Statistically, 70 percent of online businesses fail due to less-than-optimal usability. Users expect meaningful experiences that “show and don’t tell” with the products that they are going to buy.

In the last few years, there has been a radical shift in the way people use and buy software. A good user experience that leads the user to experience value without hand-holding is far more important now than it used to be in the past.

In other words, we are experiencing the product-led era that came as a replacement for the marketing and sales-led one. Or is it?

This is what we are going to cover in this article:

- What are the characteristics of a product-led approach?

- How is product-led different than sales-led?

- How is product-led different than marketing-led?

What are the Characteristics of a Product-Led Approach?

Product-led growth (PLG) is a relatively new term popularized by OpenView Venture Partners. When a software company chooses product-led growth as its go-to-market strategy, it means that:

It relies on product usage and customer experience to acquire new users, retain its existing ones, and expand its user base.

|

Companies like Calendly, Expensify, Slack, and Dropbox are just some of the SaaS companies that have used product-led growth as the main drivers of acquisition, retention, and expansion.

With PLG, modern software companies manage to reduce overhead costs by massively reducing the cost of marketing and sales activities. At this point, let’s see what some of the main characteristics of a product-led approach are.

1) Product-Led Growth is Ideal for Self-Service & Transactional Products

It is important to understand that a product-led approach creates company-wide alignment across teams like marketing, sales, customer success, engineering and design.

Having said that, PLG is not a way to replace marketing, sales or customer success—it is just a methodology to get all these teams working together towards a certain goal. After all, product-led growth works mainly for self-served products that are mostly designed for small businesses.

When a product has a complex buying process, it certainly needs a more traditional approach to growth. The following graph depicts the three SaaS sales models:

|

The product's price and the sales process's complexity determine whether or not PLG can work for your organization.

PLG companies are the ones in the transactional and self-service sphere, while—as I previously mentioned—enterprise products need a more traditional approach to growth.

2) Product-Led Companies Connect the Volume of User Engagement with Revenue

An essential characteristic that product-led growth companies have is that the volume of user engagement is connected with revenue. Offering a value-metric-based pricing model, allows you to:

- Educate your users on how to use your product

- Give them the right incentives to keep using your product

According to Patrick Campbell from ProfitWell, “the value metric needs to be intuitive to the user and make sure that it grows properly with your customer.”

Let’s use Slack as an example. Slack connects the value that users receive from the product with how much they will pay for it:

|

The fact that you are charged only for the users who are active in your account is:

- Fair, since you pay for value and not for usage

- Able to create a virality effect on a product level

Lindsay Bayuk said, “Aligning customer value to the product and go-to-market was key to growing annual recurring revenue (ARR) for Pure Chat by 230 percent within a year.”

Let’s move on to the next characteristic of PLG companies.

3) Product-Led Companies Have a Wider Top of the Funnel (TOFU)

Product-led growth allows SaaS businesses to have a wider top of the funnel. Of course, having a wider TOFU is not going to help if the user experience is not valuable. Remember that the app turnover rate in 2023 was just around four percent.

This means that users won’t stick long with your product if they don’t get instant value out of it.

Nevertheless, a PLG approach will allow you to widen the top of the funnel and get more users to try your product. Of course, this happens due to the fact that your pricing model (freemium or free trial) mainly works as an acquisition model.

In fact, according to Patrick Campbell, Founder & CEO at ProfitWell:

“Freemium is an acquisition model, not a revenue model.”

This way, you can get more users at your door and improve your product based on their feedback.

4) Product-Led Companies Have a Lower Customer Acquisition Cost (CAC)

According to Sam Richard, “Freemium can be an amazing acquisition engine, opening the top of the funnel and halving your customer acquisition costs (CAC) during a period where the industry as a whole sees CAC on the rise.”

Companies that find a product-market fit and use product-led growth are able to keep their acquisition costs low. Of course, this contradicts the fact that customer acquisition cost (CAC) has risen by 50 percent in the last five years across B2B and B2C.

|

For businesses using a freemium model, the cost is up only by 25 percent. According to Paddle:

“Freemium CAC is nearly 15 percent on an absolute basis lower than free trial CAC, which trends much closer to companies not deploying either strategy.”

Despite that difference, free trial and freemium—which are PLG acquisition models—have considerably lower CAC than other models.

How is Product-Led Different than Sales-Led?

Now that we’ve covered the basics of product-led growth, let’s see what are its main differences with a sales-led approach.

