If your startup were a Netflix series, the cap table would be the credits rolling at the end of each episode. For any up-and-coming founder, it's crucial to have a detailed understanding of who owns what at each stage of the business.

The capitalization table, or cap table, provides the information you need to get a clear understanding of your company's ownership structure. In this post, we'll discuss:

- What is a cap table?

- How to Make a Capitalization Table

- Cap Table Template

- How to Use a Cap Table

- How to Maintain a Capitalization Table

- Capitalization Table Examples

What is a cap table?

A cap table, or capitalization table, is a chart typically used by startups to show ownership stakes in the business. It lists your company's securities (i.e., stock, options, warrants, etc.), how much investors paid for them, and each investor's percentage of ownership in the company.

A cap table is the place of record for the equity-based transactions of a company. It includes ownership stakes, types of shares, and option pools.

Why is a cap table important?

Whether you're a business owner or an investor, having a capitalization table is important because:

- It provides an easy-to-understand visual of a business’ ownership structure of who owns what, who has invested, and individuals' levels of investment in the business.

- It helps you track the value of equity and debt investments so that you can stay up-to-date on the financial status of your business.

- It helps you manage company stock options and how much employees can be granted from the stock pool.

Overall, a cap table is a single source of truth that gives a full picture of financial investments for any business, making it much easier to picture business cash flow and make informed decisions.

.webp)

Free Business Plan Template

The essential document for starting a business -- custom built for your needs.

- Outline your idea.

- Pitch to investors.

- Secure funding.

- Get to work!

How To Make a Capitalization Table

Most capitalization tables are created at the inception of a business in the form of a spreadsheet carefully structured around a few variables we’ll outline below.

Ownership stake is a crucial element of any cap table. It refers to who (founders, investors, or employees) owns what percentage of a business and who has the majority stake. Most startups need a voting agreement among common and preferred shareholders, so this element shows who needs to sign off on major company decisions (like a company sale or reorganization). The ownership stakes section can sometimes list shareholder names and the number of shares they hold.

The type of shares section indicates who has common shares with no special treatment vs. who has preferred stock. Preferred stock can often be converted to a 1x payout of money invested.

Debt that can convert into equity is another transaction often found on a cap table. This convertible debt is factored into all ownership calculations on a fully diluted basis, which is a way of looking at ownership where all outstanding warrants, options, and convertible notes are exercised.

Every business has different needs, so some other variables that might be in a cap table are:

- Valuation: Total cost of your business shares.

- Total of authorized shares: The number of shares your company is authorized to sell.

- Total number of outstanding shares: The total number of shares held by all stakeholders in the company.

- Reserved shares: also called restricted shares, the total number of shares available for employees.

Let’s look at a cap table template you can use as inspiration.

Cap Table Template

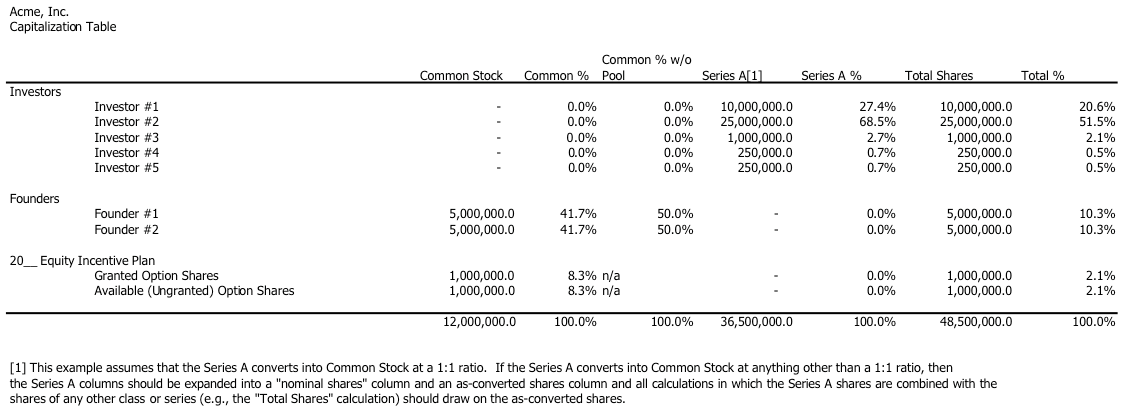

Here's a sample cap table:

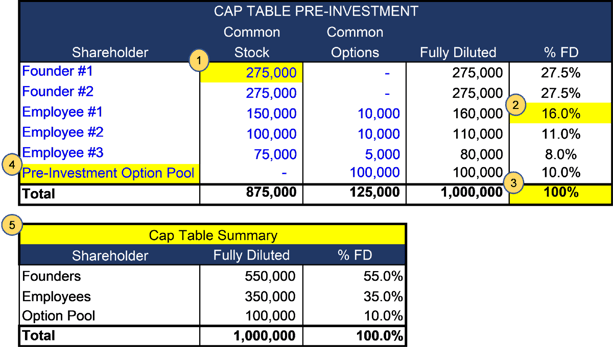

As the columns move from left to right, additional dilution items are applied to get an understanding of a person's actual ownership percentage of the company.

