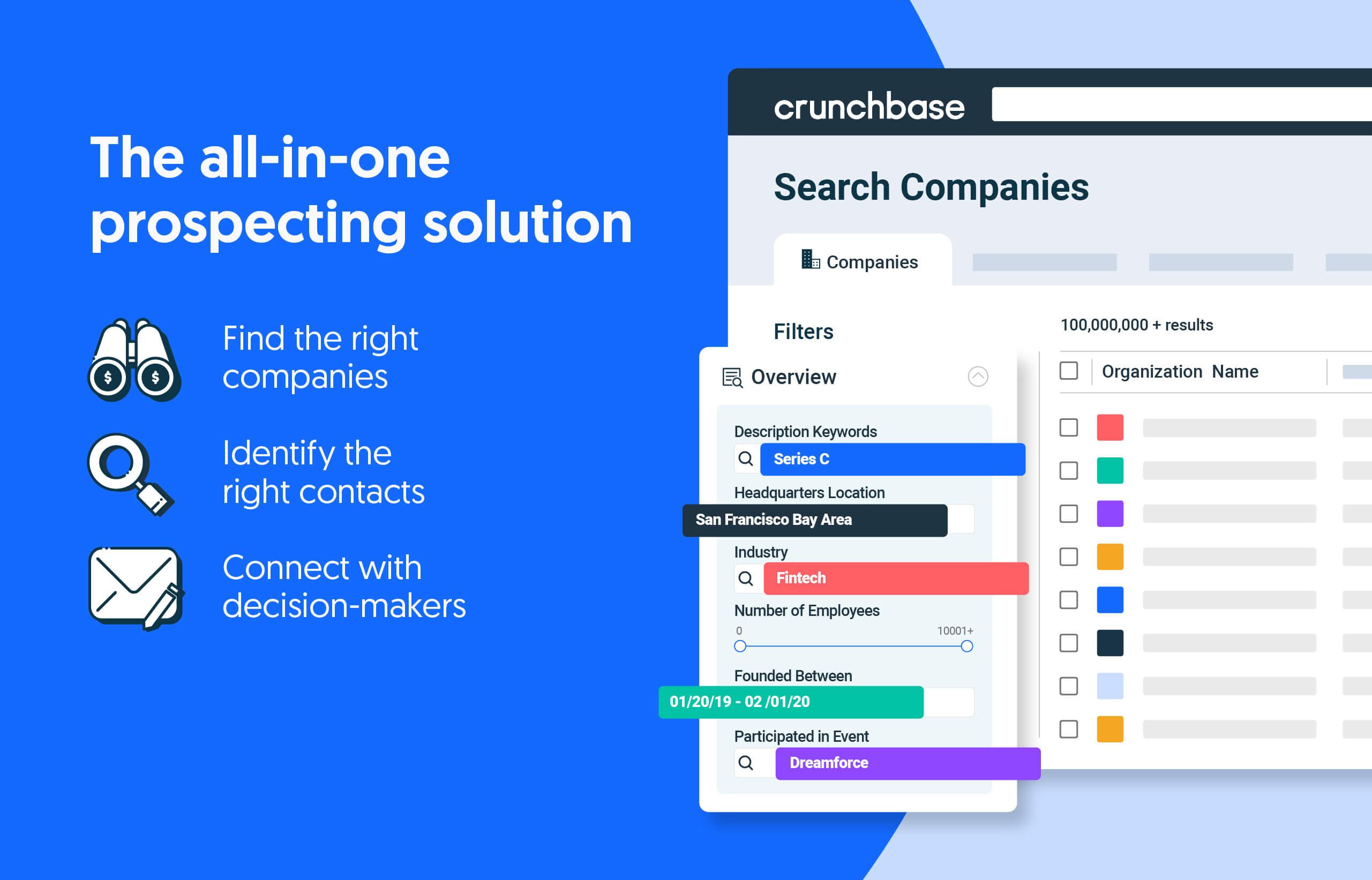

The Lead List is a monthly series that analyzes key buy signals from companies on the Crunchbase Emerging Unicorn Board with fresh funding to help you fill your pipeline with new opportunities.

