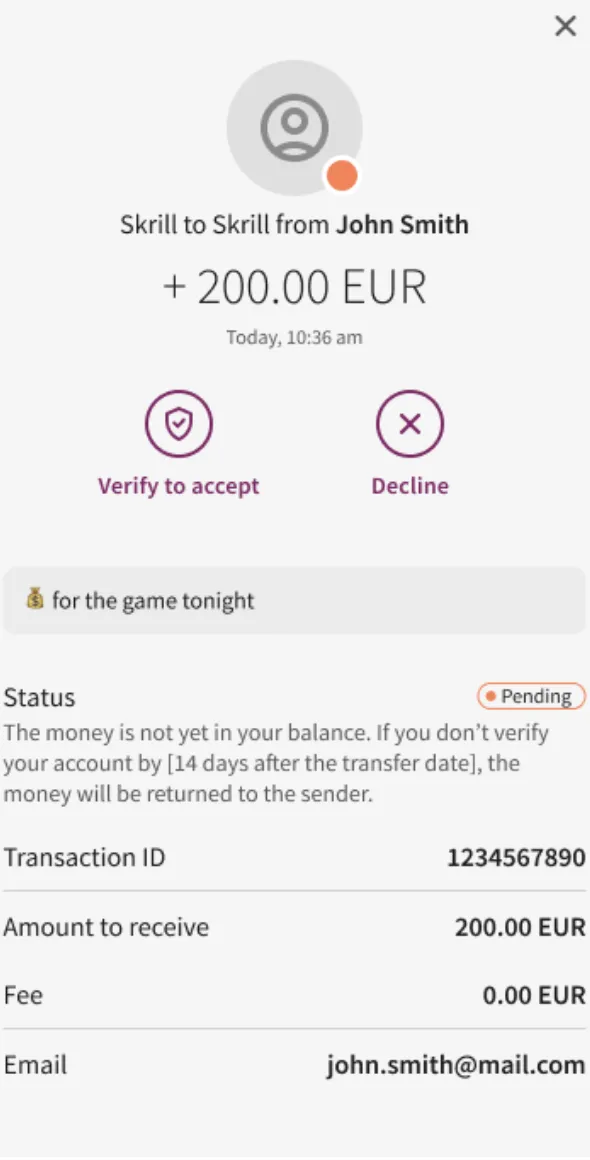

6. Skrill

Skrill allows you to send and receive money, store cards, link bank accounts, and make payments with just your email address and password. Skrill “wallet holders” also only pay fees of 1.45%, so you get to keep more of the money from every transaction. Whether you’re using Skrill for business or personal use, you’ll receive access to global support in more than 30 countries.

- Pricing: It’s free to open a personal account

- More information on transaction fees here

- Apps: iOS | Android

7. Intuit

QuickBooks Payments promises you’ll get paid twice as fast if you use their service. They allow you to take mobile card payments, send invoices online, and set up recurring billing.

You’ll get real-time alerts when customers view or pay invoices — and payment reminders are all automated. And all that invoice data entry? It appears in QuickBooks in real-time without needing any adjustments from you.

- Pricing: Varies by plan

- Pay as you go, $0 per month — Bank transfers (ACH), free

- Card — Swiped, 2.4% + $0.25 per transaction

- Card — Invoiced, 2.9% + $0.25 per transaction

- Card — Keyed, 3.4% + $0.25 per transaction

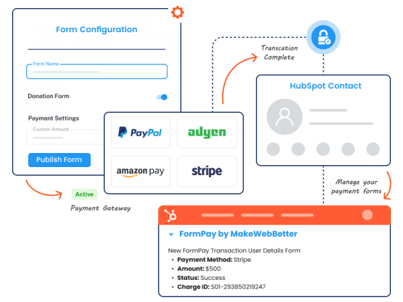

8. FormPay

One app for global payments. Accept payments anywhere from your customers all over the world, using simple payment forms with gateways of your choice. Facilitate region-specific payment modes and popular payment methods.

Be it one-time payments or recurring, get payment functionality up and running in no time. Receive, track, manage and reconcile payments seamlessly with real-time reporting and analytics.

You only need HubSpot forms to create a payment form in FormPay. Best part, you can use even the free HubSpot version for this.

Implementation: Developer Documentation

Pricing; $49 /month

9. ProPay FormPay

ProPay offers payment solutions for small businesses, enterprise businesses, and a variety of industries, including direct selling, auto dealers, and legal. They facilitate credit card payment and payment processing and offer global disbursement and commission payment options.

ProPay also offers payment solutions for SaaS platforms, marketplaces, and software providers through pay-by-text or “one-click” email payments.

- Implementation: Developer documentation

- Pricing: Available upon request

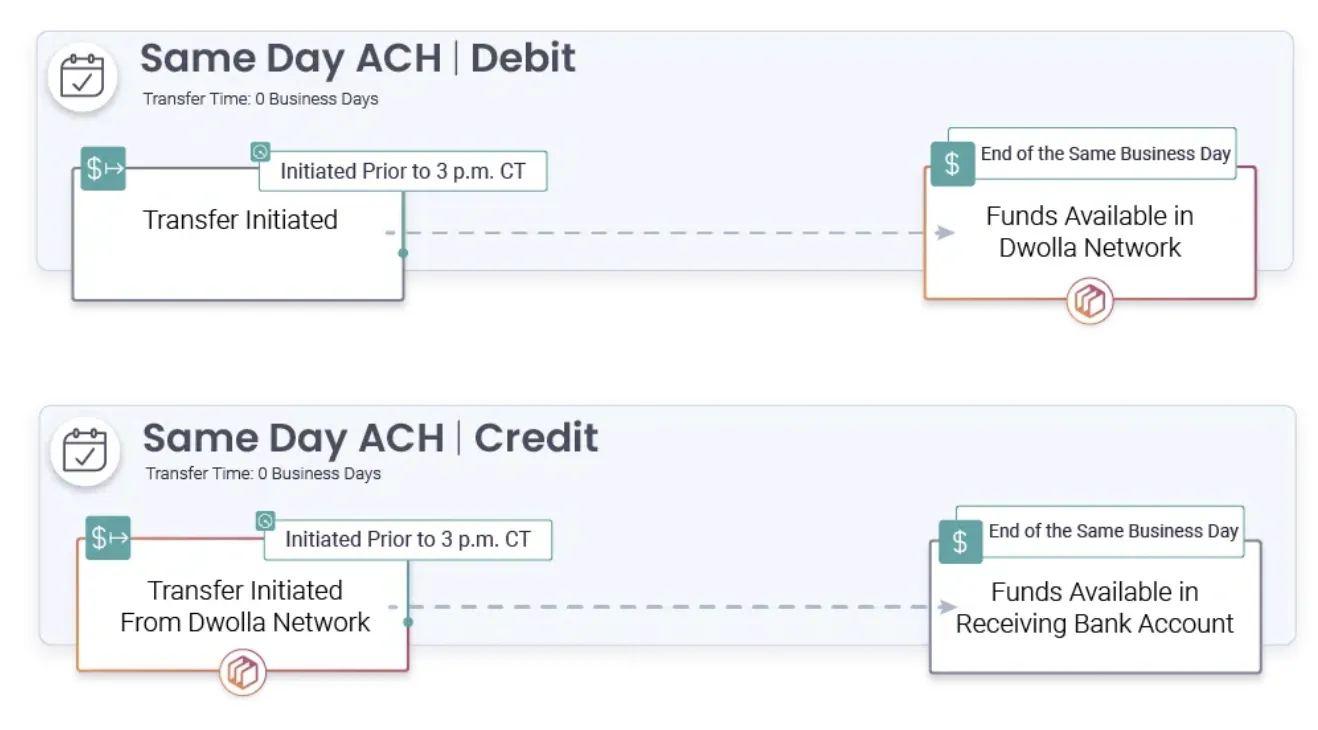

10. Dwolla

Dwolla prides itself on being developer-friendly and easily integrated with your application. It has a white-label API, which means your customers always interact with the interface they trust — yours. Customer identity is verified without third-party site involvement, and it’s easy to add bank accounts.

Dwolla will also automate your payments and send up to 5,000 payments with a single API request. It also boasts a 99.9% uptime, sophisticated security, predictable pricing, and a hands-on customer success team.

- Implementation: Developer documentation

- Pricing: Varies by plan. Available upon request.

