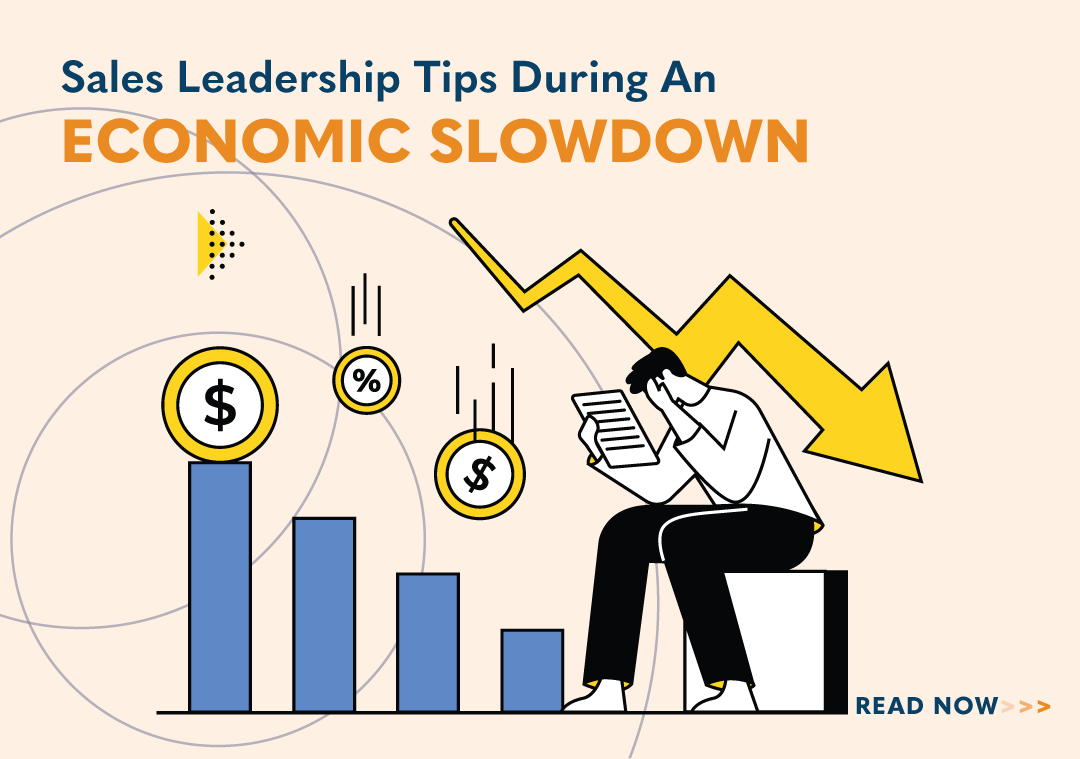

Sales Leadership Tips During an Economic Slowdown

CEOs naturally focus on financial metrics like revenue growth rate, operating expenses, and EBITDA in a downturn. However, other sales levers that drive profitability are available but not in the headlines. The last downturn in 2008-09 caused countless unprepared CEOs to close their doors. Talk to one of those CEOs, and they explain it like this, “We launched at the worst time in history, during the credit crunch.” However, great companies like Dropbox, Zoom, and Slack launched during those turbulent times. This article explores the sales levers available to CEOs to help navigate an economic downturn.

Every decision a CEO makes during a downturn will have a magnified impact on the company. First-time CEOs must make decisions and execute in an environment they’ve never experienced. CEOs who do it well outperform competitors who struggle with execution. At Janek, we view execution as a sales asset. CEOs must make critical business decisions in a downturn, and each decision carries risks that the CEO can mitigate by focusing on the basics.

Profits, People, and Process

“You cannot overtake 15 cars in sunny weather…but you can when it’s raining.”

Ayrton Senna, Formula One World Champion racer.

Selling in a downturn has advantages, but if you do the same thing as everyone else, you will make the same progress. When the economy shifts from growing to slowing, adjustments are required. If you enter this environment unconcerned and assume everything will be okay, be prepared to reap what you sow.

