It’s no secret that 2023 was a challenging year. While 2024 is bound to have its fair share of challenges, many sales leaders have kicked off the new year feeling cautiously optimistic.

How exactly will these sales leaders approach the year ahead?

Recently, we surveyed more than 750 sales leaders to get a better idea of what’s happening in their world. The results shed light on sales leaders’ top priorities and key challenges. We also gained insight into how sales organizations leverage technology – including revenue intelligence and artificial intelligence – to drive sales effectiveness and efficiency.

Here, we share 10 powerful stats curated from this survey.

#1: 64% of C-suite executives say sales funnel performance visibility is their main challenge

In addition, 62.5% of those with VP and SVP titles also cite sales funnel performance as their top challenge.

According to Mindtickle research

#2: 64% of VPs and SVPs cite a lack of benchmarks as a top challenge

Maintaining sales funnel health is a common challenge across all industries. However, the reasons why vary by industry.

For example, for those in the technology, financial services, and consumer goods industries, limited visibility is a greater challenge. This makes sense, as 64% of VPs and SVPs cite a lack of benchmarks as a top challenge.

On the other hand, the main contributing factor in the manufacturing and healthcare/pharmaceuticals industries is limited predictability and inaccurate forecasting.

Regardless of industry, increasing visibility into sales should be a top priority. Conversation intelligence is a powerful tool for gaining greater visibility.

Sales organizations can analyze calls from different sales process stages to identify benchmarks for winning behaviors. Then, sales managers can deliver skills-centric coaching to help reps hone those behaviors.

#3: Most companies have less than 100% visibility into deal outcomes

The exact figure varies widely by industry.

For example, 36% of those in the financial services sector have 100% visibility into deal outcomes. That’s the case for 40% in the healthcare/pharma space and a mere 13.5% in the technology sector.

100% deal outcome visibility by industry

This lack of visibility is problematic. After all, understanding the outcomes of business deals – and then implementing risk mitigation strategies – is essential for long-term success.

If your company has lower deal visibility, consider implementing tools or processes that provide better insights into the nuances of deal outcomes. That way, you can make more informed decisions and increase the likelihood of closing deals.

#4: Nearly 59% of organizations flag at-risk deals to managers

When managing deals, it’s common to face uncertainties. There are several strategies for navigating these uncertainties. One such strategy is flagging at-risk deals to sales managers.

Having the right tools in place is essential to identify at-risk deals. That way, managers can provide coaching and support to help sellers overcome challenges – and close more deals.

#5: 84% of organizations invest in a sales enablement function

A solid sales enablement strategy ensures sellers are always prepared for any deal that comes their way. When it’s done well, sales enablement can have a significant, measurable impact on sales outcomes.

It’s no wonder most organizations are investing in a sales enablement function.

If you’re not already, now’s the time to prioritize sales enablement. Investing in sales enablement teams and technology can transform selling behaviors – and significantly boost sales performance.

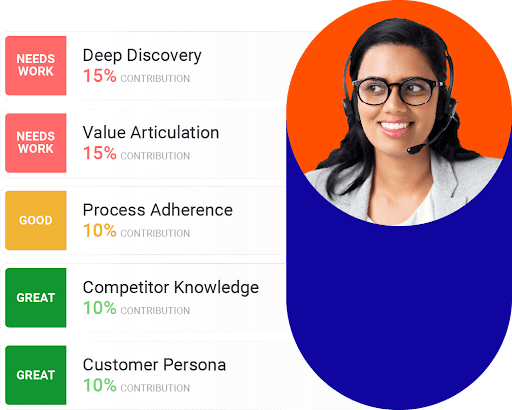

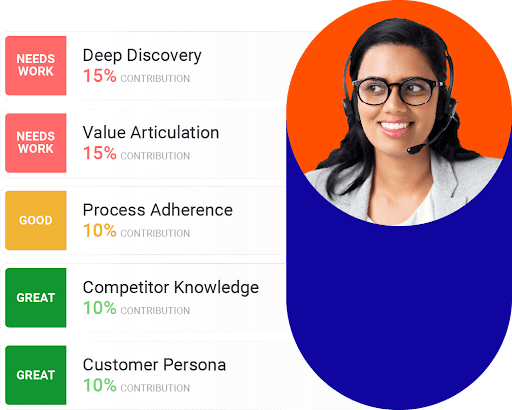

#6: Only 40% of C-level executives can identify strengths and weaknesses for customized training

Organizations recognize the impact of sales enablement. However, many continue to take a one-size-fits-all approach to sales enablement. At these organizations, enablement teams develop and deliver one-time training to all reps, regardless of whether or not they need it.

This approach isn’t effective. Instead, organizations must deliver personalized, ongoing training and enablement that addresses the needs of each sales rep.