11. Braintree Image Source

Image Source

Braintree is actually a PayPal service. Braintree Direct, Braintree Marketplace, Braintree Auth, and Braintree Extend offer payment solutions customized to the unique needs of your business.

It makes it easy to accept online and mobile payments in more than 130 currencies and more than 45 countries. And adding Hosted Fields to its Drop-in UI means your users will enjoy a seamless checkout experience.

- Implementation: Developer documentation

- Pricing: Varies by plan:

- Standard pricing, 2.59% + $0.49 per transaction

- Custom pricing available upon request

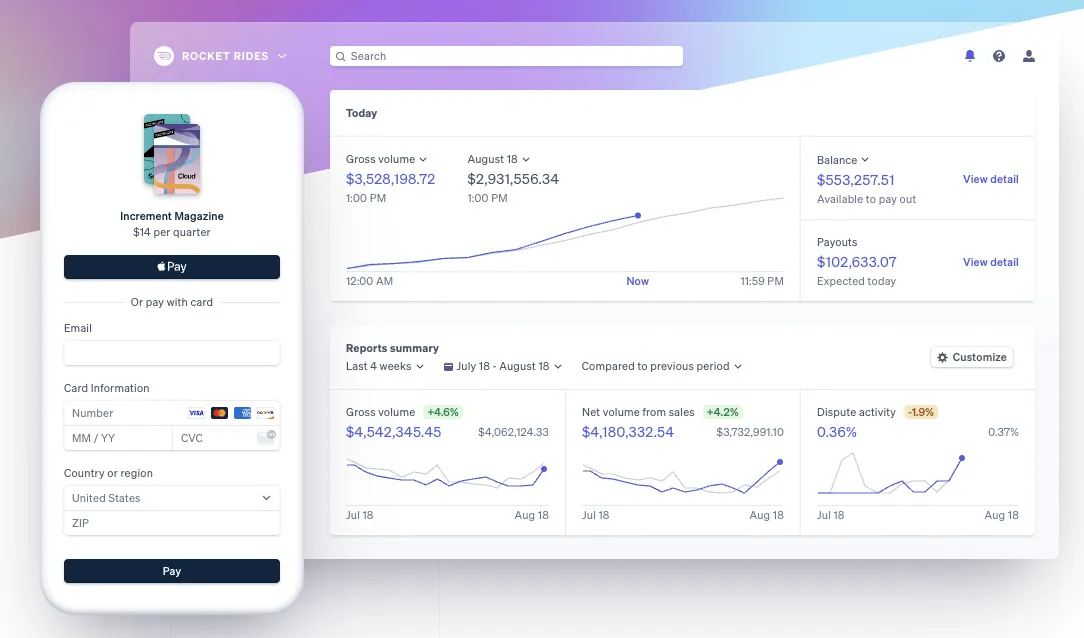

12. Stripe Image Source

Image Source

Running an internet business? Stripe could be right for you. It's a “developers first” company that believes “payments is a problem rooted in code, not finance.” With its easy API, you can have Stripe up and running in just a couple of minutes.

- Implementation: Developer documentation

- Pricing: Pay as you go:

- 2.9% + $0.30 per successful card charge, + 1% on international cards

- 0.8% and a $5 cap on ACH debits

- Custom pricing available upon request

13. Payoneer

Whether you're a business owner, freelancer, or professional, Payoneer can help you get paid quickly, securely, and at a low cost by international clients. It specializes in diverse markets and industries, so it doesn’t matter whether your company is focused on e-commerce, online advertising, or vacation rentals.

Payoneer has 4 million users in more than 200 countries and can handle your business with ease. Simply sign up for Payoneer, begin receiving online payments to your Payoneer account, and withdraw funds from your local bank or ATMs worldwide.

- Pricing: Payments from other Payoneer customers, free

- Receiving accounts using Payoneer’s Global Payment Service, free

- Payments directly from your customers, 3% on credit cards in all currencies, and 1% on eChecks

