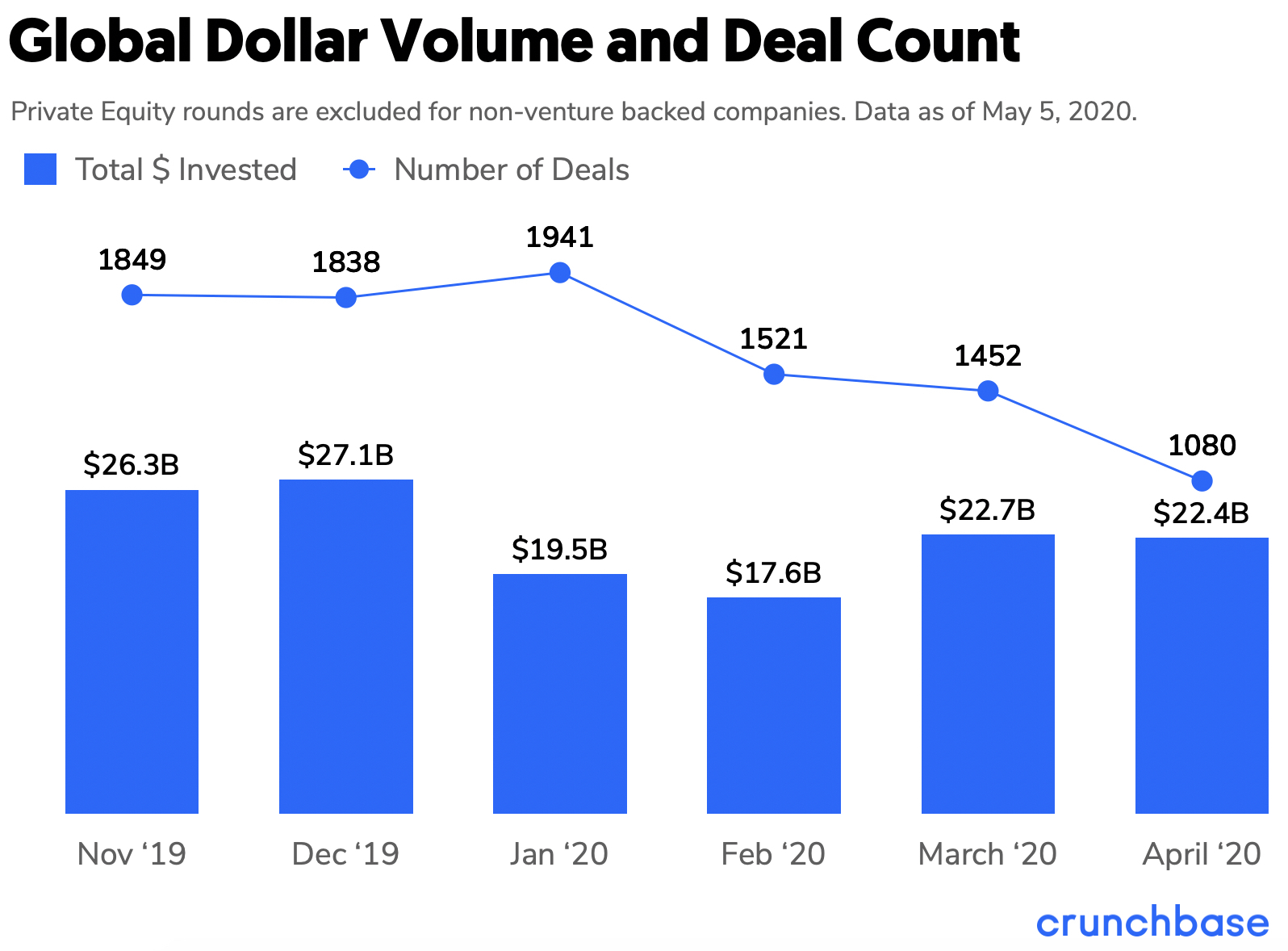

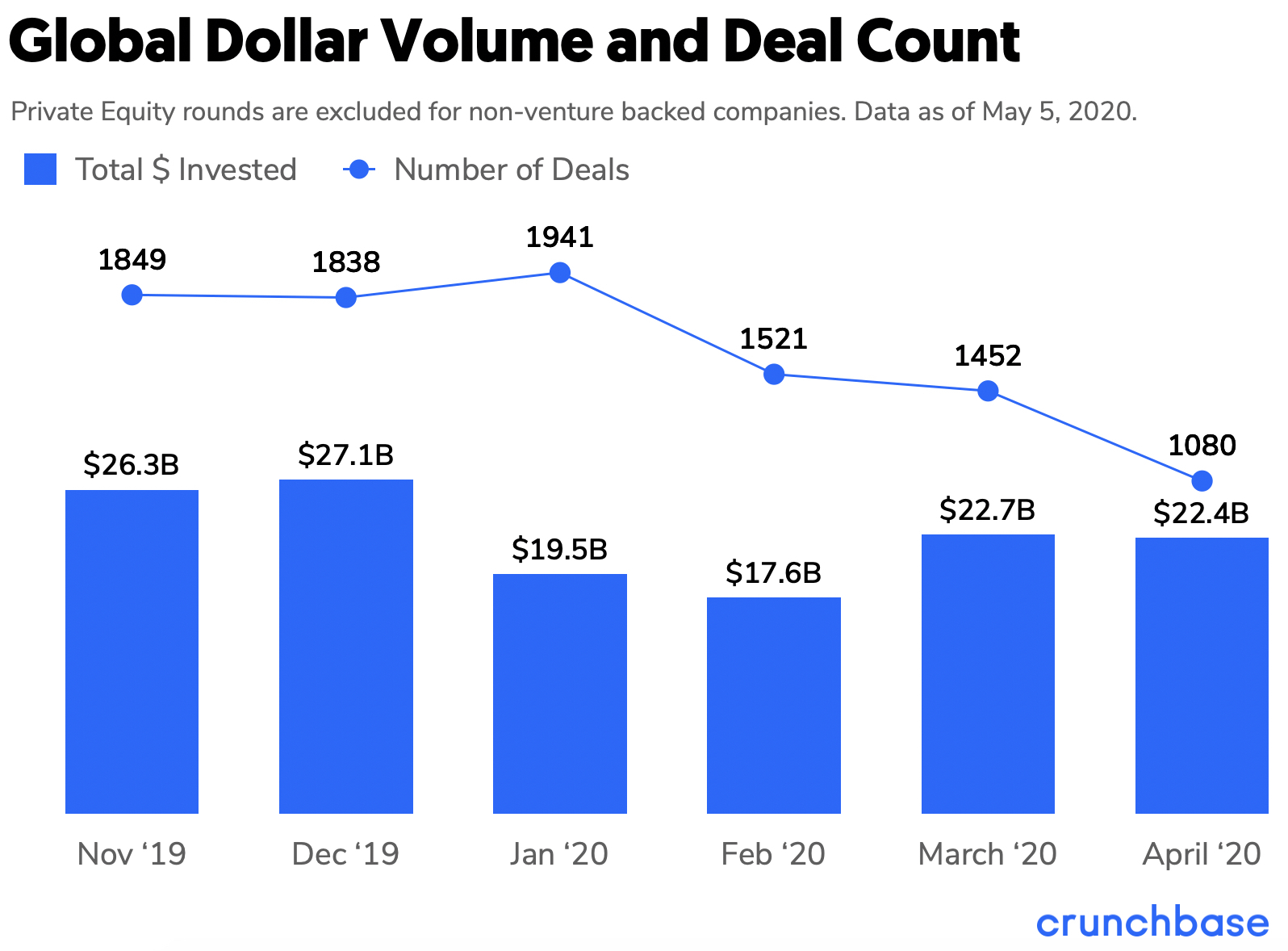

Although we saw a significant drop in global venture funding at the beginning of this year as COVID-19 took hold–from $27.1 billion in December, to $17.6 billion in February, a 35 percent decrease–March and April are showing signs of recovery. And there are still many companies making impressive strides and securing funding. Check out these recent funding rounds by Medable, Pivot Bio and Mojo Vision.