The first step is to create competency profiles (Ideal Rep Profiles or IRPs) for each of the roles on your revenue team. IRPs outline the skills and competencies necessary for success in each role. Then, measure your reps against these IRPs to identify strengths and weaknesses. Sales leadership can then deliver training, enablement, and coaching to help each rep hone weaker skills and improve sales performance.

#7: 76% of revenue teams expect AI to significantly affect their day-to-day jobs over the next year

The vast majority of revenue organizations are embracing AI to boost productivity. In fact, a mere 24% aren’t currently using AI tools.

Of course, some industries are leaning into AI more than others. Unsurprisingly, the technology industry leads the charge, with around a 93% adoption rate. The healthcare/pharma industry lags much further behind, with an adoption rate shy of 47%.

Adoption of AI tools by industry

If you’re not already, now’s the time to incorporate AI into your 2024 strategy to boost seller performance. Chances are, your competitors are already tapping into AI to increase efficiency.

Regardless of your industry, be sure you’re aligned with your information security team to understand your AI requirements regarding tool usage. Be sure to communicate these requirements to your revenue teams regularly.

#8: 58% of revenue organizations leverage AI to analyze call recordings

Analyzing call recordings is the most common AI use case among those we surveyed. That’s not surprising. AI is a great tool for streamlining mundane, manual tasks like this that take a lot of time.

However, the power of AI extends beyond summarization.

Today, winning revenue organizations look beyond AI’s most obvious use case to identify more strategic, sophisticated applications. For example, some revenue organizations leverage AI to analyze data – and make smart recommendations based on that data to improve seller performance.

#9: In the tech industry, 54% of respondents achieve 90% of quota and have 10 or more tools in their current sales tech stack

On the other hand, 75% of companies in the consumer goods sector are reaching 50% of their quota, and 72% use fewer than 10 pieces of sales tech.

There’s a strong correlation between quota attainment and a company’s level of digital transformation. Industries that are leaders in digital transformation – such as the tech sector – exhibit the highest quota achievement rates.

Of course, just because a tool has been purchased doesn’t mean it’s actively used by sales reps regularly. A trend we found in our survey data is that the percentage of tools in the tech stack exceeds those actively used daily.

Evaluate your existing tech stack to ensure alignment with operational needs. By optimizing the tech stack, you’ll increase user adoption and maximize tool utility.

Finally, be sure to grow your tech stack responsibly. Rather than purchasing several “one-off” solutions, invest in fully integrated solutions that centralize impact in a rep’s flow of work.

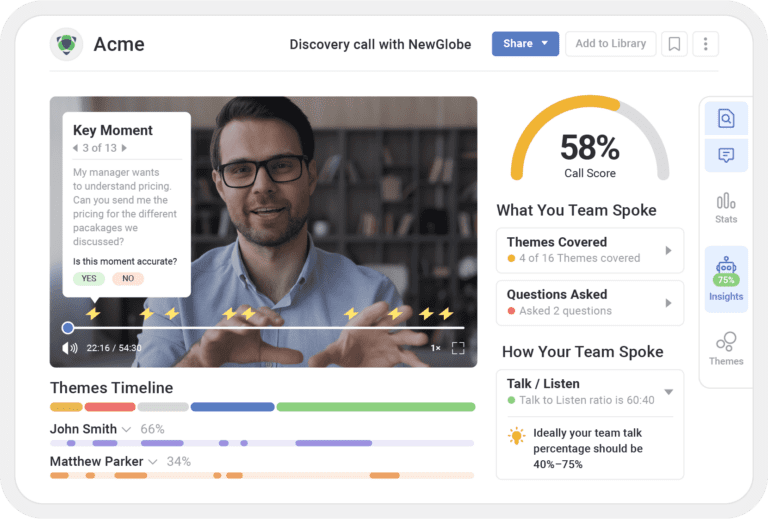

#10: Nearly 20% of C-suite respondents are considering implementing revenue intelligence tools

Today, most people in various sales roles have embraced revenue intelligence and forecasting tools. In fact, most respondents have invested in a revenue intelligence and forecasting tool beyond their CRM. This makes sense, as RI tools provide myriad benefits, including improving sales funnel performance, increasing visibility for teams and reps, scoring deal health, and providing actionable insights through dashboards.

Even the C-suite recognizes the strategic importance of these tools, with nearly 20% considering implementing them. This stat highlights the growing recognition of the importance of RI tools – even at the highest levels of an organization.

The message is clear: now is the time to adopt comprehensive revenue intelligence tools that go beyond traditional CRMs.

2024-2025 CRO Outlook Report

Ready to dig deeper into these and other insights you can use to optimize your sales productivity plans for 2024?

Get Your Copy