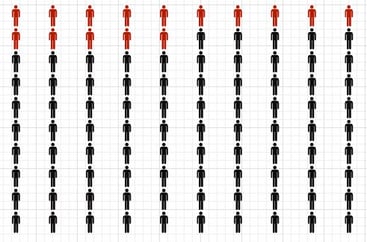

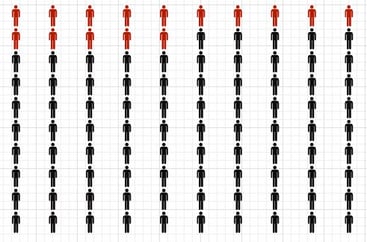

Imagine a room full of 100 shiny, new food and bev brands. If you were to revisit this room in just two years, only 15 would be left standing. With so many companies competing for a spot on the shelf and in shoppers' homes, 85 percent of all new consumer products fail within two years.

Even for brands that have already "made it" and established themselves in their category, the fight for market share at the ever-shrinking number of retail stores is relentless. In such a competitive environment where it can sometimes feel like a zero-sum game, it's no wonder brands often start to resent their competitors.

Despite fighting each other for space in the shopping cart, some brands have actually found it beneficial to work with other companies in their category to grow their brand. As backwards as it might sound, partnering with competitors can help the category, along with your sales, grow faster than going it alone.

A sobering visual of the competitive CPG landscape.

Why 74% of Brands Want to Work With The Competition

The idea of running co-marketing campaigns or promoting your products alongside your biggest competitors might sound too good to be true; an idealist's view of perfect harmony behind the scenes. However, the idea might be more popular than you realize.

According to a poll we ran on Twitter, just 26 percent of respondents were against partnering up, while 45 percent said they'd be open to it, and 29 percent gave the cheeky reply, “If I’m feeling nice.” Clearly, the idea's got legs.

So why are 74 percent of brands open to supporting their competitors?

What's that saying about a rising tide raising all ships? Or the enemy of my enemy? Whichever you prefer, the idea is that in emerging categories – or even more established segments that have to fight other categories for space on the shelf – every brand benefits when the category grows. Because a win for even one brand means more space in the store for that product, and increased awareness by shoppers. If a win for the category is a win for every brand, why not partner up?

We talked to 14 fast-growing food and beverage brands to find out, collecting their tips on how, why, and when its worth working with your competitors (and even why some are hard-pressed against it).

Build Awareness For a Growing Category

First, we connected with a few kombucha companies. Competition is rife in this segment, which is estimated to grow to $1.8 billion by 2020. But, since it's still a new category that most shoppers don't know much about, most brands are open to working together to build awareness.

Health-Ade Kombucha

“Nationwide, only about one in 20 people even know what kombucha is. We have a unique opportunity to bring massive awareness to this fermented, functional beverage and we cannot do that without partnering with other kombucha brands and brewers.

Our goal is to get real food to as many people as we can, and we will get there a whole lot faster by working together. We love participating in the Vegan Beer & Food Festival in Los Angeles, an event that brings together a bunch of different kombucha brands, big and small, to give out samples to festival goers. It’s such an amazing feeling to get to work with others in the industry to build awareness about kombucha!”

Kevin Land

Associate Field Marketing Manager, Health-Ade Kombucha

Kevita

“The kombucha category can create confusion for consumers – there is a lot of misinformation in regards to fermented beverages and probiotics. It’s important that all of the players in this functional space support the category communication for the retailers and consumers, starting with truth in labeling.”

Tamera Walters

Senior Sales Manager, Kevita

Humm Kombucha

“We're building a category that is so new, many people don't even know what kombucha is. Collaborating and working together positively impacts the entire industry, and each individual business benefits far more than it ever would if we were working alone. Plus, it's way more fun!”

“We're building a category that is so new, many people don't even know what kombucha is. Collaborating and working together positively impacts the entire industry, and each individual business benefits far more than it ever would if we were working alone. Plus, it's way more fun!”

Jamie Danek

CEO, Humm Kombucha

Legitimize a New Segment

What about smaller products that haven't quite hit the main stream like kombucha?

