The pending recession dampens wage inflation pressure on sellers’ pay in 2023, according to the results from Alexander Group’s 2023 Sales Compensation Trends Survey. For most of 2022, wage inflation made the headlines. However, emerging recessionary forces at the end of 2022 are now keeping sellers’ pay subdued for 2023. The survey results indicate sales departments are allocating a traditional and modest 3% increase for on-target-earning budgets in 2023.

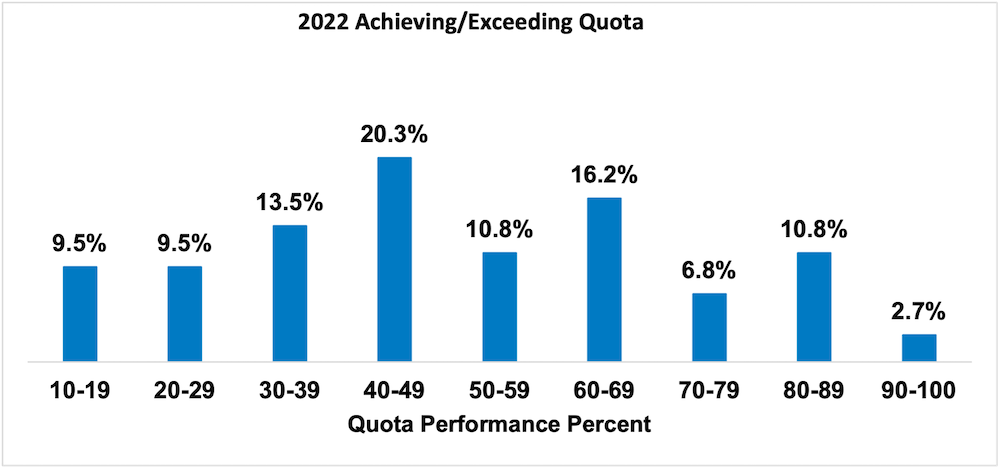

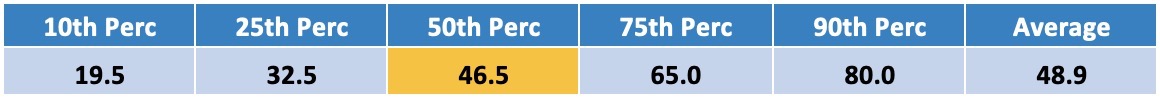

More than 85 companies reported revenue performance, turnover rates and change in compensation costs, including incentive and total compensation increases. Participants reported on 2022 performance and expected 2023 practices. While companies performed well in 2022, sellers struggled to reach quota with only 46.5% achieving their target performance.

Survey Highlights

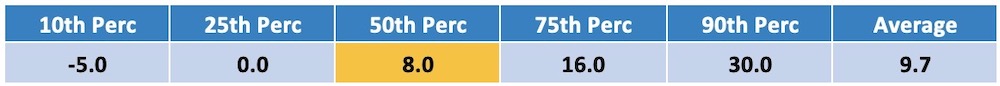

Sales departments did well in 2022. They achieved 8% median increase in sales.

2022 Sales Performance

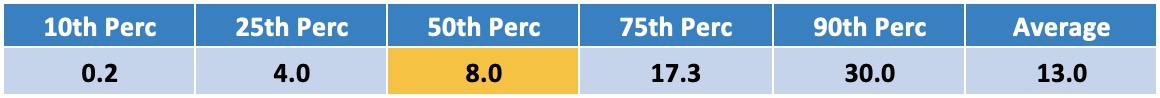

Surprisingly, sales departments expect a similar sales performance for 2023: an 8% median growth projection. Some are expecting a more robust year skewing the projected average revenue growth performance to 13%.

2023 Expected Sales Performance

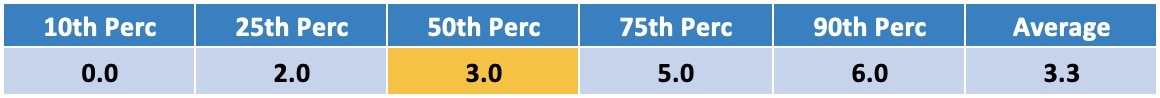

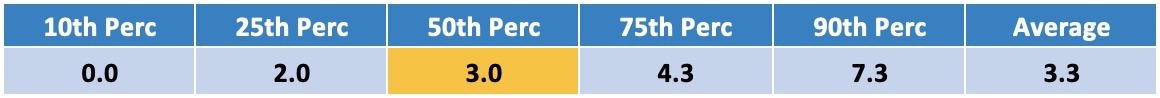

The 2022 incentive cost increase remained muted at 2%. Companies plan a 3% increase in base pay and an overall increase of 3% in target total compensation costs in 2023.