- Payments via other marketplaces and networks, pricing varies

- Apps: iOS | Google Play

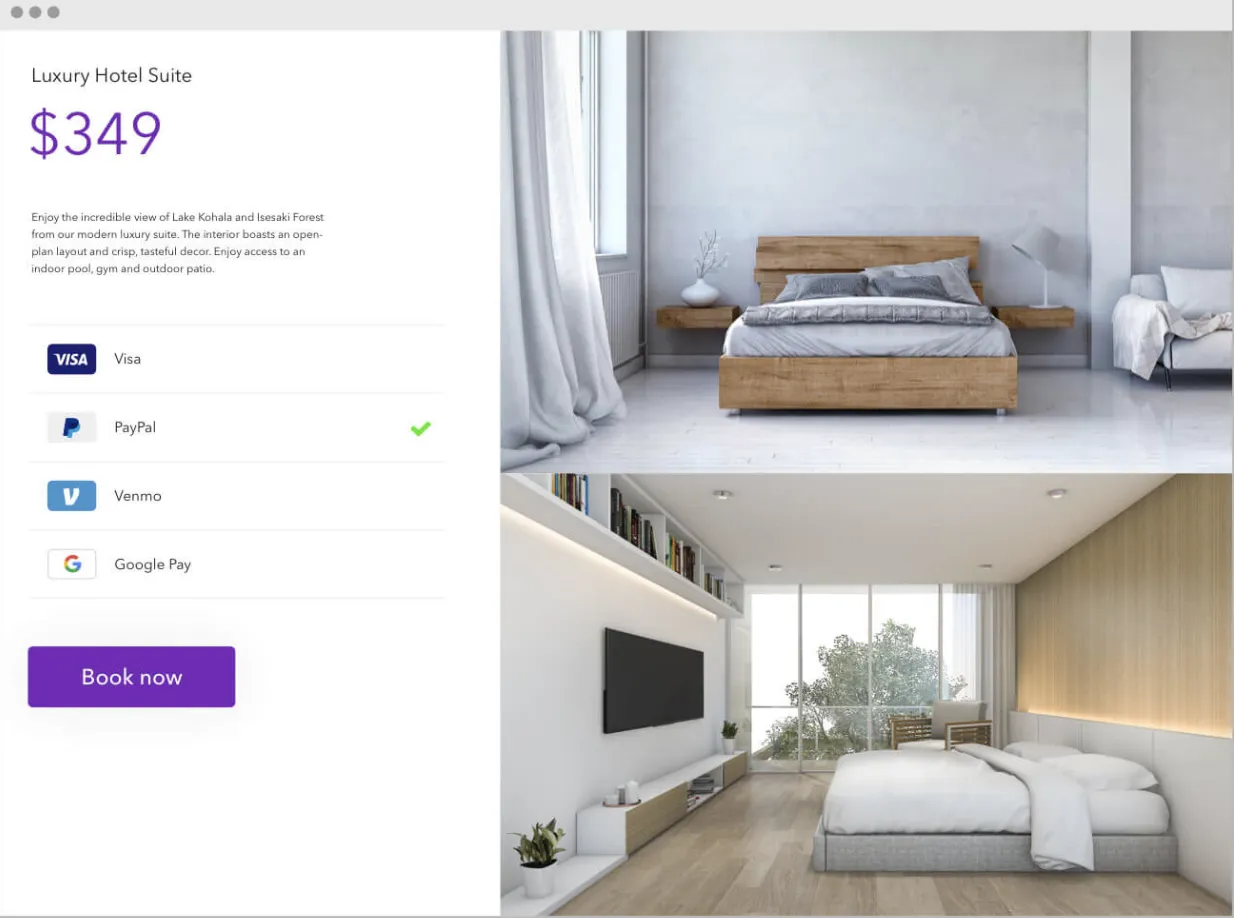

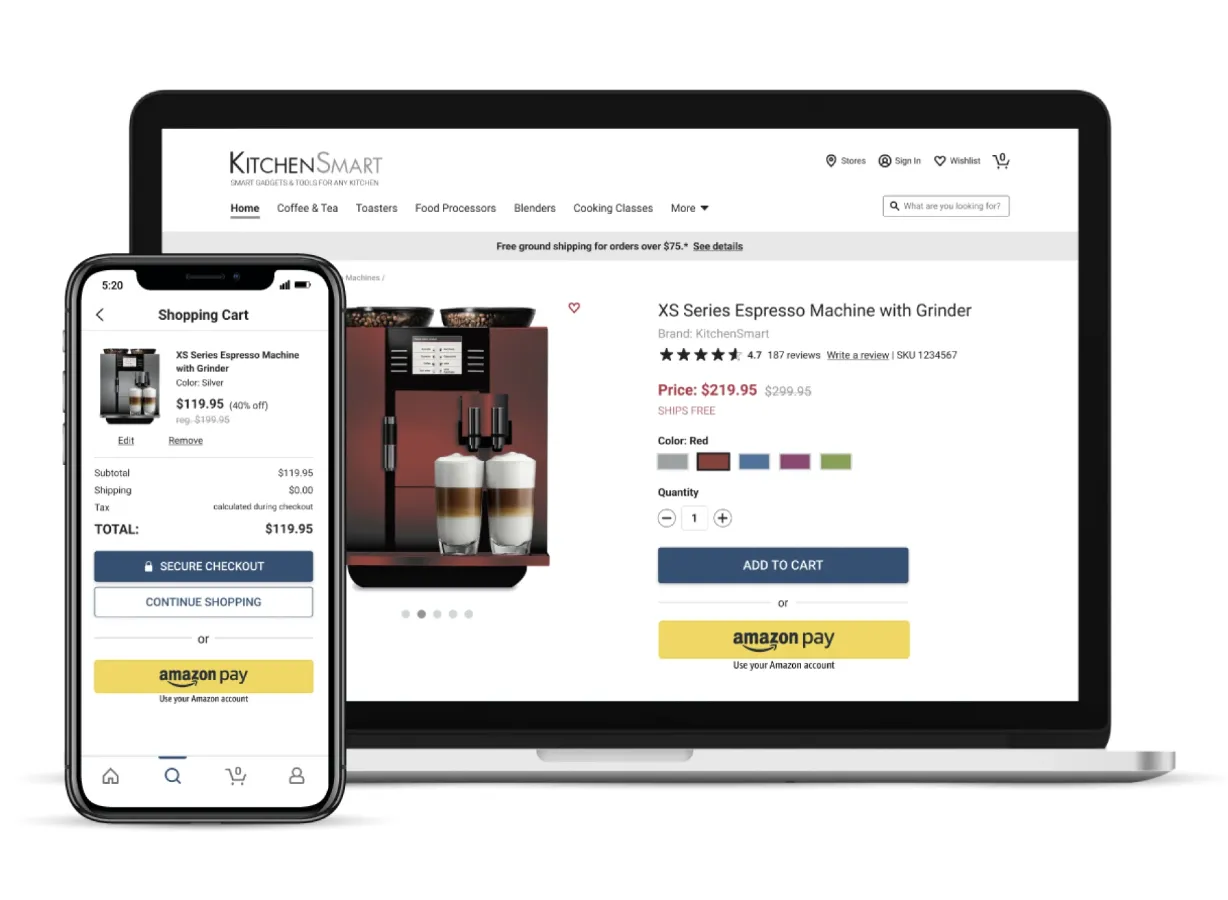

14. Amazon Pay

Amazon has portals for merchants, shoppers, and charities. Your customers will find it easy to use because they’ll log in using their Amazon account information and check out using the same Amazon process they already trust.

Plus, you get the extra security of Amazon’s fraud protection at no additional cost. All transactions are completed on your site, and Amazon Pay integrates with your existing CRM. It’s also available across devices, so you can manage payments on the go.

- Implementation: Developer documentation

- Pricing: 2.9% + $0.30 cents per domestic U.S. transaction, 3.9% for cross-border processing fee, and $20 for disputed charges