Before we get started, let me say once again that product-led is not here to replace sales-led. As Chris Savage from Wistia mentions, “... my perception of sales was very black and white. Today, it’s clear to me that there’s actually quite a bit of gray on that spectrum.”

In that context, I am not going to convince you that a product-led approach is better than a sales-led approach. Instead, I am going to give you four differentiation points between them.

Let’s see what the four differentiation points are.

Differentiation Point #1: Product-Led Leads the User to a Meaningful Outcome in a Self-Served Manner

The first difference between product-led and sales-led is that product-led leads the user to a meaningful outcome in a self-served manner. Some examples of a meaningful outcome are:

- Sending the first email campaign to a number of subscribers (email automation tools like Mailchimp)

- Creating the first channel and communicating with your colleagues (team communication tools like Slack)

- Doing keyword research and discovering keyword opportunities (Ahrefs or other keyword research tools)

The way to achieve this is by getting users from point A (signing up for a free trial or freemium account) to point B (meaningful outcome) in the shortest time frame possible.

While companies using a product-led approach can achieve that through bumpers (product bumpers and conversational bumpers), sales-led companies need to provide human assistance so that the user can reach the first meaningful outcome in a timely manner.

|

Keep in mind that users nowadays want to be self-educated...meaning that they want to learn how to use a product by themselves. Of course, self-directed onboarding won’t work for every product or user. Some examples where self-directed onboarding may not work are:

- The product is complex or sophisticated and requires human assistance

- The user is not experienced or proficient enough to use the product

- The market is not mature—not yet ready for that particular product

In most other cases, a served product is a better way to help the user reach the first meaningful outcome in a timely manner.

Differentiation Point #2: Product-Led Helps You Attain More Cost Efficient Growth

An important difference between a product-led and a sales-led approach is cost efficiency. As I already mentioned, CAC for subscription-based businesses is higher than it was five years ago.

With product-led growth, you can attain cost-efficient growth in three ways:

- Since users onboard themselves, you reduce the sales cycle and time-to-value

- You have a lower cost to serve and higher revenue per employee (RPE) since you essentially need to have fewer people on your team

- You offer a better user experience with the least human assistance possible

Once again, I must say that product-led and sales-led can work together. Product-led companies like Wistia and Userpilot offer demos, except for the free trial or freemium version. This means that they partly offer hand-holding for some of their users.

However, their user onboarding and overall experience follow a product-led approach, which allows them to keep overall costs lower than if they used a sales-led approach.

Differentiation Point #3: Product-Led Companies Usually Target Smaller Businesses

Product-led companies mostly target smaller businesses. As mentioned in the first section, the product-led approach is ideal for companies with transactional and self-served products.

Sales, on the other hand, are ideal for products targeting enterprises. In these companies, users—who are usually not the buyers—don’t have the time or willingness to use new tools.

However, the lifetime value (LTV) is much higher here, as these products are usually more expensive, and customers stick with them longer. Marketo (now part of Adobe) is an example of such a product.

|

Marketo is a marketing automation tool that focuses on enterprise businesses.

Author’s Note: With Zapier, you can connect Close to Marketo with a codeless integration.

Thus, while product-led companies mostly target small businesses, sales-led companies mostly target enterprises. Keep in mind that small businesses are usually eager to try new tools that could help them drive growth for their business.

Differentiation Point #4: Product-Led Companies Focus on PQLs Rather than SQLs

Jonathan Kim from Appcues tells us that, “customers who talk with a salesperson consistently close at a higher rate compared to customers who are left to their own devices.”

This means that even for a self-served company like Appcues, human interaction with a salesperson can be very effective. In fact, according to Kyle Poyar, “for SaaS companies with a free version, only one-in-four see >50 percent of their paying customers buying purely via self-service.”

This means that sales are still very important. The only difference is that sales focus on sales qualified leads (SQLs) rather than PQLs. That can cause a misalignment since SQLs are not enough to measure product growth.

Similar to MQLs that we’ll see later, SQLs measure actions unrelated to the value that the user experiences from the product. However, trying to qualify and quantify the value that the user gets from the product is the best way to understand her/his intent on a product level.

Today, only one in four companies direct their sales and customer success efforts at PQLs. But, focusing on PQLs is essential for any software company that wants to follow a product-led approach.

Now that I have told you how product-led is different than sales-led, let’s see how product-led is different from marketing-led.

How is Product-Led Different than Marketing-Led?