Despite the overall fall in VC funding in May (from $45 billion in April to $39 billion in May), 16 companies closed on fresh funding in May and 13 of those companies joined Crunchbase’s list of emerging unicorns.

Why emerging unicorns should be on your radar: Emerging unicorns are private, high-growth companies valued between $500 million and $1 billion. Why should these companies matter to you? These not-yet unicorns (unicorns are private companies valued at $1 billion or above) represent a sweet spot for salespeople. They’re established, cash-rich, growing and solving a business problem that could make them the next billion-dollar unicorn.

These newly minted emerging unicorns span a variety of industries, including foodtech, car sharing and cybersecurity. In this edition of The Lead List, we’ll take a look at these high-growth startups and equip you with all the information you need to sell to them in June.

Hot tip for salespeople: In contrast to unicorns, which get all the attention, emerging unicorns may not be as inundated with sales pitches.

Add these rapidly growing companies to your CRM

Now Pro and Enterprise users can sync accounts directly from Crunchbase to Salesforce, speeding up their prospecting workflow and reducing time spent on manual data entry. Check out this Crunchbase list and add these emerging unicorn companies to your CRM.

Methodology

This issue of The Lead List includes companies featured on Crunchbase’s Emerging Unicorn Board that raised new funding throughout May. The companies listed in the article are based on funding rounds recorded for companies on the Crunchbase’s Emerging Unicorn Board by Jun. 1. All additional companies with funding rounds added to the Crunchbase list after Jun. 1, are not included in this article.

This issue of The Lead List includes companies added to Crunchbase’s Emerging Unicorn Board throughout May and are ordered based on their Crunchbase rank score (a proprietary, dynamic ranking that uses intelligent algorithms to score and rank companies) as of June 1. An entity’s Crunchbase rank is fluid and subject to rise and fall over time due to time-sensitive events such as product launches, funding events and leadership changes, so the current rank score may not reflect the listed rank scores below.

The Emerging Unicorn Board is updated whenever a new company reaches a specific valuation range (companies valued between $500 million and less than $1 billion). Once a company reaches a valuation of $1 billion, it is classified as a “unicorn” and added to The Crunchbase Unicorn Board. Companies that exit through a public listing or acquisition are also removed from the Emerging Unicorn Board.

If you have any questions about companies on the board or this list, please contact us at support@crunchbase.com.

1. Ather Energy

Crunchbase Rank: 43

Post Money Valuation: $900 million

Ather Energy is a manufacturer of electric scooters and an electric vehicle charging network called Ather Grid. The company recently closed on a $128 million Series E led by National Investment and Infrastructure Fund, India’s first infrastructure-specific investment fund, with participation from HeroMotoCorp Ltd. Ather Energy is an emerging unicorn to keep your eyes on since venture-backed startups in the EV space raised upward of $20 billion in 2021, more than double the nearly $10 billion raised by companies in the sector in 2020, according to Crunchbase News.

Why Ather Energy should be on your radar: Ather Energy was added to the Crunchbase Emerging Unicorn Board following its Series E, which brought its valuation to $900 million. With the fresh funding, the company looks to “enhance its capacities across the board, bring additional focus on its new platforms, expand into new geographies, and double down on the reputation it built for making a product that is high in quality,” according to the VC Circle. Ather Energy could be your next big deal as the company continues to grow and approach unicorn status.

Crunchbase User Tip: Do you want to monitor Ather Energy’s activity?

With Crunchbase Starter and Pro, you can enable automatic alerts to stay up to date on high-growth startup news and buy signals. With automatic alerts, you can select what you want to be notified of (funding rounds, news, etc.) by designating either Daily or Weekly updates for that alert type. Learn more about automatic alerts.

2. Firework

Crunchbase Rank: 51

Post Money Valuation: $750M

Firework is a livestreaming commerce and digital platform that brings interactive video experiences to websites and apps. The company recently closed on a $150 million Series B led by the SoftBank Vision Fund 2. The livestreaming platform raised one of the largest funding rounds in May and has now raised nearly $270 million through eight funding rounds. The company intends to use the capital to “increase talent acquisition in engineering, product and marketing, and deliver several enhancements to its overall platform.”