We tapped Kuli Kuli, one of the first companies to produce and sell products with the superfood moringa. Carving out a new category, Kuli Kuli leads the fledgling market with a mission similar to that of kombucha mavens: educate consumers and set industry standards. Positioning themselves as an authority in the moringa space, Kuli Kuli doesn't spend any time stressing over competition.

Kuli-Kuli

"There currently aren't any standards on the way that moringa is grown and processed which results in a lot of low-quality moringa. Kuli Kuli has teamed up with other moringa brands to help define the quality standards for this new superfood."

Lisa Curtis

CEO and Founder, Kuli Kuli Foods

Sometimes, however, you're in a space so new that you have to fight for its very existence. That's just what this brand had to do in order to use Hemp in its products and begin a revolution in the agriculture industry.

Evo Hemp

“The domestic hemp industry only exists because of collaboration. Together with hemp processors and lobby groups, we legalized hemp farming in the United States for the first time in nearly 80 years. By establishing a supply chain of U.S. grown hemp, we're working to revive the country's agricultural system.”

Ari Sherman

President & Co-founder, Evo Hemp

Create Excitement in Existing Segments

On the opposite end of the spectrum is the tea industry. Though it's been booming for a while now, there have certainly been some shake-ups.

These two emerging brands are taking the tea world by storm, providing quality products above the market average. Still, however, they both remain committed to the commodity of shared passion, or perhaps, passionfruit.

Matcha LOVE

“What certainly comes to mind is our support and participation of the Tea Festivals in San Francisco, Los Angeles, and Seattle (Northwest Tea Festival). Being part of the tea community helps broaden the overall appreciation for matcha. We realize consumers today are not loyal to only one brand, and often have several brands in their pantry, so there is opportunity for everyone to benefit.”

“What certainly comes to mind is our support and participation of the Tea Festivals in San Francisco, Los Angeles, and Seattle (Northwest Tea Festival). Being part of the tea community helps broaden the overall appreciation for matcha. We realize consumers today are not loyal to only one brand, and often have several brands in their pantry, so there is opportunity for everyone to benefit.”

Rona Tison

Executive VP Corporate Relations, ITO EN (North America) INC.

Harney & Sons

“I don't think we work with our competitors so much as share in the pain, suffering and happiness of growing our business. That is what I have found the most enjoyable about keeping in contact with our competition. Nobody can understand the issues you face as well as your competition, and the humor in that makes it much more enjoyable.”

Paul Harney

Vice President, Harney & Sons

And what about water? This year, bottled water became the #1 beverage based volume in the United States.

The Beverage Marketing Corporation (BMC) reported that it had officially overtaken carbonated soft drinks for the top spot earlier this year. This means rapid category growth and increased market dollars for major industry players, as well as innovative brands able to provide something fresh. The latter is exactly what these next two brands were able to do, showing that with a little ingenuity, there's enough room for everyone.

Ugly Drinks

“We are trying to change people's perceptions of what a canned sparkling drink can be. We want to show people that you don't need sugar or sweeteners to have a delicious and exciting drinking experience. We welcome brands and entrepreneurs that are contributing in the same way, and we love to see healthier areas of the chiller or the store that are championing innovative products and brands.”

“We are trying to change people's perceptions of what a canned sparkling drink can be. We want to show people that you don't need sugar or sweeteners to have a delicious and exciting drinking experience. We welcome brands and entrepreneurs that are contributing in the same way, and we love to see healthier areas of the chiller or the store that are championing innovative products and brands.”

Joe Benn

Co-CEO & Co-Founder, Ugly Drinks Ltd.

GIVN Water

“As a social impact product, it is important that we team up to strengthen our giving to those in need. Together, we can make much more impact than apart.”

Liz Skalla

Business Development Team, GIVN

Inspire Customer Loyalty

As for the juice and juice drinks category, products with low sugar and high nutrition are coming out on top. Though the industry as whole has been unstable, the "premium" segments have shown rapid growth.

