I hate to break it to you. Even if you hit your sales target in terms of volume, there is still a possibility that you‘ll miss your revenue target. Why? If you’re not calculating sales variance, your revenue target will be at risk, and you won't have the information you need to pivot your sales strategy.

Although this scenario can be disappointing, it is a reality of doing business, especially for those companies in competitive markets.

In this post, I'll show you how to calculate sales variance, which formula to use, and how to use the data to make informed business decisions.

What is Sales Variance?

Sales variance is the overarching term that explains the difference between actual and budgeted sales. Sales variance allows companies to understand how their sales are performing against market conditions.

Sales variance can either be favorable, which is when the company receives more money from the sale of a product than expected, or unfavorable when the company receives less money from the sale of a product than expected.

Types of Sales Variance

1. Selling Price Variance

Selling price variance is a type of sales variance that accounts for the difference in price for goods or services compared to the expected selling price. Selling price variance can impact the company‘s revenue goals either positively or negatively if it isn’t calculated and anticipated.

2. Sales Volume Variance

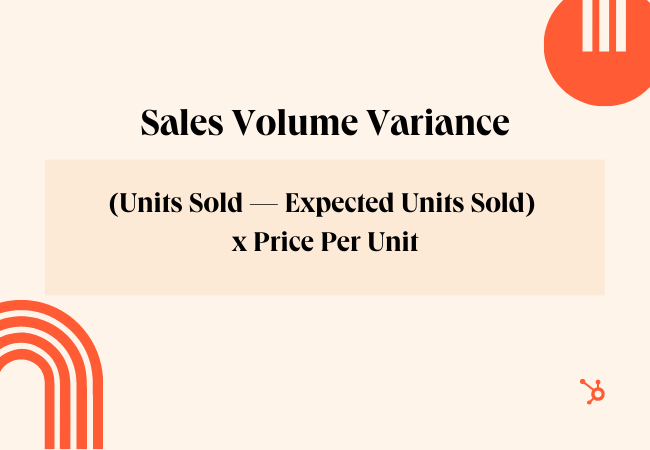

Sales volume variance measures the difference between expected units sold and actual units sold. This type of sales variance can also be positive or negative.

It‘s important to note that the two types of sales volume variance can be intertwined and impact each other. You can have both sales price variance and sales volume variance together, or one of each, at a time. In fact, it may be an advantageous sales strategy to strive for one type of variance if you’re changing the positioning of a product, entering a new market, or if you'll have a better chance at achieving a high-impact goal.

Sales Variance Outcomes

Favorable sales variance happens when a company is able to sell their product at a higher price than what was budgeted. This is more likely in less competitive markets where companies are able to charge a premium for their goods and services.

On the other hand, when unfavorable sales variance occurs it is because a company charges less for their product compared to what was budgeted. This scenario is more common in competitive markets where companies lower their prices in an effort to appeal to customers.

Now that we understand the causes and potential outcomes of sales variance, let’s walk through how to calculate it.

How to Calculate Sales Variance

To calculate selling price variance, you need the following values:

- The actual sale price of your product (per unit)

- The standard sale price of your product (how much you budgeted to sell your product for per unit)

- The number of units sold

Once you have this information handy, you can plug your values into the following sales variance formula:

SalesVariance = (Actual Sale Price — Standard Sale Price) x Number of Units Sold

Sales Variance Example

Now let’s put this formula to use with an example. Say you work for a company that sells potted plants online, and your company expects to sell 100 pothos plants in decorative pots for $30 each. After one month, the plants are selling above projections due to a viral TikTok review, and the demand for your product is sky-high. To allow time for your manufacturing team to restock, you raise prices to $35.

During this sales period, your company sells all 100 potted pothos plants for $35. Using the formula, we can calculate the sales variance for the potted pothos plants.

Sales Variance = ($35 — $30) x 100 = - $500.

From this calculation, we can see we there was a favorable variance of $500 from the sale of the potted pothos plants. This means the company brought in $500 more than anticipated from the sale of the plants.

In this situation, the company raised the price of their product to temporarily reduce demand, and they still brought in more revenue than they originally planned.

How to Calculate Sales Volume Variance

To calculate sales volume variance, use this formula:

- The number of units sold

- The number of expected units sold

- The price per unit

Then, plug these figures into the following equation:

Sales Volume Variance = (Units Sold — Expected Units Sold) x Price Per Unit

Sales Volume Variance Example

Let’s walk through an example of sales volume variance in action. In this instance, you work for a company that sells subscriptions to an online music streaming service. The founder of your company has a background in entertainment law and was able to secure the widest selection of music available—featuring numerous artists and albums that are unavailable on any other streaming platform.

Initially, your company budgeted to sell 1,000 subscriptions for $9 per month. , an existing streaming service added new features without raising the price of their product. This resulted in the competitor gaining additional market share right before the launch of your company's new music catalog. After a month of promoting the new catalog and charging $9 per subscription, you were able to sell 900 new subscriptions. Using the formula, we can calculate sales volume variance for the music service subscription.

Sales Volume Variance = (900 —1,000) x $9 = -$900

From this calculation, we can see there was a negative variance of $900 from the sale of new subscriptions to your service. This means the company brought in $900 less than originally anticipated during this sales period.

This company realized a negative variance because their competitors gained market share just as they were differentiating their product.

Stay on Track with Sales Variance

Calculating sales variance for the products your company offers is a worthwhile activity for each sales period to ensure you are on track with your revenue goals.

If for some reason you find your company has unfavorable sales variance and you are not in a position to raise your prices, you may want to consider revising your sales strategy in an effort to get more units out the door to account for the difference.

Editor's note: This post was originally published in April 2020 and has been updated for comprehensiveness.