I don't pay for much with checks anymore, but when I do write one to pay rent every month, I always write down the check number and the amount in the little paper ledger at the front of my checkbook.

As it turns out, this isn't the proper way to maintain a ledger at all. Whoops.

Instead, financially-minded individuals -- and businesses -- use ledgers to fastidiously document money that's they're paying out, or being paid.

And while as an individual, I can rely on my banking app to give me a snapshot of how much money I'm being paid relative to how much I'm spending, businesses need to maintain more detailed ledgers in order to accurately and legally conduct financial transactions.

In this blog post, you'll learn about how businesses document and measure finances using a general ledger, and how the general ledger helps businesses track financial health and growth over time.

General Ledger (Accounting)

The general ledger tracks all of a company's accounts and transactions and serves as the foundation of its accounting system. It's typically divided into five main categories: assets, liabilities, equity, revenue, and expenses. These categories contain all accounting data derived from a company's different sub-ledgers, such as accounts payable and accounts receivable, and the general ledger records amounts of money that are credited and debited on a constant basis.

Like a personal checkbook, the general ledger must always be in balance between the credit and debit amounts, and the information recorded holds all account information about a company over the course of its lifetime that is needed to prepare the financial statements.

The general ledger details all financial transactions of all accounts so as to accurately account for and forecast the company's financial health. Think of the general ledger as the main database of a company's financial records and information, with other financial documents being derived from the information recorded in the general ledger.

Let's dig into the different elements of the general ledger a little deeper:

Ledger Accounts

There are five different categories the general ledger is broken down into, and these categories are known as "accounts." The categories are:

1. Assets

Assets are any resources that are owned by the business and produce value. Assets can include cash, inventory, property, equipment, trademarks, and patents.

2. Liabilities

Liabilities are current or future financial debts the business has to pay. Current liabilities can include things like employee salaries and taxes, and future liabilities can include things like bank loans or lines of credit, and mortgages or leases.

3. Equity

Equity is the difference between the value of the assets and the liabilities of the business. If the business has more liabilities than assets, it can have negative equity. Equity can include things like common stock, stock options, or stocks, depending on if the company is privately or publicly owned by owners and/or shareholders.

4. Revenue

Revenue is the business' income that is derived from the sales of its products and/or services. Revenue can include sales, interest, royalties, or any other fees the business collects from other individuals or businesses.

5. Expenses

Expenses consist of money paid by the business in exchange for a product or service. Expenses can include rent, utilities, travel, and meals.

The general ledger typically includes a front page that lists the names of the accounts documented within, and this list is known as the "chart of accounts." The documentation of one account within the general ledger is referred to as an "account ledger."

Sub-Ledgers

Sub-ledgers within each account provide details behind the entries documented in account ledgers, such as if they are debited or credited by cash, accounts payable, accounts receivable, etc.

Double-Entry Bookkeeping

The double-entry bookkeeping method ensures that the general ledger of a business is always in balance -- the way you might maintain your personal checkbook. Every entry of a financial transaction within account ledgers debits one account and credits another in the equal amount. So, if $1,000 was credited from the Assets account ledger, it would need to be debited to a different account ledger to represent the transaction.

This bookkeeping method helps ensure that the business never over-extends itself financially, and that the general ledger is always in balance to maintain the accounting equation:

Assets = Liabilities + Equity

General Ledger Example

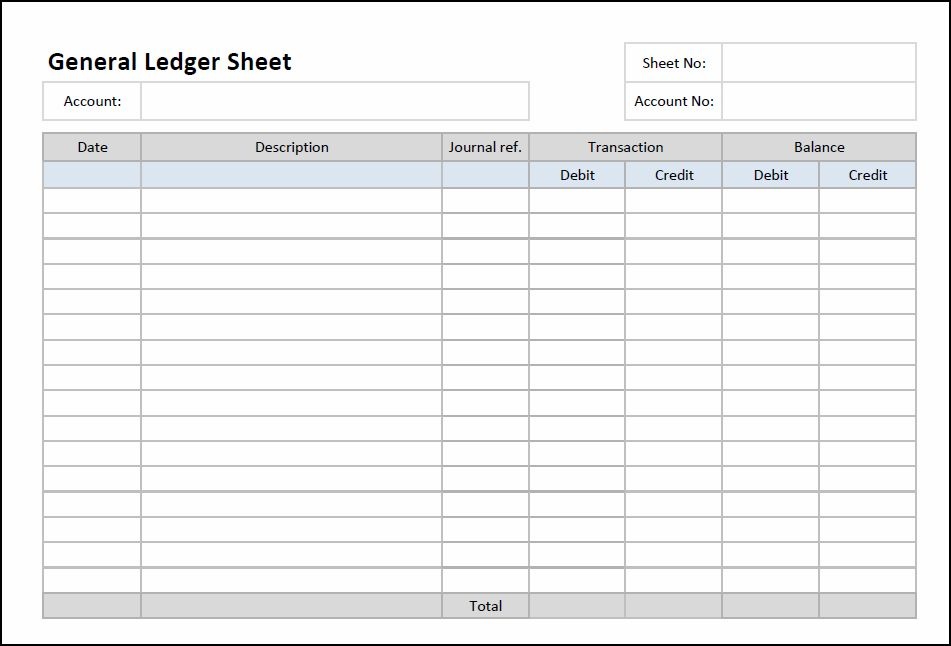

Below is an example of what a blank general ledger sheet would look like before filling in any accounting information. In the "Account" cell, you would fill in which account ledger's transactions you were recording:

Source: Double-Entry Bookkeeping

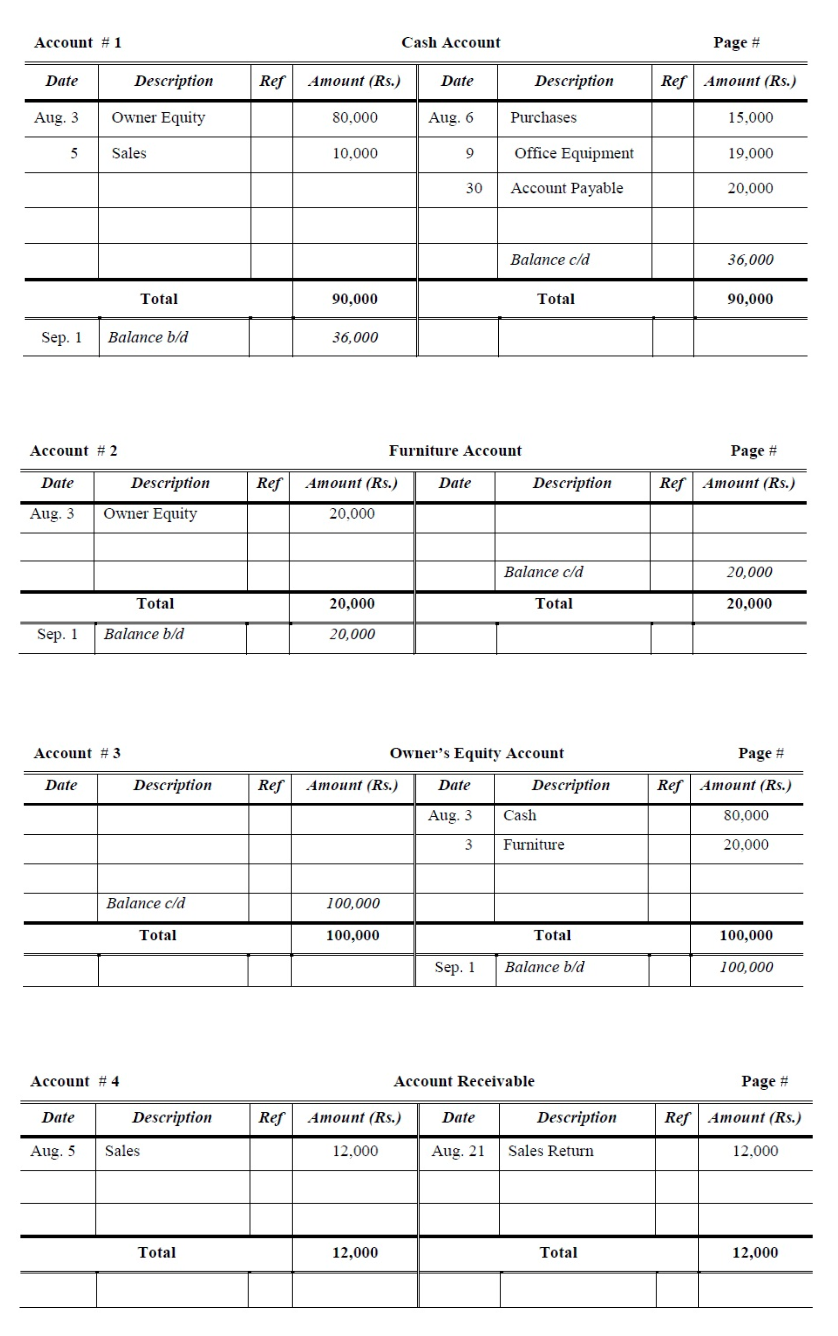

Here's what a few accounts within general ledger would look like filled out with transaction information:

Source: Accountancy Knowledge

(You can find a general ledger template to fill in with your company's own financial information in Microsoft Excel's template gallery, or by clicking here to download one.)

Next, we'll dive into a few other financial accounting documents that are closely related to -- but distinct from -- the general ledger.

General Ledger vs. General Journal

A general journal lists business transactions according to the date. A business' financial transactions are first recorded in a general journal. From there, the specific amounts are posted into the correct accounts within the general ledger. Sometimes referred to as a book of original entry, the general journal lists all financial transactions of a business, and the general ledger organizes and balances transactions.

General Ledger vs. Trial Balance

A trial balance is an internal report that lists each account name and balance documented within the general ledger. It provides a quick overview of which accounts have credit and debit balances to ensure that the general ledger is balanced faster than combing through every page of the general ledger.

General Ledger vs. Balance Sheet

A balance sheet provides a quick snapshot of the business' financial health at a specific moment in time by measuring if its accounting equation is balanced. The balance sheet documents the accounting question measured above (Assets = Liabilities + Equity) and pulls those numbers from account ledgers within the general ledger. Balance sheets are typically used when businesses are being evaluated by banks, creditors, or investors, versus general ledgers which are maintained internally. (You can check out HubSpot's balance sheet here.)

To learn more, read about the first-mover advantage next.

![How to Start a Business: A Startup Guide for Entrepreneurs [Template]](https://blog.hubspot.com/hubfs/How-to-Start-a-Business-Aug-11-2023-10-39-02-4844-PM.jpg)

![How to Write a Business Proposal [Examples + Template]](https://blog.hubspot.com/hubfs/how-to-write-business-proposal%20%281%29.webp)