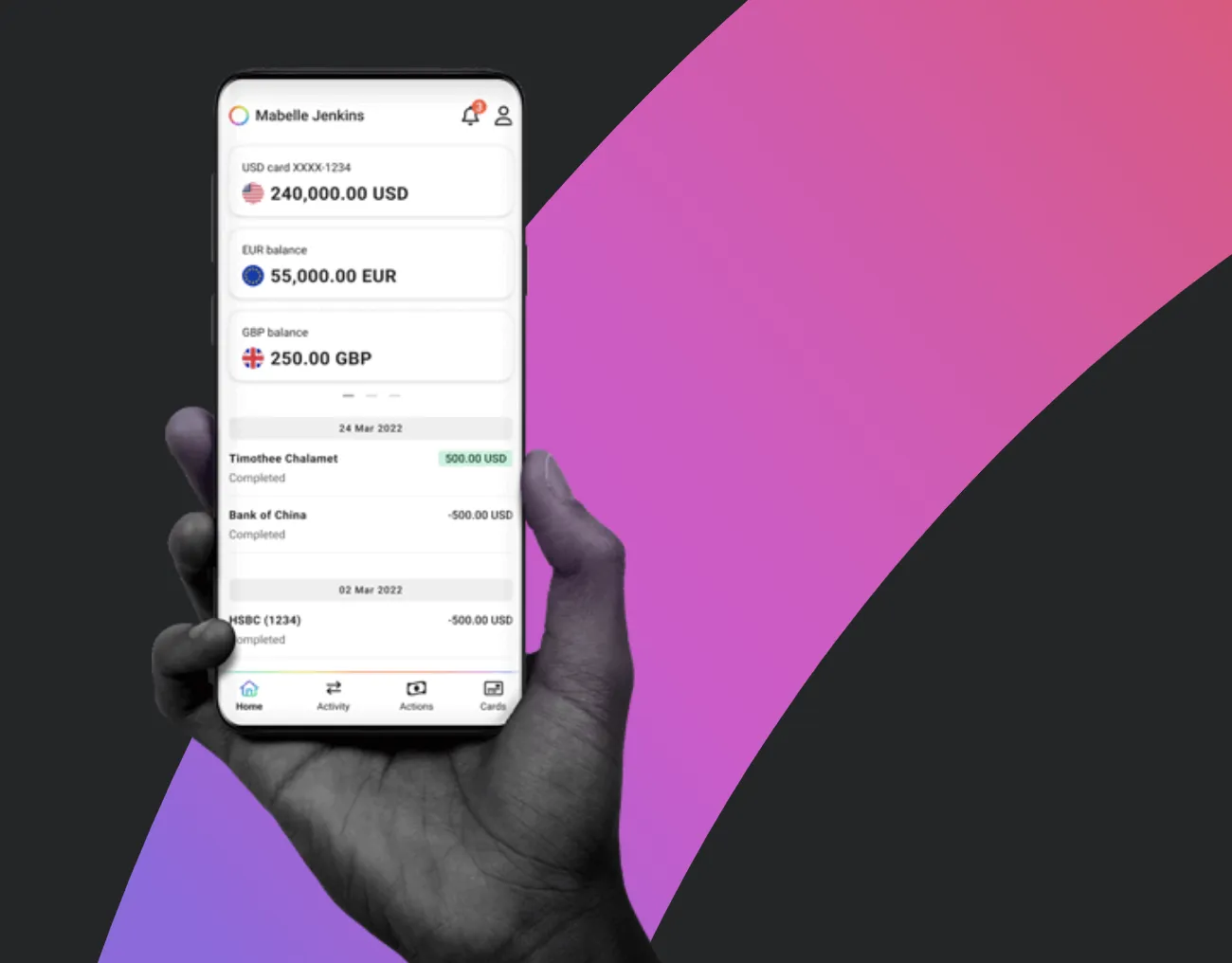

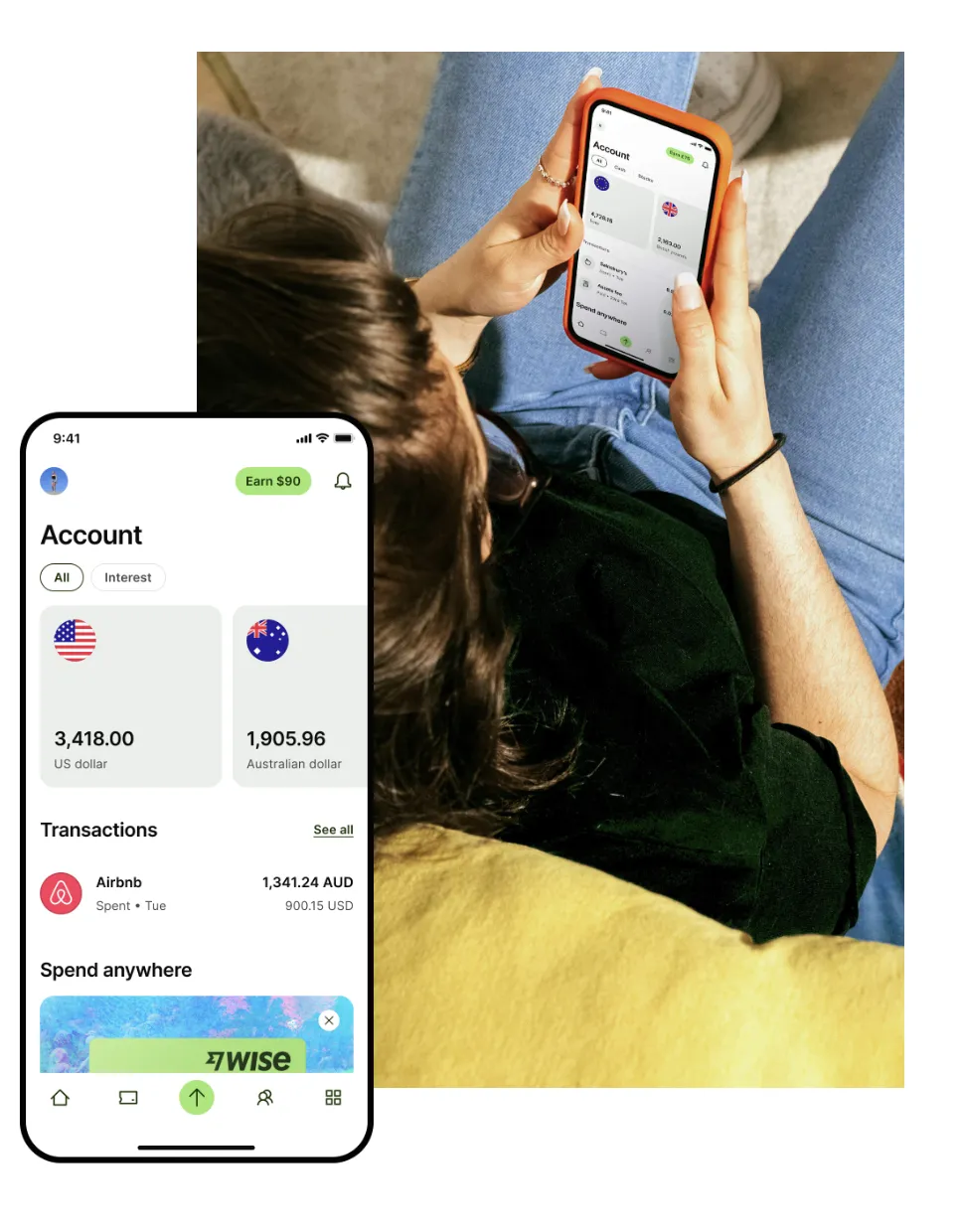

15. Wise

Wise bills itself as “a cheaper way to send money internationally.” Send and receive money with a Wise borderless account, join the waitlist for a Wise debit card, run payroll or batch payments, get paid as a freelancer, and even explore the payouts API.

It also claims to have the fairest exchange rate, banishes hidden fees, and completes 90% of transfers from the U.K. to Europe in one business day. If you conduct a high volume of international transactions, Wise is worth checking out.

- Pricing: View fee structure here

- App: iOS | Android

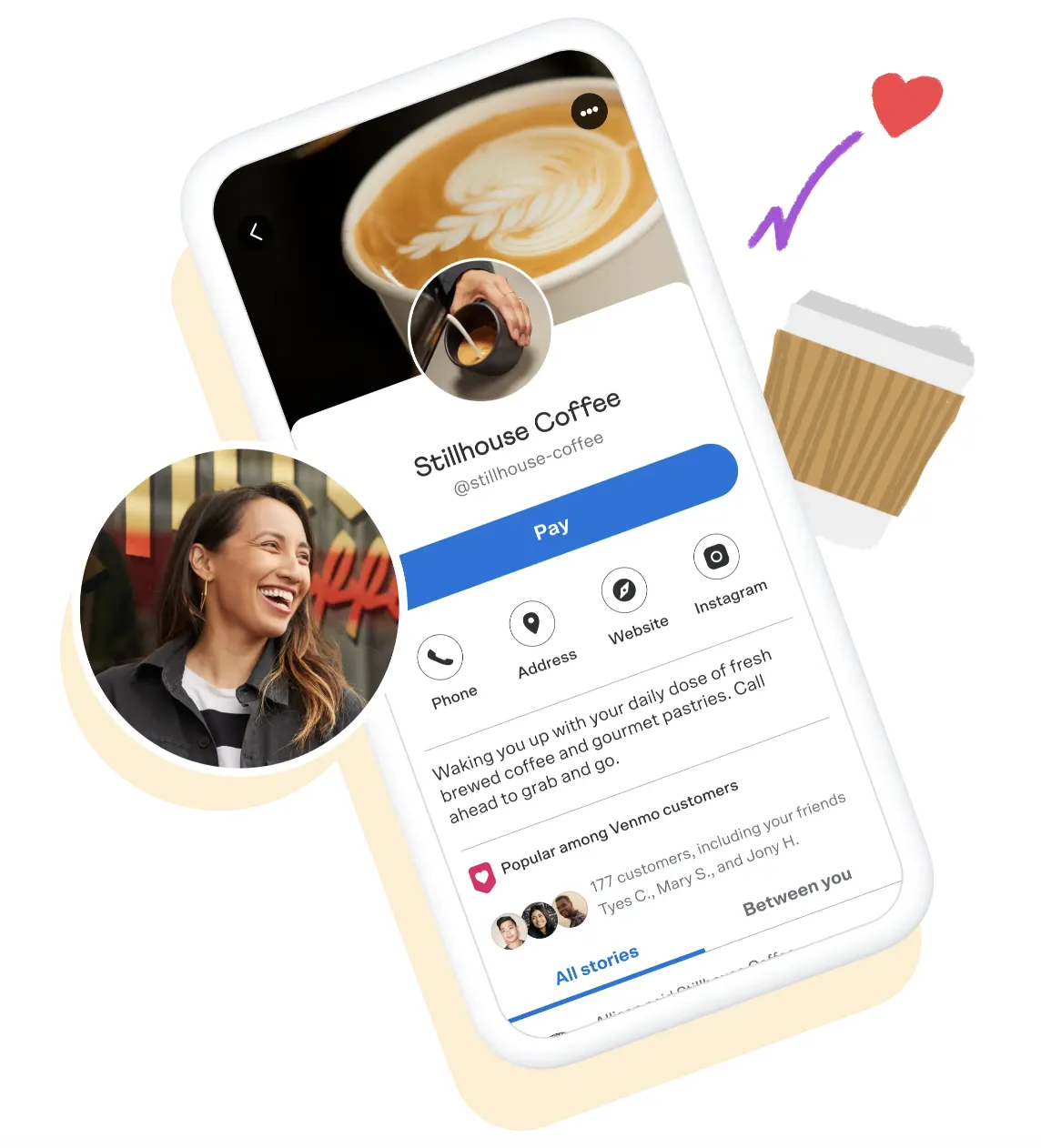

16. Venmo

You’ve probably used Venmo to pay a friend back for pizza or concert tickets — but did you know Venmo works for business transactions as well? Add the platform to your mobile website or app and use Venmo’s social benefits as bonus marketing for your business.

You’ll need to integrate with either Braintree or PayPal Checkout to add Venmo as a payment option, but if the social aspect of payments intrigues you, Venmo is worth a look.

17. Square

Select your business size and type, and you’re signed up for Square. It works best for retail and in-person transactions and offers two main plans. Square Point of Sales allows you to accept cards, cash, check, and even gift cards, print or digitally send receipts. You can also process invoices and recurring payments.

A big bonus here? You can also swipe cards without a connection, so you never have to worry about losing business from outages again.

Square for Retail allows you to sell faster with a search-based point of sale, track, adjust, and transfer inventory, manage your vendors, and create customer profiles with every sale. You can also create cost of goods sold reports, send purchase orders, and set up employee time cards and permissions.

- Implementation: Developer documentation

- Pricing: View all pricing options here

18. Payline

Payline offers products that fit your business — whether you’re in-store, mobile, or online. Payline has various partnership options that allow you to customize your plan.