According to Beverage Industry's 2017 state of the industry, "'raw juices' (unpasteurized), cold-pressed (or HPP) juices, fringe juices like coconut water and other plant waters, and juice smoothies" have prospered. These two brands know this first-hand. Both grounded by strong values, these companies show no animosity towards competitors, but rather an optimistic outlook for a healthier future for all.

Lumi Juice

“We are constantly collaborating, and looking to collaborate, with complementary brands that carry the same ethos and organic ingredients as Lumi. Everything we make is USDA Certified Organic with no fillers, so you are truly enjoying fruits and vegetables the way nature intended. Lumi’s message is simple and loving, just like our products, and we are always open to collaborating with other companies that have that same brand mission with quality products to back that message up.”

“We are constantly collaborating, and looking to collaborate, with complementary brands that carry the same ethos and organic ingredients as Lumi. Everything we make is USDA Certified Organic with no fillers, so you are truly enjoying fruits and vegetables the way nature intended. Lumi’s message is simple and loving, just like our products, and we are always open to collaborating with other companies that have that same brand mission with quality products to back that message up.”

Hillary Lewis Murray

CEO and Founder, Lumi

Koia

"The industry is like one big family when it comes to sharing tips and information. Even though Koia has no direct competitors, we find the most value in collaborating with similar brands for event opportunities. In the end, all of us are working toward the same goal: to raise awareness and provide healthier food options."

Maya French

Co-Founder, Koia

Build Momentum Through Creativity

In other segments, it's not so straightforward when and how to partner up with other brands. Some have found success in merging with competitors, while another formed a coalition with other like brands to further their shared missions. Sometimes, the best way forward is just to have an open mind and get creative.

Brewla

"Merging capabilities can be a great way to work with competitors. In the case of Brewla, we were acquired earlier this year by a competitor. Both companies bring together different proficiencies that result in an overall competitive advantage."

Daniel Dengrove

Co-Founder, Brewla

Dang Foods

“We created a 'healthy snack coalition' with 4 leading brands with the goal of educating and sharing best practices with our retailer partners. Many retailers don't know what to do with healthy snack sets, so we serve as an industry guidance group to help them maximize their sales.”

Vincent Kitirattragarn

Co-founder and CEO, Dang Foods

As we've seen, brands in new categories can often benefit from working together to build awareness for their segment. That being said, when carving out a completely new category and blazing the trail alone, some companies prefer to completely separate themselves from existing players in their space.

“We hate our competition! The pickle category is very competitive. We try to blow out our competition by educating consumers on the benefits of Grillo's fresh, all-natural pickles. The choice is obvious when you compare our quality and ingredients to our competitors. If there was one thing we use the competition for, it’s to compare our ingredients and show that to consumers. We have zero chemicals, much lower in sodium than many other brands and use all natural, fresh ingredients.”

Eddie Andre

Senior Sales Manager, Grillo's Pickles

So, whether you're carving out a new category, breaking into an existing market, or pushing a growing segment forward, consider working with the brands you typically compete with for space on the shelf. While it might feel like you're giving up mindshare in the short-term, the long-term benefits of growing your category could get you better shelf placements, bigger marketing impressions, and better sales numbers.

“We're building a category that is so new, many people don't even know what kombucha is. Collaborating and working together positively impacts the entire industry, and each individual business benefits far more than it ever would if we were working alone. Plus, it's way more fun!”

“We're building a category that is so new, many people don't even know what kombucha is. Collaborating and working together positively impacts the entire industry, and each individual business benefits far more than it ever would if we were working alone. Plus, it's way more fun!”

“What certainly comes to mind is our support and participation of the Tea Festivals in San Francisco, Los Angeles, and Seattle (Northwest Tea Festival). Being part of the tea community helps broaden the overall appreciation for matcha. We realize consumers today are not loyal to only one brand, and often have several brands in their pantry, so there is opportunity for everyone to benefit.”

“What certainly comes to mind is our support and participation of the Tea Festivals in San Francisco, Los Angeles, and Seattle (Northwest Tea Festival). Being part of the tea community helps broaden the overall appreciation for matcha. We realize consumers today are not loyal to only one brand, and often have several brands in their pantry, so there is opportunity for everyone to benefit.”