In just the last week, 284 funding rounds for a total of $23.1B were recorded in Crunchbase.

Yes, that’s $23.1 BILLION … Woah.

That means no matter how bleak the economic forecast might appear, there are pockets (deep pockets) of opportunity out there–now you’ve just gotta find ‘em.

To help you in your quest for opportunity, I’ve created “The Monthly Rundown” series. Each month I dive into a few up-and-coming startups from the past month, filtering by two key indicators of momentum: recent funding rounds and significant influxes of new website visitors.

Without further ado, here is my list of five startups to watch (April 2020 edition):

1. Cinnamon AI

HQ: Tokyo

Industry: Artificial Intelligence, Machine Learning

Funding: Recently raised $13 million Series C on April 23.

Web traffic: 47 percent monthly visits growth

Why I’m watching: Cinnamon is an AI company out to enable AI-empowered enterprises with natural language understanding. AI is being applied to everything, but it’s not necessarily resulting in success in every industry. Cinnamon is looking to help every finance department automate unstructured data for the finance industry (invoices, financial statements), into automated dashboards. Bill.com has shown us that the financial department is moving to a fully digital and automated workflow. Not to mention, the fintech industry at large is eager to automate and adapt to changing consumer demands.

2. Glassbox

HQ: London

Industry: Analytics, Risk Management, CRM, Big Data

Funding: Recently raised $40 million Series C on April 7. Lead Investor: Brighton Park Capital

Web traffic: 71 percent monthly visits growth

Why I’m watching: Product teams are constantly looking for feedback before they introduce a feature, and sometimes the data doesn’t tell the whole story. Glassbox has a unique value proposition: It’s not just about the data, it’s about the people behind the numbers. The company offers insights into why your users do or do not interact with your platform. As every user researcher is well aware, there is immense power in the insights behind decisions, and understanding the user is the key to creating a successful product.

3. Miro

HQ: San Francisco

Industry: Enterprise Applications, Product Design, Project Management

Funding: Recently raised $50 million Series B on April 23. Lead Investor: ICONIQ Capital

Web traffic: 103 percent monthly visits growth

Why I’m watching: Miro is a collaborative whiteboard platform designed to allow distributed teams to work effectively together. Now more than ever, brainstorm sessions, workshops, project and product planning rely on an integrated, digital platform to bring people and ideas together. Miro lets distributed product and research teams stay on track for executing on their upcoming features. It’s no secret that collaboration and project management tools like Slack and Asana have taken off–who knows, Miro could be next.

4. Trade Republic

HQ: Berlin

Industry: FinTech, Mobile

Funding: Recently raised €62 million ($67 million) Series B on April 16. Lead Investors: Accel and Founders Fund

Web traffic: 105 percent monthly visits growth

Why I’m watching: Across the globe, Fintech remains red hot, with investments in fintech companies growing more than ninefold since 2010. Trade Republic is Germany’s first mobile-only and commission-free broker–essentially the Robinhood of Germany (speaking of, Robinhood secured a massive round of funding this week). After raising an eye-popping €62M Series B last month, this is certainly a company to keep on your radar.

5. Coder

HQ: Austin, Texas

Industry: Cloud Security, Developer Platform, Enterprise Software

Funding: Recently raised $30 million Series B on April 15. Lead Investor: GGV Capital

Web traffic: 40 percent monthly visits growth

Why I’m watching: Speaking of red hot, bottoms-up developer tools are also continuing to gain popularity. Coder is an up-and-coming company in the developer tools space, with the ultimate mission to build better products for developers. Coder equips developers with open-source tools and an enterprise platform that makes it easier to configure, secure and scale development environments. While this may sound like rocket science to some, the future has long been dictated by code. Maybe Westworld isn’t that far off. …

What else would you like to see? Shoot me a note: shamus@crunchbase.com

– Shamus

Shamus Noonan is a sales manager at Crunchbase, where he leads a team of AEs & SDRs across inbound and outbound channels. Find him on LinkedIn.