- Implementation: Developer documentation

- Pricing: See full plan breakdowns here

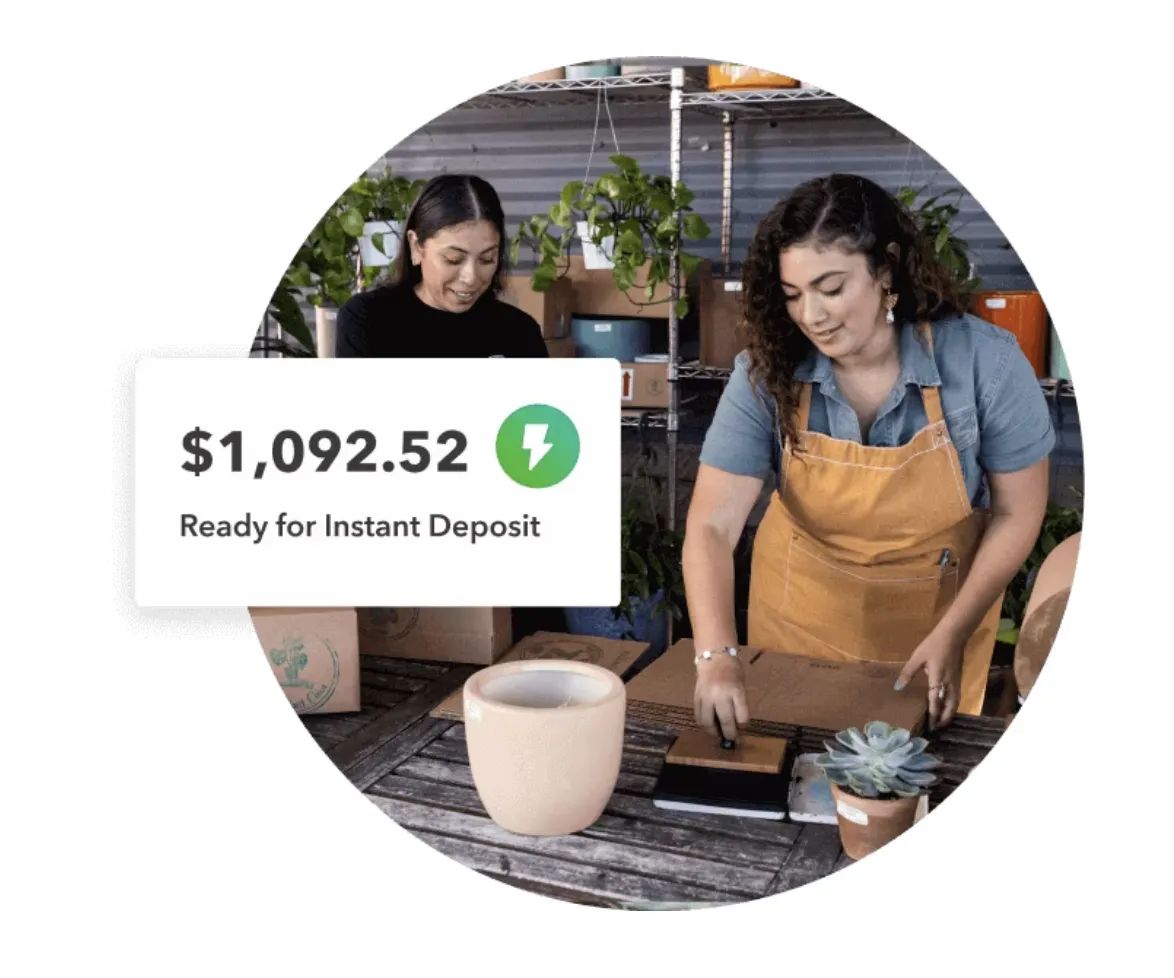

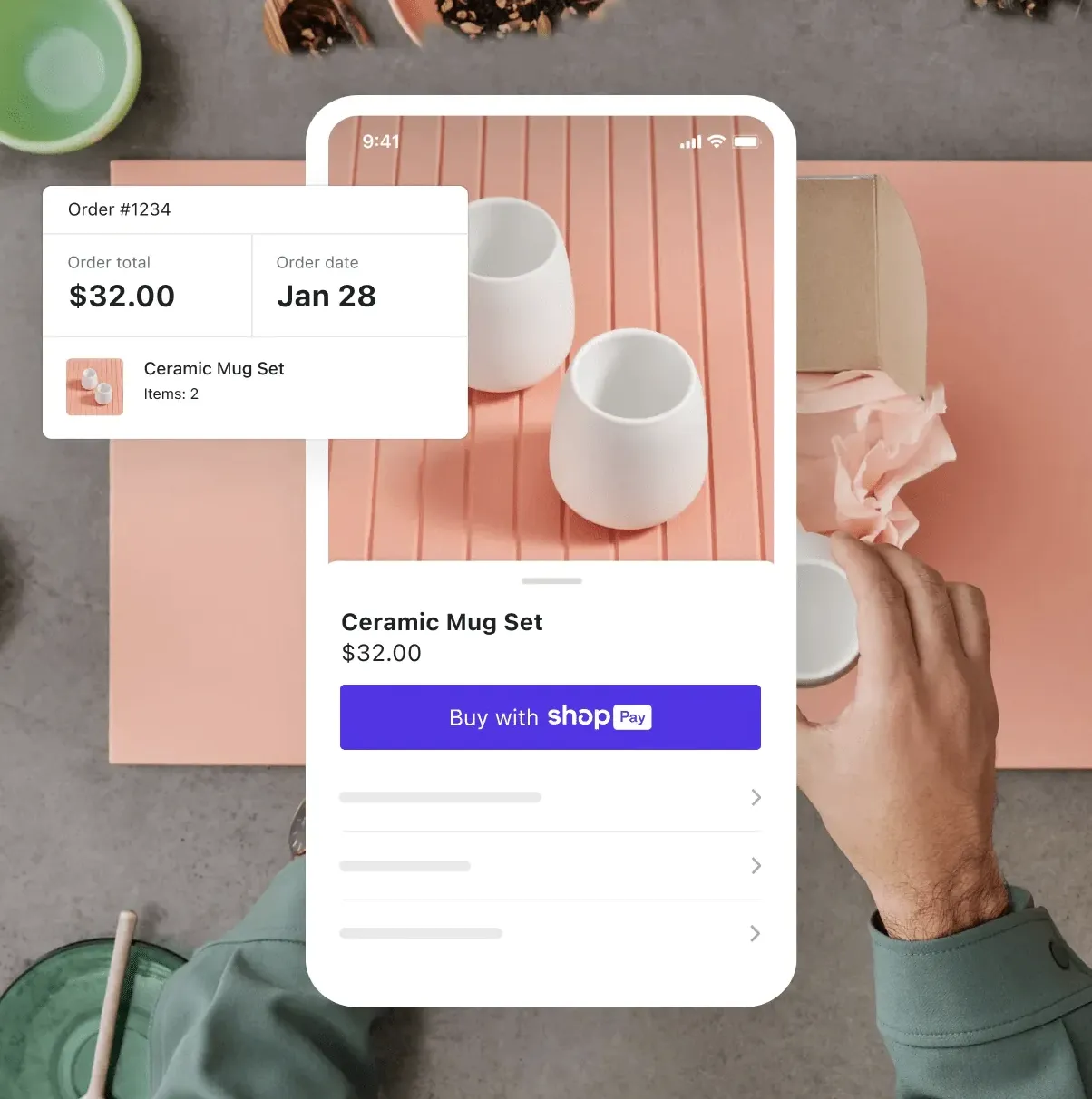

19. Shopify Payments

Accept credit cards directly with Shopify, no third-party required. Track your balance and payment schedule from a convenient store dashboard and get email alerts when new funds arrive in your bank account. Shopify POS makes it possible to accept credit cards — whether you’re on the go or in a retail store — all while taking advantage of rates as low as 2.4% + $0.30.

Shopify also facilitates Pinterest Buyable Pins, Facebook shops, Facebook Messenger, Amazon, eBay, and Enterprise-level accounts.

