Can you solve your sales problems before they happen?

It was a weekly meeting of sales team leaders. Our goal was to identify urgent problems and decide how to fix them. We all had different points of view about lead generation, and conversations often got heated. Everyone was concerned with how the proposed solutions would impact themselves and their teams. No one was really happy with the “fix.”

I thought back on those meetings when I read Frank M. Campbell’s post: “An Ounce of Prevention.” The title borrows from the old Benjamin Franklin quote: “An ounce of prevention is worth a pound of cure.” I remember hearing people say that when I was young and thinking: “What in the heck does that mean?”

I recently learned that Franklin made this famous proclamation during a visit to Philadelphia, where he learned about the city’s fire prevention methods. That was in 1773.

Franklin was talking about actual fires, but when we quote him, we’re usually talking about metaphorical fires. That’s what we were doing in those weekly sales leadership meetings—putting out fires. But what if we had prevented them from happening in the first place? Could an ounce of insightful planning have saved us a pound of problems, and a ton of headache-inducing meetings? Could it have unclogged our sales pipelines and prevented our teams from having to resort to hours and hours of needless, thankless cold calling?

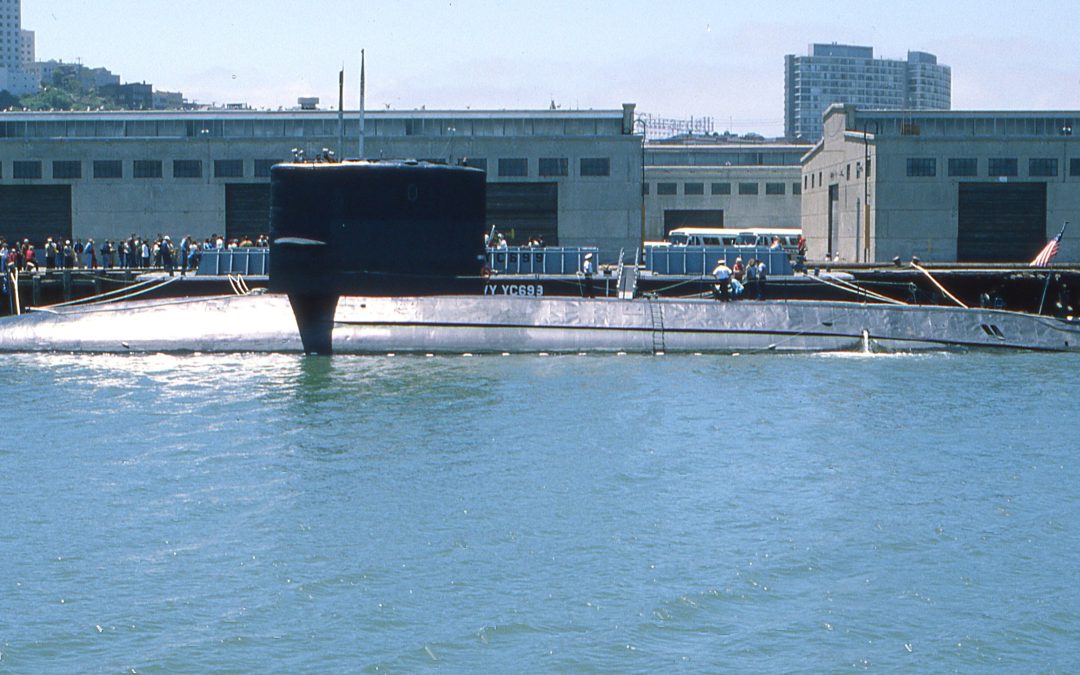

Frank W. Campbell, founder of Stratus Financial Partners, learned some early lessons about the value of preventive measures during his time working on a submarine. Read his recent post below to find out how those insights have served him well in business:

An Ounce of Prevention

By Frank M. Campbell, CLU

I was at an estate planning meeting recently, and the room was filled with attorneys, CPAs, and investment advisors. It was a great cross-section of the various professionals who serve as advisors and provide guidance and advice to their clients. The program was a case study.

We were asked to discuss the issues that concerned us from our different vantage points so that, in the end, the client in the case study would be particularly well-served and protected.

Problem

The direction of the discussion quickly got pushed off course. We were discussing all the issues that could go wrong and how to correct them. There were a lot of really well-qualified advisors in the room, sharing what they would do to fix the many, many problems that would be cropping up from the fact pattern.

Responding to a problem when it crops up is good. When I was a crewmember of a submarine we trained so hard all the time that, when a problem did come up, our response was immediate and intuitive. We were trained to minimize and eliminate the threat without having to first think very hard about it.

It was a crucial skill that served us all very well.

85% of the people in the room were excellent at responding to and prevailing over the problems presented in the case study.

Solution

Even better than properly responding to a problem is to not incur that problem in the first place. My recollection of time onboard my submarine is that we spent even more effort and training on doing what we needed to do to keep the problems from cropping up in the first place.

15% of the people in the room were excellent at anticipating and planning for the problems before they cropped up in the first place.

Outcome

At the end of that meeting, I was left with two takeaways; first, if the 15% of us who focus on preventing our client’s problems in the first place were successful, the other 85% would have a lot less to do because the issues they needed to correct were no longer going to be so prevalent.

Secondly, the great good we do as advisors for our clients is when we’re able to remind them that an ounce of prevention is only uncomfortable at first, but a pound of cure can be really painful for a much longer period of time.

About Frank M. Campbell, CLU

As the Founder of Stratus Financial Partners, Frank Campbell and his team ensure consumers and businesses receive their full insurance benefits. They use the knowledge and expertise gained from 30-years of providing clients with the best insurance vehicles possible. Stratus has one meaningful purpose: To protect clients, making sure their life insurance policies pay their full benefit. Read about Frank on LinkedIn.

(Featured image attribution: Malcolm Hill)

Great insight! Prevention is better than cure is 100% true for all the situations even in sales. Having a meeting to discuss possible problems is better than discussing after something has happened.