2023 Expected Incentive Plan Budget Increase

2023 Expected Total Compensation Budget Increase

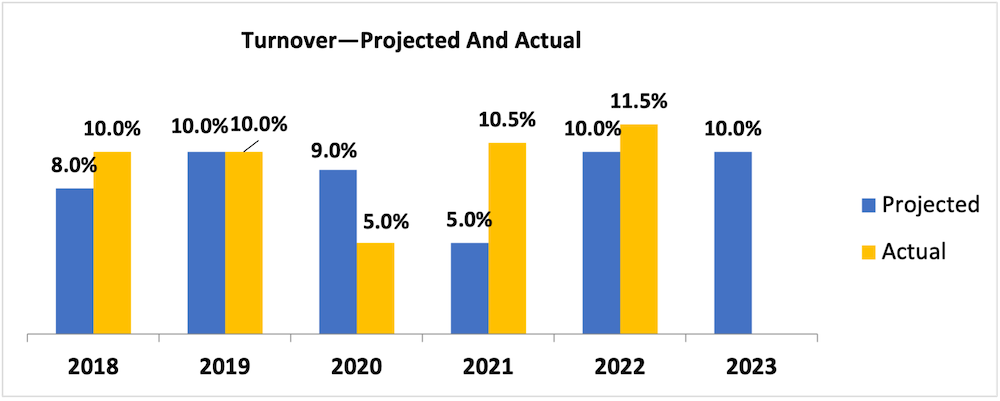

While companies made progress in reducing open positions, turnover was 11.5%–a rate higher than the historic 10% turnover rate. Companies expect a 10% turnover rate in 2023.

Overall, sellers did not fare as well. Only 46.5% of all sellers reached quota in 2022. The median average quota performance was 93%.

Overall 2022 Quota Performance

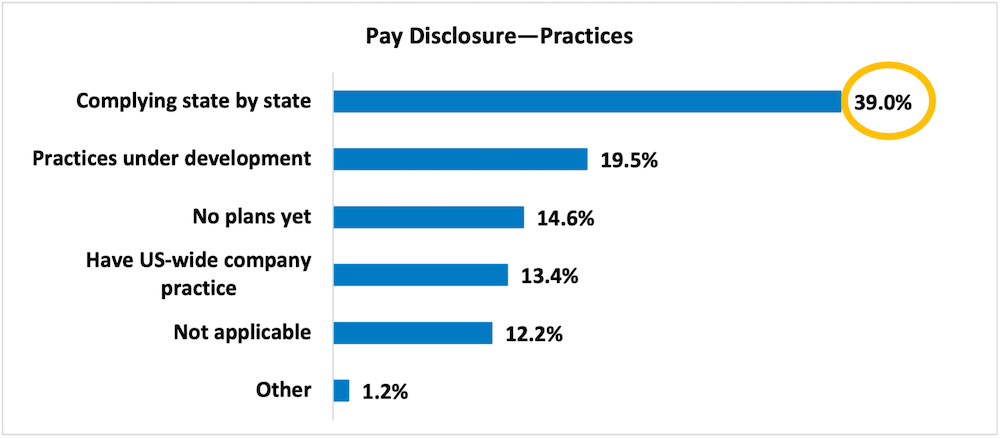

Special Topic: Pay Disclosure Practices

Several states now require pay disclosure (pay ranges) to be posted with job openings and provided to requesting applicants. The survey participants reported on their practices with 39% complying on a state-by-state basis.

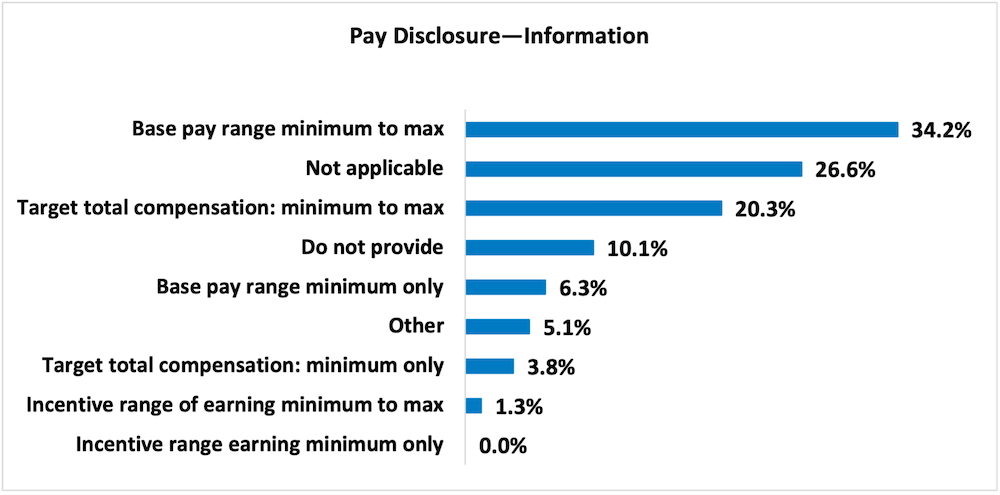

And what are they disclosing? Mostly, base pay ranges (34.2%), followed by target total compensation ranges (20.3%).

What’s Expected in 2023?

While participants expect a mild recession in 2023, they still expect 8% revenue growth. Turnover will be about 10%. Wage increases will remain close to 3%.

About the Survey

Now in its 21st year, the annual Sales Compensation Trends Survey gathers employment, pay and incentive plan design information. In addition to topical questions, key metrics repeat each year giving a multiyear perspective on trends and practices. Participants submitted data in November/December of 2022, and results were published to participants in January 2023. 86 sales departments participated in the survey.

Get our newsletter and digital focus reports

Stay current on learning and development trends, best practices, research, new products and technologies, case studies and much more.