- Pricing: Varies by plan:

- Basic Shopify, $39 per month, online credit card rates of 2.9% + $0.30, in-person credit card fees of 2.7%

- Shopify, $105 per month, online credit card rates of 2.6% + $0.30, in-person credit card fees of 2.5%

- Advanced Shopify, $399 per month, online credit card rates of 2.4% + $0.30 cents, in-person credit card fees of 2.4%

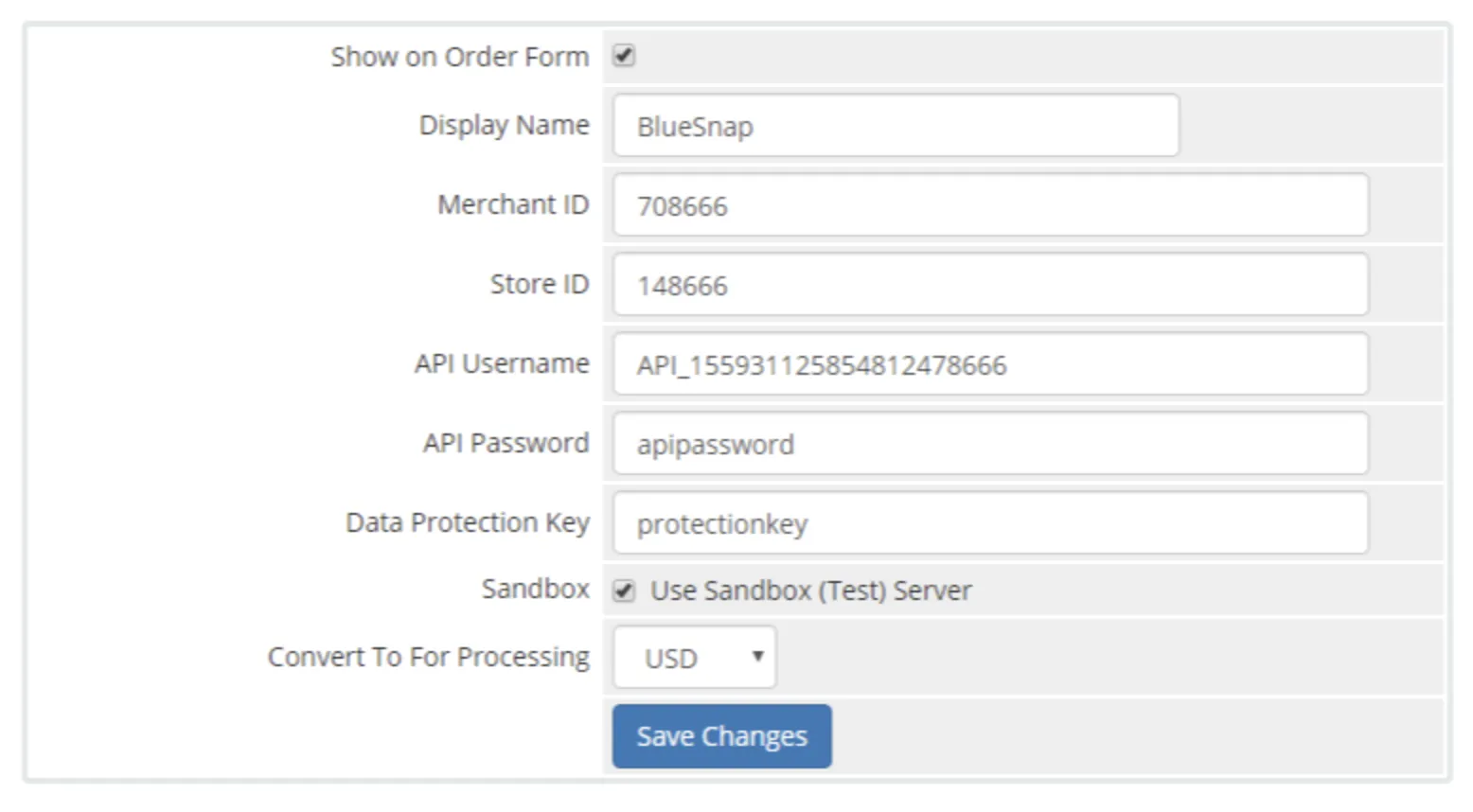

20. BlueSnap

Get a payment gateway solution, merchant account, and other features to help you grow your business. Intelligent payment routing offers optimized conversions, payment analytics, chargeback management, risk management, and the ability to process more than 100 global payments.

BlueSnap also integrates with the platforms you already use, including your shopping cart, ERP, and CRM systems, to make implementation a breeze.

- Implementation: Developer documentation

- Pricing: Varies based on business needs

- Card transactions, 2.90% + $0.30 cents

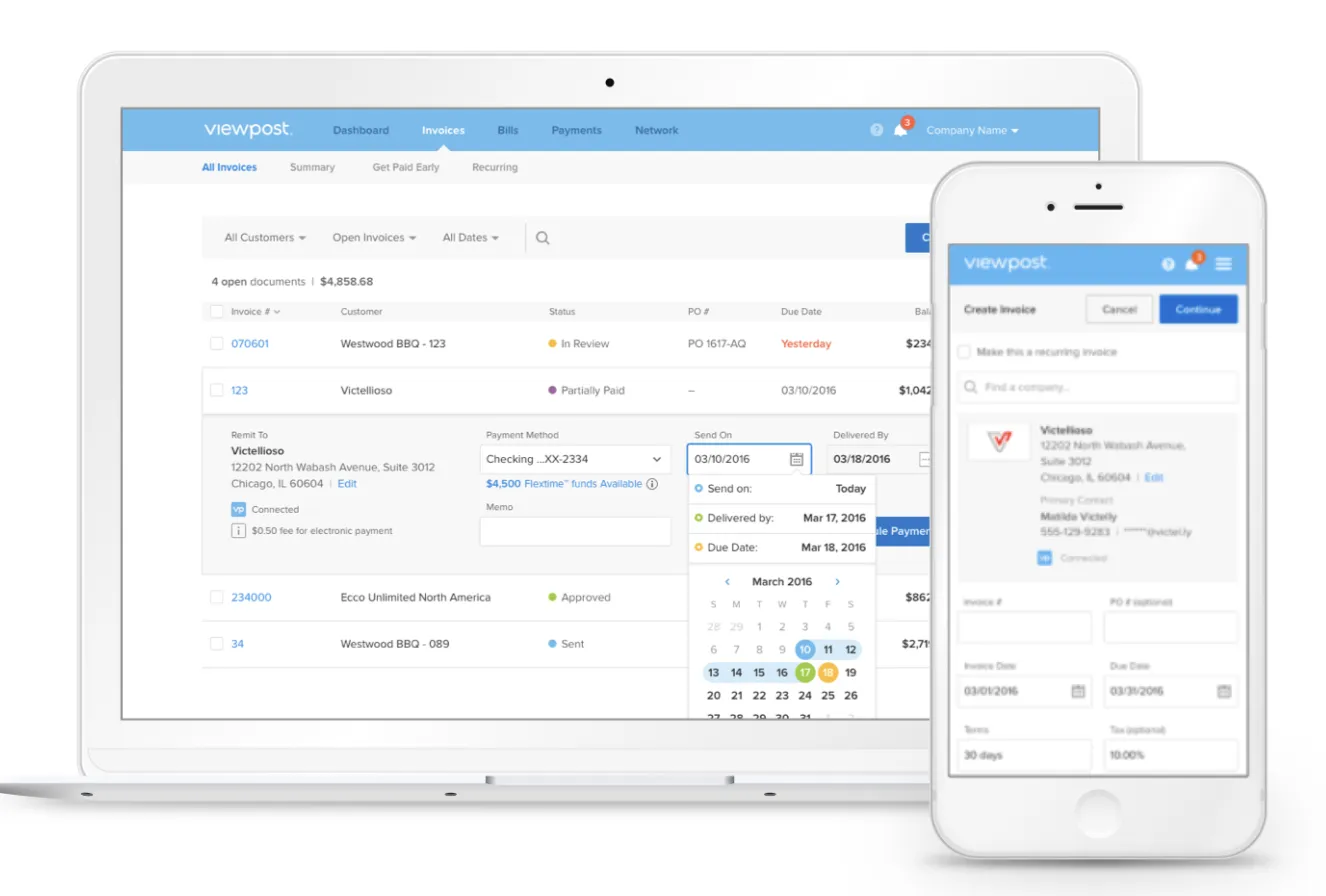

21. Viewpost

Send and track professional, customized invoices, and access early payment discounts for greater control over working capital. Plus, save time with a full-featured billing and payment solution that works whether you’re a freelancer or an enterprise company.