You'll notice the cap table lays out the essential pieces of a transaction:

- Shareholder name as it appears on the security,

- Date of issuance,

- Number of shares or units issued.

How To Use a Cap Table

1. Understanding your equity.

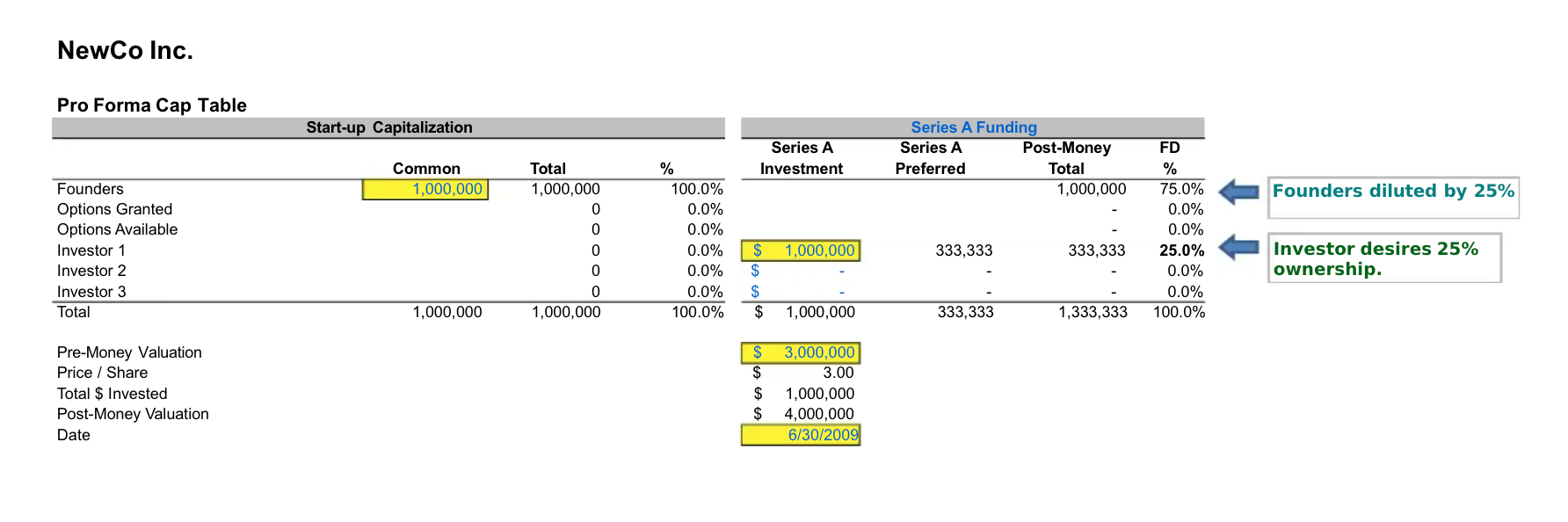

One of the primary uses of the cap table is to show how decisions impact the equity structure of a company. Do you want to expand the employee option pool? Are you raising another funding round?

Either way, you can see exactly what impact actions will have on your shareholder groups. When raising funding for the first time, you need to know exactly what you're giving up. The cap table will do just that and show you the proposed new structure of the company.

2. To discuss initial equity distributions.

When you create a company, a cap table has your company breakdown in writing. Having a cap table will make your job easier from the start, though, as it can help you facilitate important conversations like discussing initial equity distributions with the founding team.

3. For managing employee options.

When hiring new employees, you want to align their incentives with your company's objectives. Stock options are a great way to do just that, as you can match employee contributions with the appropriate amount of stock.

Your cap table will show exactly how many options are authorized and available to be issued to employees and the number of options used to date. When creating your table, ensure you have enough options to cover a 12-month rolling period.