Profitability Over Growth

The “growth-at-all-cost” mindset can be detrimental in a downturn. Those grand growth plans that were made when the economy was on fire must be re-calibrated against the softer demand reality. On the other hand, some CEOs think they can make a small cut here, a small cut there, and still make their numbers in a downturn. Cutting costs in isolation leads to a death by a thousand cuts. Defensive cuts here and there may improve the balance sheet slightly, but they are not enough to create an advantage out of adversity. The sales team must go on the offensive and consistently beat the competition at winning the best customers.

People

If the sales team is not consistently winning the best customers, the CEO must decide if the right people are in the right roles. If you listen to CEOs describe how they managed to outperform the competition in past downturns, you’ll hear two recurring themes, “Tough decisions and our people.”

What we are looking for from the sales team is simple: Is the sales department comfortable having uncomfortable business conversations with clients rather than comfortable product conversations? Those easy deals are few and far between. Let the competition pitch their products and fight over the breadcrumbs. To outsell the competition when demand softens requires a sales team who can have complex business conversations with clients. We call them trusted advisors.

In a downturn, the labor market will get tight. Companies are already laying off, but there is one position with job security — revenue producers. Demand for high-performing sales talent increases in a downturn because their value increases. The obvious implication is that CEOs cannot afford to lose a high performer. The other outcome, retaining marginal producers (who are fighting for breadcrumbs with the competition), is a luxury few companies can afford in a downturn. Improving sales talent in a downturn leaves CEOs with two options: Go into the market and upgrade their sales talent or get serious about training and developing the current sales team.

Process

In a growing market, inefficiency in the sales process can impair profits, but the same inefficiencies can be crippling in a downturn. For example, when business was booming, high-growth companies had the luxury of an overabundance of inbound leads. Sales reps would make a handful of attempts at connecting with prospects and, if unsuccessful, place the opportunity into an automated sequence. The sales team had a high closing rate of bottom-of-the-funnel opportunities, but the CRM was full of unconverted opportunities. In a slowdown, bottom-funnel opportunities dry up first. Fewer inbound opportunities place a premium on business development, prospecting, and nurturing skills.

The slowdown effect will be unique to each company’s sales process. However, it would be unreasonable to think the old sales process will remain optimized for the current environment. Adjustments likely will need to be made, especially once you decide to target the highest-value customers in your market.