Why Firework should be on your radar: Livestreamed shopping has long been popular in China, but it has been slow to take off in Western markets, including the U.S. In Firework’s company update, it stated, “The short-form video and live-shopping wave are just beginning to lap America’s shores. A live-commerce market that generated over $300 billion in China last year, making up almost a fifth of all retail e-commerce sales, [the live-commerce market] holds immense promise here [America].” With tech giants like Meta, Amazon and Alphabet already developing their own livestream shopping tools, Firework should be on your radar as the live-commerce market continues to grow in popularity and expand worldwide.

3. FINN

Crunchbase Rank: 80

Post Money Valuation: $500M

FINN is an automotive leasing company that offers monthly car subscriptions to create a sustainable method for mobility. The company recently closed on a $110 million Series B, which valued the company at more than $500 million. The round was led by Korelya Capital with participation from existing investors such as White Star Capital, HV Capital, Heartcore Capital, UVC Partners and Picus Capital. The automotive company also saw funding from new investors such as Keen Venture Partners, Climb Ventures, Greentrail Capital and Waterfall Asset Management.

Why FINN should be on your radar: Car subscription platforms are becoming increasingly popular as consumers shift away from traditional car ownership models. According to FINN, “Customers favor access to items and services rather than owning them, which would require them to pay large amounts of cash in advance.” The company offers new cars for rent with no hidden fees or down payment and lowers the barrier for many consumers looking to try out electric vehicles. With the fresh funding, FINN looks to accelerate hiring across its global teams, advance its technology and continue expanding throughout the U.S. and Europe, indicating a focus on company and product growth.

4. Tailscale

Crunchbase Rank: 177

Post Money Valuation: $785M

Tailscale is a VPN service that makes the devices and applications you own accessible anywhere in the world, securely and effortlessly. The company recently raised a $100 million Series B led by CRV and Insight Partners with participation from Accel, Heavybit and Uncork Capital. CEO Avery Pennarun told TechCrunch in a recent article that Tailscale plans to use its new funding to “expand its marketing and sales teams, but especially investing in building additional product features.”

Why Tailscale should be on your radar: Tailscale has experienced 1,200% year-over-year growth and continues to sustain 20% growth quarter over quarter in active monthly users, primarily due to organic word-of-mouth, according to the company. The company is rapidly growing and establishing itself as a leader in the VPN space which can be used to “share software services or replace a [big-name competitor] corporate VPN like Cisco AnyConnect, OpenVPN and Palo Alto Global Protect.” Tailscale currently has a handful of open roles for which it’s actively hiring. The majority of these roles are in engineering and marketing, signaling a focus on company expansion and product growth.

5. Deserve

Crunchbase Rank: 125

Post Money Valuation: $500M

Deserve is a fintech company that looks to remove the complexity of launching a credit card. The company secured a $250 million credit facility from Cross River, Goldman Sachs and Waterfall Asset Management. According to Fintech Futures, the company intends to use the funding to “roll out new credit card offerings from this year, including subscription management programs, buy now, pay later (BNPL), home equity and SME card programs.”

Why Deserve should be on your radar: According to Deserve’s recent press release, “In the last year, Deserve’s platform business has successfully launched credit card programs for partners such as BlockFi, M1 Finance and OppFi, among others. In 2022 and beyond, Deserve plans to bring innovative card programs that help consumers manage subscriptions, augment BNPL, unlock their home equity as well as card programs for SMBs and commercial customers.” With the concentration on product growth and its backing from big-name giants, such as Visa, Mastercard and Sallie Mae, it would be smart to keep Deserve on your radar.

6. Zepto

Crunchbase Rank: 134

Post Money Valuation: $900M

Zepto is an instant grocery delivery startup spearheaded by Aadit Palicha and Kaivalya Vohra, two 19-year-old entrepreneurs who dropped out of Stanford to start their quick-commerce business. The company raised a $200 million Series B earlier in May, led by Y Combinator with participation from Kaiser Permanente and its previous investors, Nexus Venture Partners. Zepto currently operates in 10 cities in India and plans to cover 24 more in the next quarter with this new round of funding.