Similar to the differences between a product-led and sales-led approach, I am going to give you four differentiation points between product-led and marketing-led approaches. The fact that these differentiation points exist doesn’t mean that product-led and marketing-led approaches can’t coexist.

However, it means that in order for them to co-exist a PLG company has to close the gap between them. Let’s see what the four differentiation points are.

Differentiation Point #1: Product-Led Companies Care About Acquisition, Activation and Retention

Most marketing-led companies care about acquisition rather than activation and retention. What’s even worse is that only 44 percent of SaaS companies define user activation for their product.

As you can imagine, that can cause a major problem, not to mention all the marketing budgets that get wasted. The name of that problem is churn.

|

According to Paddle, “churn strongly correlates with company age.” This means that early-stage companies that have found a product-market fit can’t afford to care only about acquisition since retention is a big problem for them.

Having said that, SaaS companies should focus on acquisition, activation, and retention to grow. Of course, this can only happen by building meaningful experiences for users and by marketing for users, not for buyers.

Differentiation Point #2: Product-Led Companies are More Cost-Efficient

It is no secret that the cost of marketing is constantly rising. Traditionally, software companies spend a large percentage of their revenue on marketing.

In fact, some of the biggest software companies like MindBody, Salesforce, Bottomline Technologies, Tableau and Oracle dedicate 20 percent of their revenue to marketing.

That’s not a problem when you are Oracle, but when you are a SaaS that has found a product-market fit and needs to grow, you can’t afford to spend so much money on marketing.

Most marketing-led companies focus on the buyer rather than the end user. However, as Expensify CEO David Barrett puts it, “Our users outnumber the buyers 100:1. They are the ones with the power.”

This allows Expensify and any other product-led company to build trust and bring cost-efficiency. Thus, a product-led approach focusing on the user and not the buyer is much more cost-efficient.

Differentiation Point #3: Product-Led Companies’ Growth Depends on User Experience

Regarding product value, we have a) perceived value and b) experienced value. A typical phenomenon observed in marketing-led companies focuses more on perceived value than actual value.

This is inevitable because the cost of building a SaaS can be $0, and therefore, there is strong competition in both paid and organic acquisition.

The gap between perceived value and experienced value is typically referred to as the value gap.

This means that users believe something else about your company when they decide to give it a try and experience something different when they sign up for a free trial or freemium account. To close that gap, you need to:

- Use perceived value as a way to communicate the value of your product without creating high expectations

- Use experienced value as a way to delight your users and keep them engaged with your product