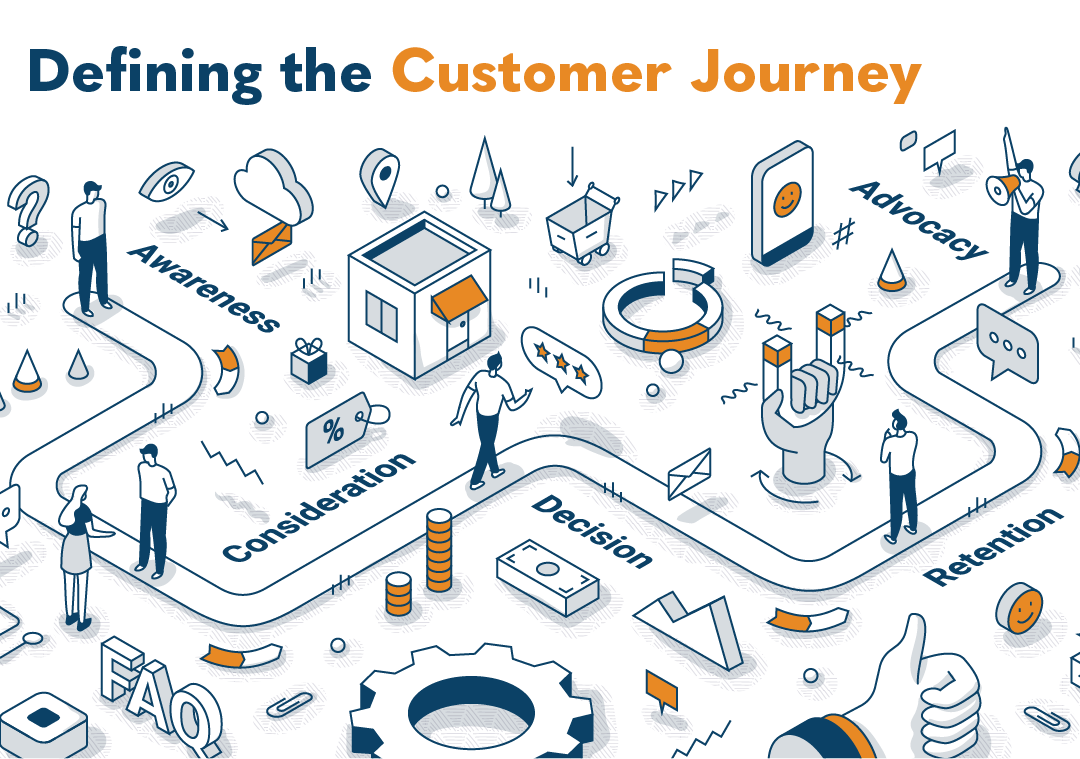

How to decide what specifically needs to change? Maniacal focus on the buyer’s journey.

If winning in a downturn requires acquiring the best customers, figuring out why the best customers are not buying from you is an excellent place to start. Customers are still buying products from your competitors, yet most companies have no visibility into the purchase decision. Without this data, companies play a never-ending guessing game. This lack of data drives up client acquisition costs and negatively impacts profitability. Worse, without visibility into your customer’s path to purchase, it is impossible to course correct. Learning what impacts the buying decision requires a business conversation discussed earlier. These vulnerabilities will only escalate as the market tightens without finding the truth about why buyers purchased from competitors.

The Speed Factor

During a slowdown, the standard timeline for reviewing performance metrics shrinks. Quarterly reviews are too long because the focus has tightened. For example, during high growth periods, initiatives are launched with extended timelines to measure the impact. However, faster feedback loops from clients and sales should be prioritized during a market slowdown. A key client may leave, competitors may drop their price, while your vendors rolled out a price increase, all in the same week. In other words, time to unplug the autopilot and start manually navigating the ship.

Let’s assume the CEO is executing all the obvious levers, price, upsell, cross-sell, new markets, and reducing customer churn. The team would have a quarter or two to execute each initiative under normal market conditions. In a downturn, the timeline is compressed, and team members may need to manage multiple initiatives simultaneously. Again, the CEO must have the right team members to execute the new initiatives. If the team lacks experience or bandwidth, it might be better to bring in an outside expert rather than delay profit-generating initiatives.

In Conclusion

It’s not all doom or gloom. I’m reminded of how Tiger Woods viewed poor weather conditions. For Tiger, bad weather was an advantage because there was less room for error, which played to his strengths. In sales, when demand softens, there’s also less room for error. The best operators are rewarded, while average operators are penalized.

The best way to win in a downturn is to focus on the basics: profits, people, and process. Likely, a few CEOs reading this are screaming, “You didn’t mention products!” I avoided products for a reason. CEOs with a product background reduce the sales process to “the best product wins.” In my opinion, this oversimplifies the complexity of navigating a downturn. Wishing away the increased competition, softer demand, and the impact on sales performance is detrimental to success.

Navigating a business in a downturn is hard. There is no easy path. The only thing that makes it easier is experience. A huge part of getting it right is setting the right priorities, ignoring the outside noise, and focusing on executing the next best action. If you are uncertain about the next best action for your sales process, we view ourselves as partners who help CEOs navigate the risks associated with a downturn.

- Account Planning (16)

- Awards (42)

- Client Testimonial (37)

- Personal Branding (21)

- Podcast (12)

- Research (77)

- Sales Career Development (90)

- Sales Coaching (164)

- Sales Consulting (141)

- Sales Culture (181)

- Sales Enablement (380)

- Sales Leadership (111)

- Sales Management (267)

- Sales Negotiation (11)

- Sales Prospecting (136)

- Sales Role-Playing (19)

- Sales Training (242)

- Selling Strategies (279)

- Soft Skills (78)

- Talent Management (101)

- Trusted Advisor (29)

- Virtual Selling (57)

- Webinar (13)