Why Zepto should be on your radar: Due to the pandemic, there was a massive shift in customer demand and buying decisions, and the modern customer journey evolved to favor fast deliveries and convenience. The quick-commerce industry was said to generate between $20 billion and $25 billion in U.S. retail sales by the end of 2021, according to a Coresight Research report. In other words, Zepto is a great company to keep on your radar. As the quick-commerce sector continues to be a hot topic, it might be worth setting up alerts for Zepto and similar companies.

Crunchbase User Tip: Want to find successful startups similar to Zepto? Let Crunchbase find hyper-targeted sales leads for you.

With similar companies, it’s easy to identify companies that resemble your recently closed deals and figure out which companies with high-growth potential to watch. Crunchbase profiles now have a new ‘similar companies’ tab that utilizes our unique machine-learning model to automatically surface similar accounts and possible competitors for the profile you’re viewing. Similar companies makes it easier to discover and qualify accounts without interrupting your workflow.

7. TIFIN

Crunchbase Rank: 137

Post Money Valuation: $842M

TIFIN is a fintech platform that uses artificial intelligence and “investment-driven” personalization to shape the future of investor experiences. The company recently secured a $109 million Series D led by Motive Partners with participation from Morningstar, J.P. Morgan Asset Management, Hamilton Lane, Franklin Templeton Investments and Broadridge. Just a few weeks after its funding announcement, the company launched its new product, the Magnifi+ platform, which provides investment intelligence from leading financial pros through proprietary and engaging video content.

Why TIFIN should be on your radar: TIFIN uses AI to drive personalization for wealth management and digital distribution for investment managers. In pursuing its mission to make investing a more meaningful driver of financial well-being, TIFIN operates an ecosystem of products that include Magnifi, Financial Answers, TIFIN Wealth and Distill. The company plans to use its funding to “support its continued growth, with particular emphasis on Magnifi’s consumer platform, Distill’s expansion with asset and wealth enterprises, TIFIN’s expansion outside the U.S. and additional fintech innovation initiatives.” In addition to global expansion, TIFIN currently has a handful of open roles for which its hiring. The majority of these roles are for its engineering team, indicating a focus on product growth.

8. Hello Heart

Crunchbase Rank: 146

Post Money Valuation: $600M

Hello Heart provides cardiovascular digital therapeutics to empower people to track their blood pressure, pulse, medications, weight and activity using AI-based technology. The health-tech company closed on a $70 million Series D led by Stripes with participation from Resolute Ventures, Maven Ventures, IVP and BlueRun Ventures. As the leading provider of digital solutions for heart health, the Hello Heart app has shown a high engagement rate among its users with sustained long-term app engagement. The company plans to use its funding to further its product development and hire top talent across its go-to-market teams (sales, marketing, customer success, etc.) as well as its engineering and data science teams.

Why Hello Heart should be on your radar: The focus on prioritizing heart health has intensified in light of the Surgeon General’s Call to Action for improving hypertension control across the United States. Hypertension is the most prevalent chronic condition impacting roughly half of U.S. adults. Unfortunately, more than 3 in 4 adults don’t have their blood pressure under control. Hello Heart’s product focuses on a hypertension self-management program that provides wellness tips to help people make healthier choices, which in turn can reduce their blood pressure and subsequently reduce their risk of heart disease and stroke. With successful companies like Apple and Google expanding their heart-health tracking capabilities, Hello Heart should be on your radar as the health-tech market continues to grow into the large market opportunity ahead.

9. Pyramid Analytics

Crunchbase Rank: 406

Post Money Valuation: $900M

Pyramid Analytics provides “decision intelligence” for employees across user organizations with enterprise-level business analytics software. Decision intelligence is a strategic platform approach combined with AI that lowers the skills barrier and empowers anyone—from the C-suite to the frontline—to make faster, more intelligent decisions. The company raised a $120 million Series E led by H.I.G. Growth Partners with participation from Clal Insurance Enterprises Holdings, Kingfisher Capital LLC, Kreos Capital and General Oriental. Early investors that also participated in this round include Sequoia Capital. Jerusalem Venture Partners, Maor Investments and Viola Growth.