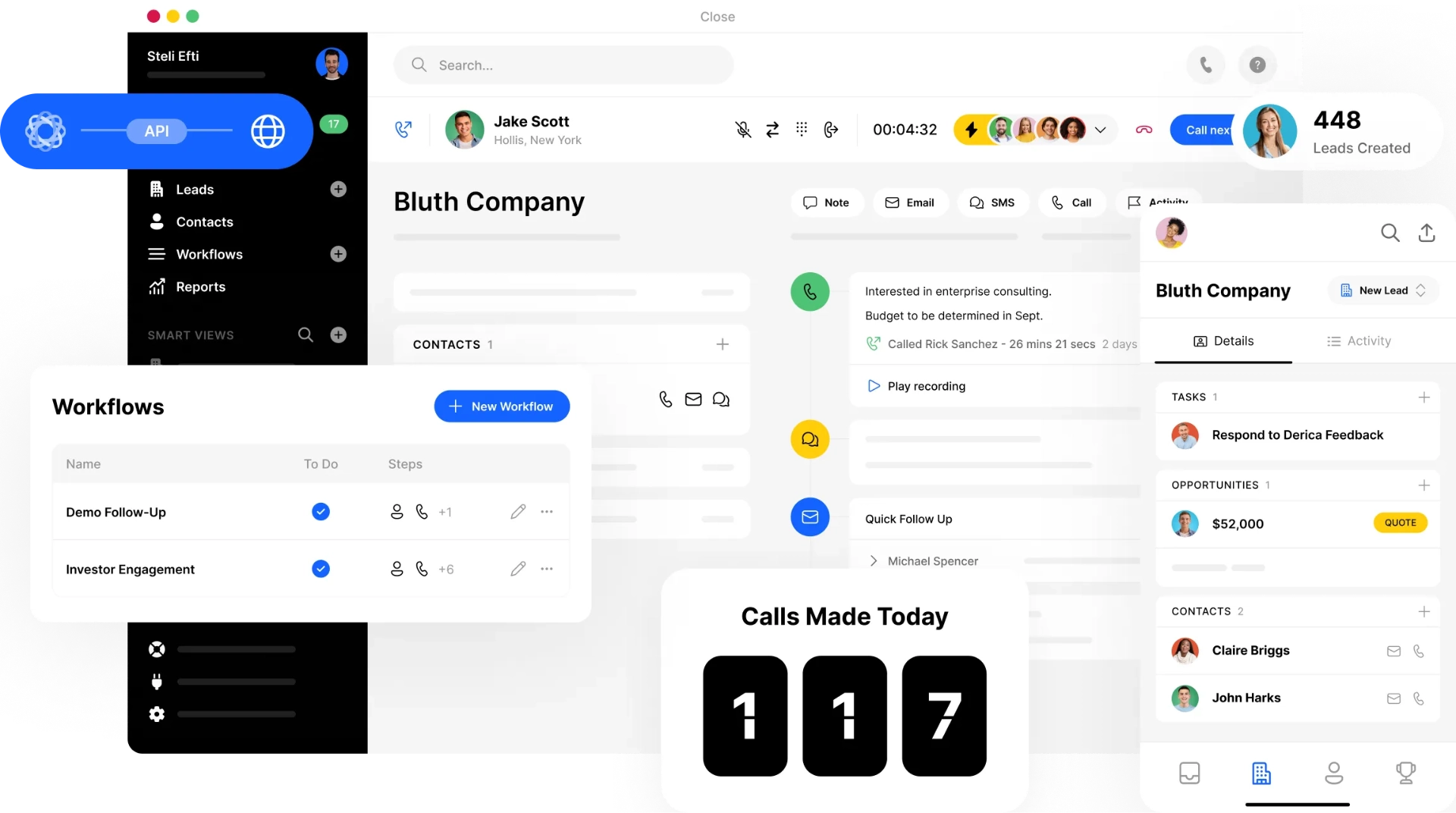

A perfect example of how perceived value is communicated in a way that reflects the product’s value is Close:

|

Close doesn’t make any promises they can’t keep, neither do they create false expectations. Instead, they communicate the value of the product simply. The user knows that what they’ll find inside is:

“A CRM that offers lead management, email sequences, predictive dialers, and more features.”

Of course, when someone uses the product, they experience that value firsthand. This is why it is essential that marketing also focuses on the experienced value and the user experience rather than communicating the perceived value of the product.

Differentiation Point #4: Product-Led Companies Focus on PQLs Rather than MQLs

The main difference between marketing qualified leads (MQLs) and PQLs is that MQLs are insufficient to measure product growth. MQLs determine the buying intent based on things like:

- Filling out a form

- Downloading free content

- Signing up for a company’s newsletter

These actions may indicate intent on a marketing level, but they don't indicate intent on a product level. On the other hand, product qualified leads (PQLs) help you take into account the product experience value.

In 2024, content consumption in blogs, ebooks, or lead magnets doesn't prove intent to buy. Users like to self-educate themselves, and they expect to reach a meaningful outcome in a timely manner. This has created a distance between someone who is qualified based on marketing criteria and someone who is willing to test and buy your product.

This is why many lead magnets nowadays are basically smaller versions of the actual product (i.e., MozBar Chrome Extension). These lead magnets might help on a marketing level, but in reality, they are trying to give a flavor of freemium to the company's acquisition efforts.

Thus, it is obvious that if you want to use a product as your main driver of growth, you need to align your marketing and product goals. To achieve that, you need to prioritize the following two metrics:

- Quantity metric—visitor to sign up

- Quality metric—sign up for PQL

By aligning your teams to reach goals on both the quantity and quality metrics, you ensure a steady flow of sign-ups that ultimately lead to PQLs. Let’s close this with some final thoughts on sales, marketing, and product.

Final Thoughts

Product-led growth is not here to replace sales or marketing. As I hope it is clear by now, product-led companies use both sales and marketing to attain growth. Ideally, you should find the perfect balance between the three to get the most out of product-led growth.

However, as we’ve seen throughout this post, whether or not you can use a product-led approach is affected by other factors, such as the maturity of the market, the complexity and sophistication of the product, and the proficiency of the user.

There is no doubt that product-led growth is here to stay, and when it comes to SaaS companies, it will become one of the best ways to drive growth. That growth will be led by ignoring more traditional acquisition tactics that don’t seem to work anymore.