- Pricing: $19.99 per month plus transaction fees (available upon request)

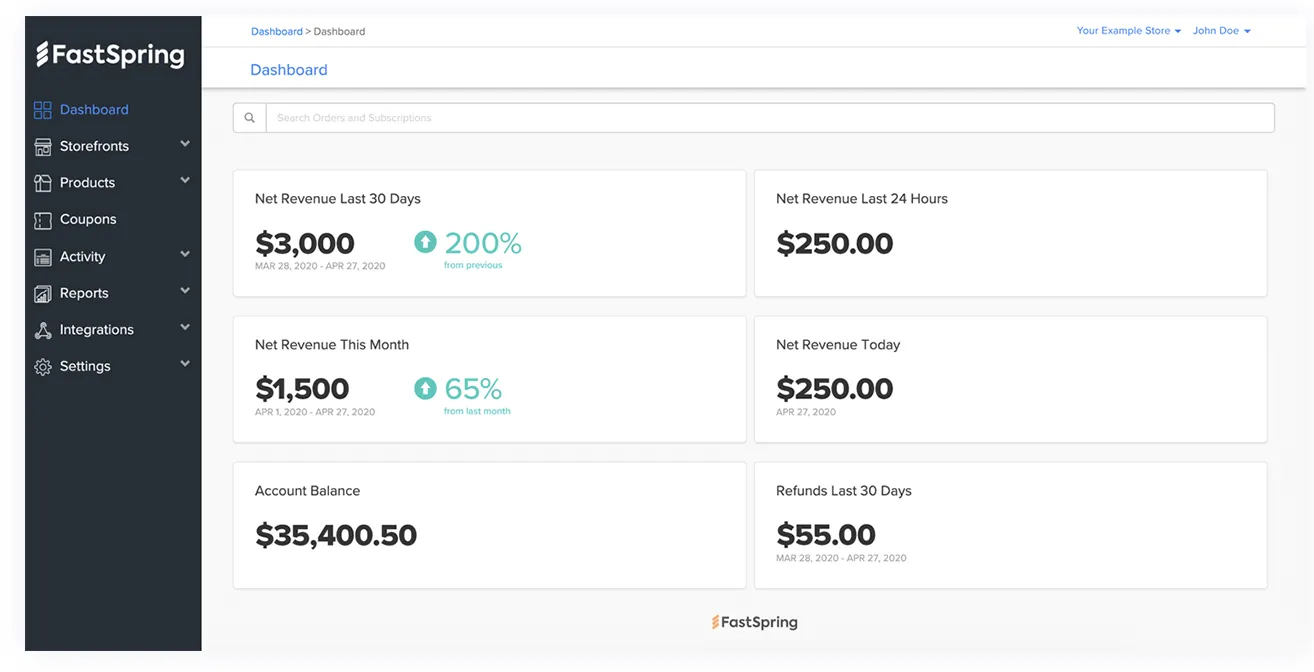

22. FastSpring

This “end-to-end” e-commerce platform specializes in companies selling software, content, or apps online. They enable global subscriptions and payments for digital companies (across web, mobile, and in-app) and integrate with the digital products you need to grow your business.

They offer omnichannel distribution enablement, a personalized ecommerce shopping experience, popup checkout for customers, subscriptions, and recurring billing. They also facilitate global payments with localized experience and offer tax management help.

- Implementation: Developer documentation

- Pricing: Available upon request

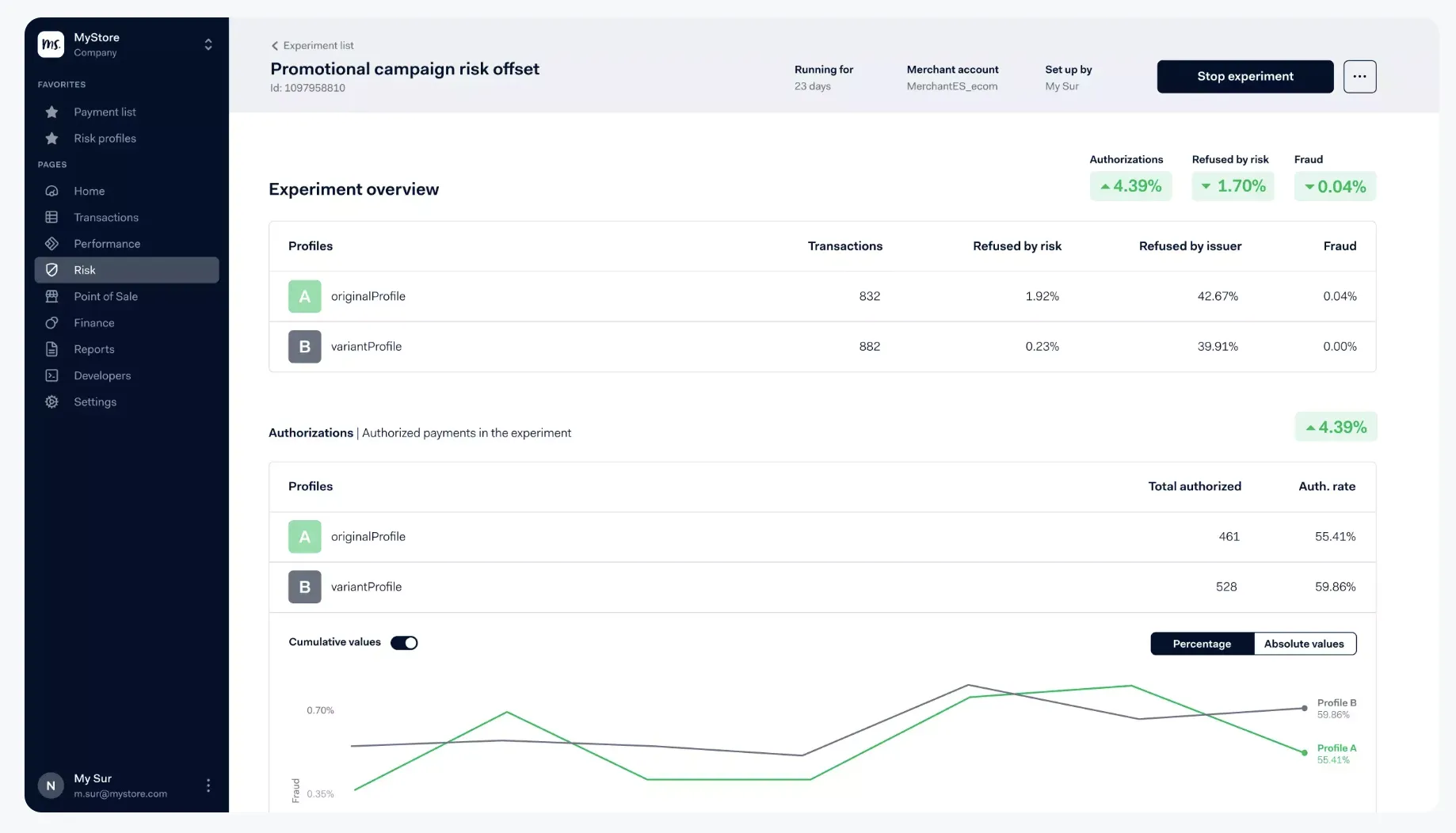

23. Adyen

Ayden is a multichannel option that allows your customers to use whatever payment method they see fit, whether that be online, in-app, or in-store. The company boasts an impressive list of customers, including Uber, eBay, and Spotify — and for good reason.

The solution is dynamic, reliable, and accessible. Backed by a reasonable pricing structure, Ayden can work for businesses of any size.