Why Pyramid Analytics should be on your radar: In a company press release, Pyramid Analytics CEO and co-founder Omri Kohl stated, “At no time in our company’s history have the stars aligned so perfectly. With a competent and experienced leadership team, a product team driving the development of our innovative Decision Intelligence Platform, a customer-focused Go-To-Market team, and investors who see the promise of our vision, technology, and market opportunity, the future is bright.” The company plans to use its funding to further product development, expand its global geographic presence, and hire additional talent. As the company continues to grow and approach unicorn status, Pyramid Analytics could be your next big deal.

10. Vention

Crunchbase Rank: 510

Post Money Valuation: $767M

Vention is a next-generation digital manufacturing platform for machine design, enabling engineers and other manufacturing professionals to design and automate their production floor in just a few days. The company closed on a $95 million Series C led by Georgian with participation from White Star Capital, Walter Ventures, Fidelity Canada, Bolt and Bain Capital Ventures. Proceeds from the Series C financing will grow Vention’s go-to-market activities, expand its global distribution footprint, and accelerate the development of its hardware and software platforms.

Why Vention should be on your radar: Vention’s Series C came just a few months after its announcement of its North American expansion in Boston. “Having a local presence in the U.S. will bring us closer to our American clients and business partners,” said Etienne Lacroix, Vention’s CEO and co-founder. The expansion is the second one this year, as the company recently opened an office in Berlin, Germany. In addition to global expansion, Vention is rapidly hiring and has 46 open roles in which they are looking to hire top talent. The majority of these roles are for its software, sales and operations team, indicating a focus on company and product growth.

Crunchbase User Tip: Make Crunchbase Research for You

If you are a Crunchbase Pro or Enterprise user, your recommendations page will automatically surface relevant companies to help you find your next opportunity. These recommendations are powered by machine learning and include context about why we are suggesting each company specifically for you. Learn more about Crunchbase’s company recommendation engine to automate account discovery and qualification.

11. Absolute Foods

CB Rank: 542

Post Money Valuation: $500M

Agritech startup Absolute Foods raised a $100 million Series B in its first institutional funding round from Sequoia Capital India, Alpha Wave Global and Tiger Global Management. Absolute Foods controls the whole cycle of agricultural produce, from seed to harvest. Its offering includes AI-driven FARM OS that can be implemented across vertical and open farms, which enables farmers to grow crops without using synthetic enzymes. According to Inc 42, “The startup will use the funds to ramp up hiring and expand to newer geographies.”

Why Absolute Foods should be on your radar: Investors are not backing away from plowing more investments into startups that help grow more greens. According to Crunchbase News, “Agtech has become a darling sector among investors after seemingly being an afterthought for years. Until 2020, the sector had never reached the $2 billion investment threshold in any year. However, in 2020 funding jumped and in 2021, it hit nearly $5.7 billion.” Absolute Foods is well-positioned to become a high-growth company as some of Silicon Valley’s big-player VCs back its product and mission, and it would be smart to keep the agtech company on your radar.

12. Tiki

CB Rank: 634

Post Money Valuation: $850M

Tiki is an e-commerce company that specializes in the end-to-end supply chain and partnering with brands. The company was recently added to the Crunchbase Emerging Unicorn Board following Shinhan Financial Group’s acquisition of a 10% stake in the Vietnam-based e-commerce platform. This acquisition made the Shinhan Financial Group the third-largest shareholder of Tiki.

Why Tiki should be on your radar: Tiki was first launched as a bookstore by Son Tran Ngoc Thai in 2010, but has become an e-commerce giant with around 20 million users. The company closed on a $258 million Series E in October 2021 led by AIA Group and participation from Yuanta Investment, UBS, Taiwan Mobile Co Ltd, STIC Investment and Mirae Asset-Naver Asia Growth Fund. AIA’s lead investment of $60 million, pushed the company’s valuation to $850 million in late 2021.

13. Ninjacart

CB Rank: 2,247

Post Money Valuation: $815M

Ninjacart operates an online business-to-business platform that directly connects farmers, manufacturers and brands to retailers through a lean and connected supply chain. The company’s platform enables the distribution of vegetables and fruits to retailers and restaurants across India. Ninjacart recently raised a $9 million Series D led by STIC Investments and Mainstreet Digital, just months after it closed a $145 million round led by Walmart and Flipkart. According to Ninjacart’s press release, “This investment will further accelerate Ninjacart’s journey towards building technology and infrastructure to organize, empower and enhance the lives of millions of agri-value chain participants including farmers, resellers, retailers, consumers, and supply chain participants.”