4. Term sheet negotiation.

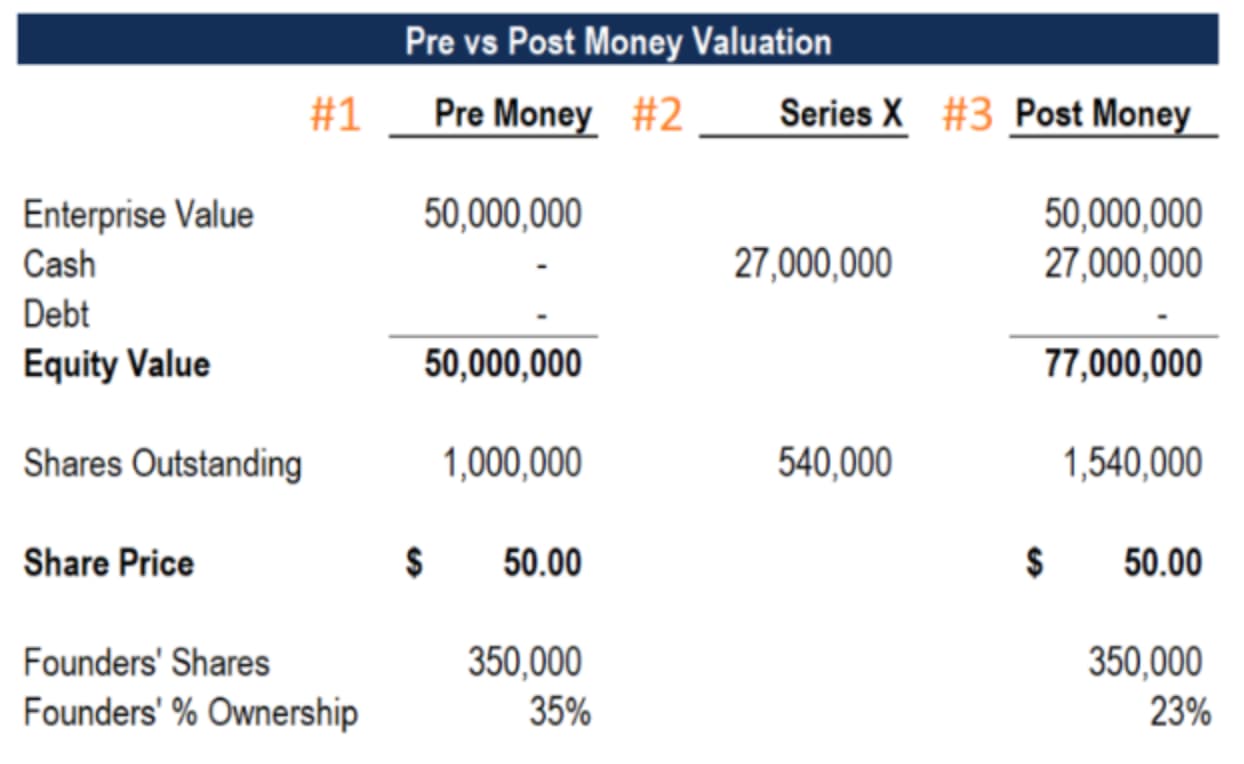

A clear snapshot of your company’s ownership structure also helps you run a what-if analysis on a financing round. You can look at what happens to your ownership stake and company control at different valuation levels and consider other factors, like the impact of issuing new options at different stages.

You’ll get insight into the situations you’re happy with and where you’ll need to draw your line in the sand.

How To Maintain a Capitalization Table

Maintaining your cap table is essential as businesses are constantly changing. For example, increased investments, more funding rounds, and more employees will all impact the totals in your chart, and staying up-to-date ensures you always have the most relevant information.

Here are some common elements to keep track of and update when necessary on your cap table:

- Valuation: Whenever your stock price changes, update it.

- Investors: When you get new investors, add them to your table.

- Reserve/restricted Stock: If you offer stock to employees, update the number of shares when you hire.

- Debt that has converted to equity.

- Total outstanding shares.

- Remaining authorized shares.

Assigning specific people or teams to manage your cap table is also important. Multiple people having access can confuse if people make their own edits, so having a designated person make all updates ensures a streamlined process.

.webp)

Free Business Plan Template

The essential document for starting a business -- custom built for your needs.

- Outline your idea.

- Pitch to investors.

- Secure funding.

- Get to work!

Capitalization Table Examples

The capitalization table you create can vary depending on the stage your business is in and the metrics you're hoping to track. Let’s review some examples that will help you understand what to include in your table.

Basic Cap Table

This cap table has the essential elements to include if you’re hoping for a simple overview of shares and stock.

Pre-Investment Cap Table

For businesses that have yet to go through funding rounds or obtain investments.

Post-Money Comparison Cap Table

For businesses that have gone through funding or investment rounds and want to compare new capital to pre-funding rounds.

A Cap Table Is A Guiding Source of Truth

A cap table is a guiding source of truth for your business, giving you a snapshot of ownership stake, stock options, and who should be involved in critical business decisions. The information in this piece will help you create your own high-quality cap table that can make your next big fundraising decision or employee hire a bit easier.

So, whatever type of episode your startup turns out to be, don’t forget to write down the credits.

![300+ Business Name Ideas to Inspire You [+7 Brand Name Generators]](https://blog.hubspot.com/hubfs/business-name-ideas_17.webp)