- Implementation: Developer Documentation

- Pricing: $0.12 processing fee per purchase

- Apps: Android

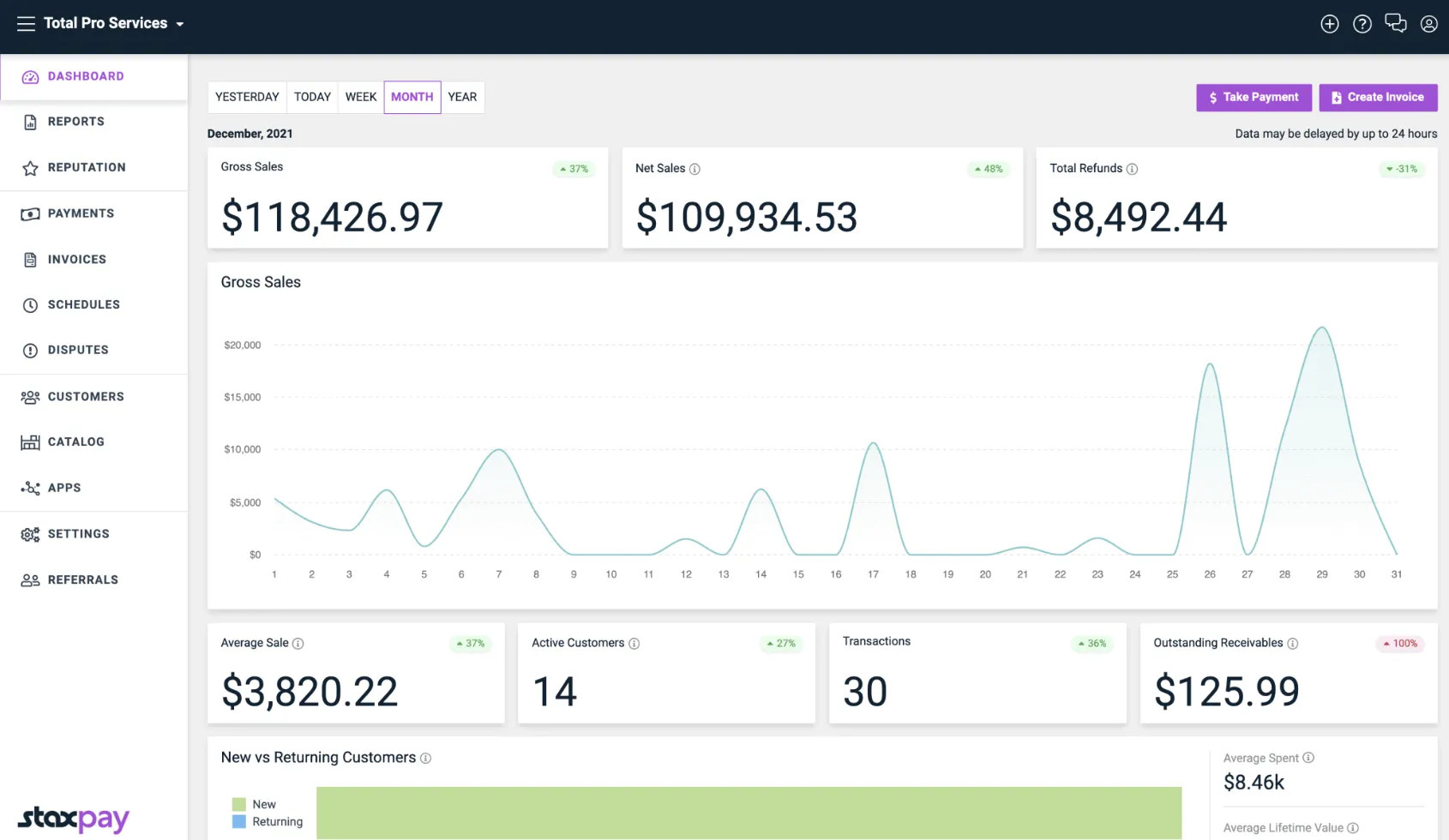

24. Stax Pay by fattmerchant

Stax Pay is included in the broader Stax finance platform. It's a versatile solution that allows for fast, secure payments over the phone, on the go, or in person with its Stax Pay Smart Terminal device. The platform can accommodate businesses of virtually every size and serves various industries — including retail, professional services, field services, and healthcare.

- Implementation: Developer Documentation

- Pricing: Plans start at $99 per Month

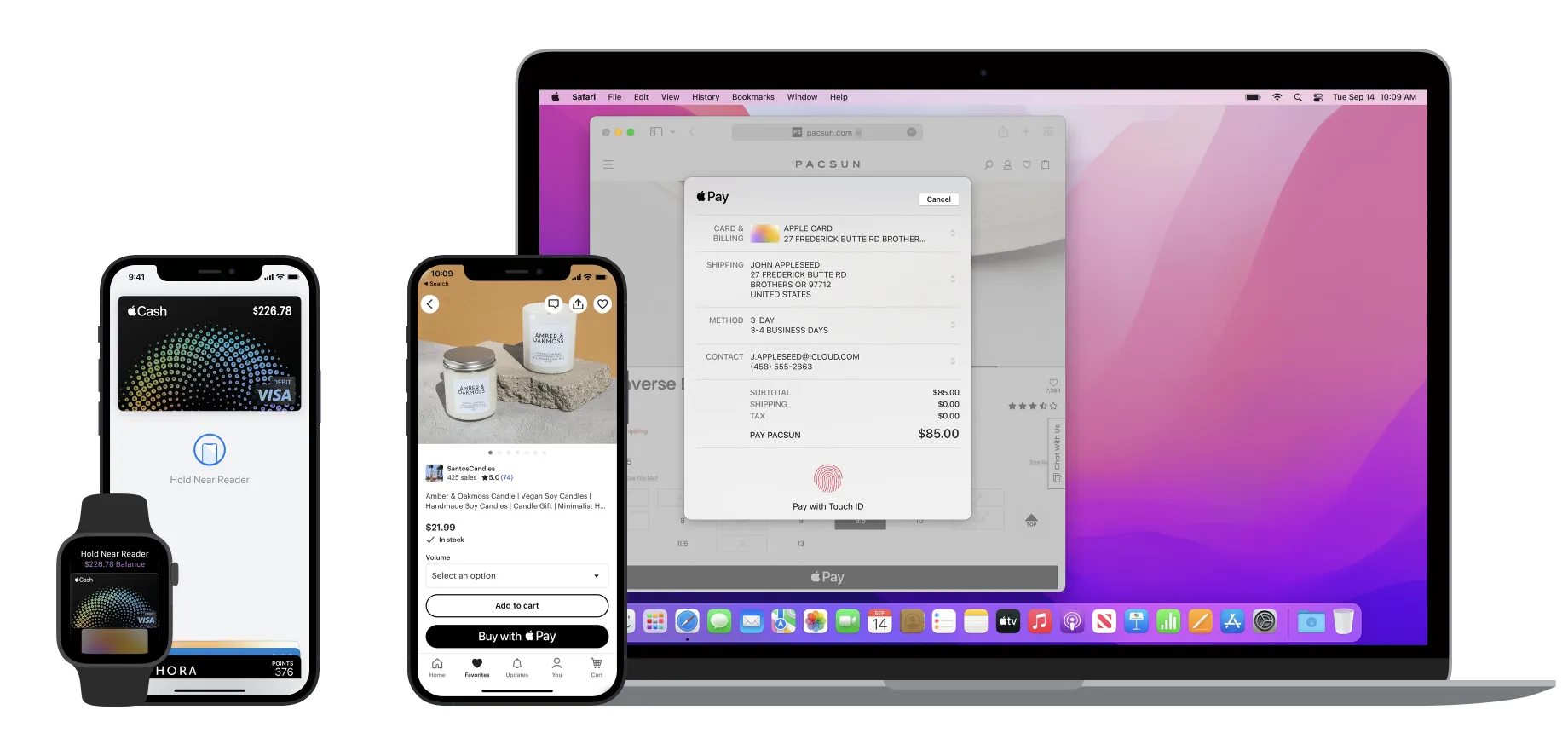

25. Apple Pay

Apple Pay is a secure and private payment platform designed for collecting in-person, online, and in-app payments. Apple Pay-enabled devices, such as an iPhone, Apple Watch, or other wearables, allow for in-person, contactless payment directly from the client’s device to the business without the need for an external terminal.

Or, if your customers have an EMV Contactless Indicator on their debit or credit card, you can use Apple Pay to collect debit or credit card payments.

Apple Pay integrates with other apps, and you will need to set up an external payment processing servicer to use this system.

- Implementation: Developer Documentation

- App: iOS

Getting Started

Entrepreneurship and business ownership aren’t easy. However, these PayPal alternatives make it easier for you to manage the revenue going in and out of your company. Soon, you can put the calculator down and get back to running your business.

Image Source

Image Source Image Source

Image Source Image Source

Image Source

![How to Start a Business: A Startup Guide for Entrepreneurs [Template]](https://blog.hubspot.com/hubfs/How-to-Start-a-Business-Aug-11-2023-10-39-02-4844-PM.jpg)

![How to Write a Business Proposal [Examples + Template]](https://blog.hubspot.com/hubfs/how-to-write-business-proposal%20%281%29.webp)