Why Ninjacart should be on your radar: Recent investor to Ninjakart, Kalyan Krishnamurthy, CEO of Flipkart, said, “As a homegrown company, we have constantly focused on creating the right infrastructure and technological solutions that support local farmers, producers, and food processors.” The investments will help Ninjacart further its grocery footprint and offerings to consumers across India while still offering its quality and affordable options. Ninjacart currently is hiring for 41 open roles. The majority of these roles are for its recruiting and sales teams, indicating a focus on company expansion.

14. Neo Financials

CB Rank: 4,737

Post Money Valuation: $780M

Neo Financial is a fintech company that is reimagining the way Canadians manage their money with tech-first financial tools to spend, save, invest and more in the digital age. The company recently closed on a $185 million Series C led by Valar Ventures. In addition to Valar Ventures, other participants in the Series C round include Tribe Capital, Altos Ventures, Blank Ventures, Gaingels, Maple VC and Knollwood Advisory. According to VCA Online, “Since its inception in 2019, Neo Financial has grown to over 1 million customers and reached a ‘unicorn’ valuation [$1 billion CAD] in less than 3 years, making it one of the fastest Canadian companies to achieve these milestones.”

Why Neo Financial should be on your radar: In the VCA Online article, Andrew McCormack, a founding partner of Valar Ventures and investment partner in Neo Financial said, “The pace at which this team releases new products and grows its customer base is among the fastest we have seen in our careers. As a result, Neo can be the biggest disruption the Canadian banking industry has seen in decades, and their influence on financial services available to Canadians will impact the lives of millions.” With its fast-paced product releases and over 7,000 business partnerships nationwide, it would be smart to keep Neo Financial on your radar.

15. Freetrade

CB Rank: 8,077

Post Money Valuation: $878M

Freetrade is an app that makes investing simple and free. The company recently raised $37.6 million in a debt financing with its existing institutional investors, Molten Ventures, Left Lane Capital and L Catterton, participating in the round. The funding round was also joined by new investors, Phoenix, an investment manager with over $100 billion in assets, and Capricorn Capital Partners, a private investment firm. With the new capital, Freetrade looks to accelerate international plans and provide access to markets in a responsible and trusted way.

Why Freetrade should be on your radar: In the past few months, Freetrade has introduced a series of new features to its products, such as Freetrade Web, as well as securing a license from the Swedish financial regulator, a big step forward in its European expansion. According to Freetrade’s press release, “We raised this capital following a period of strong performance for the business amid volatile equity markets. Our registered users surpassed 1.3m in the UK alone, revenue for the calendar year 2021 increased over 6x to £15.1m, AUA surpassed £1bn and trading volumes for the year exceeded £3.7bn.” This signals a focus on growth and expansion as it starts to scale up throughout the country.

16. Motif

CB Rank: 21,716

Post Money Valuation: $726M

Motif is a Boston-based food technology company that focuses on plant-based food. The company recently raised an undisclosed investment from FootPrint Coalition Ventures, a firm co-founded by actor Robert Downey Jr., Steve Levin and Jonathan Schulhof. In 2020 and 2021, investors poured more than $2 billion into startups around the world working on cell-cultured meat and other cell-cultured food alternatives, per Crunchbase data.

Why Motif should be on your radar: According to Crunchbase News, “Investors say the alternative protein space has plenty of runway to grow, with both younger startups developing real technology and established companies that are looking to scale needing investment capital.” Motif was among the many top-funded startups last year focused on the animal-alternative meat and dairy space, including Impossible Foods, Perfect Day and Nature’s Fynd. Foodtech is a relatively new startup sector that has experienced tremendous momentum in just a few short years, going from about $2.2 billion in total venture investment in 2017 to almost 6x that amount last year. As a key player in the foodtech industry, Motif is an emerging unicorn to keep your eye on.

Join us next month as we continue to keep an eye out for hot companies. You can use this list to track the cohort of new fast-growing startups being added to the Emerging Unicorn Board throughout the month.