The Lead List is a monthly series that analyzes key buy signals from companies on the Crunchbase Emerging Unicorn Board with fresh funding to help you fill your pipeline with new opportunities.

Imagine how much your deal size could grow if you sold into startups like Rivian or Snowflake before they went on to become multibillion-dollar companies with some of the splashiest, most lucrative IPOs in the last few years. So the question is–how do you find these companies before every other salesperson does? Enter the Crunchbase Emerging Unicorn Board.

Emerging unicorns are private companies valued between $500 million and $1 billion. These not-yet unicorns (unicorns are private companies valued at $1 billion or above) represent a sweet spot for salespeople. They’re established, cash-rich, growing, and solving a business problem that could make them the next billion-dollar unicorn.

Hot tip for salespeople: In contrast to unicorns, which get all the attention, emerging unicorns may not be as inundated with sales pitches.

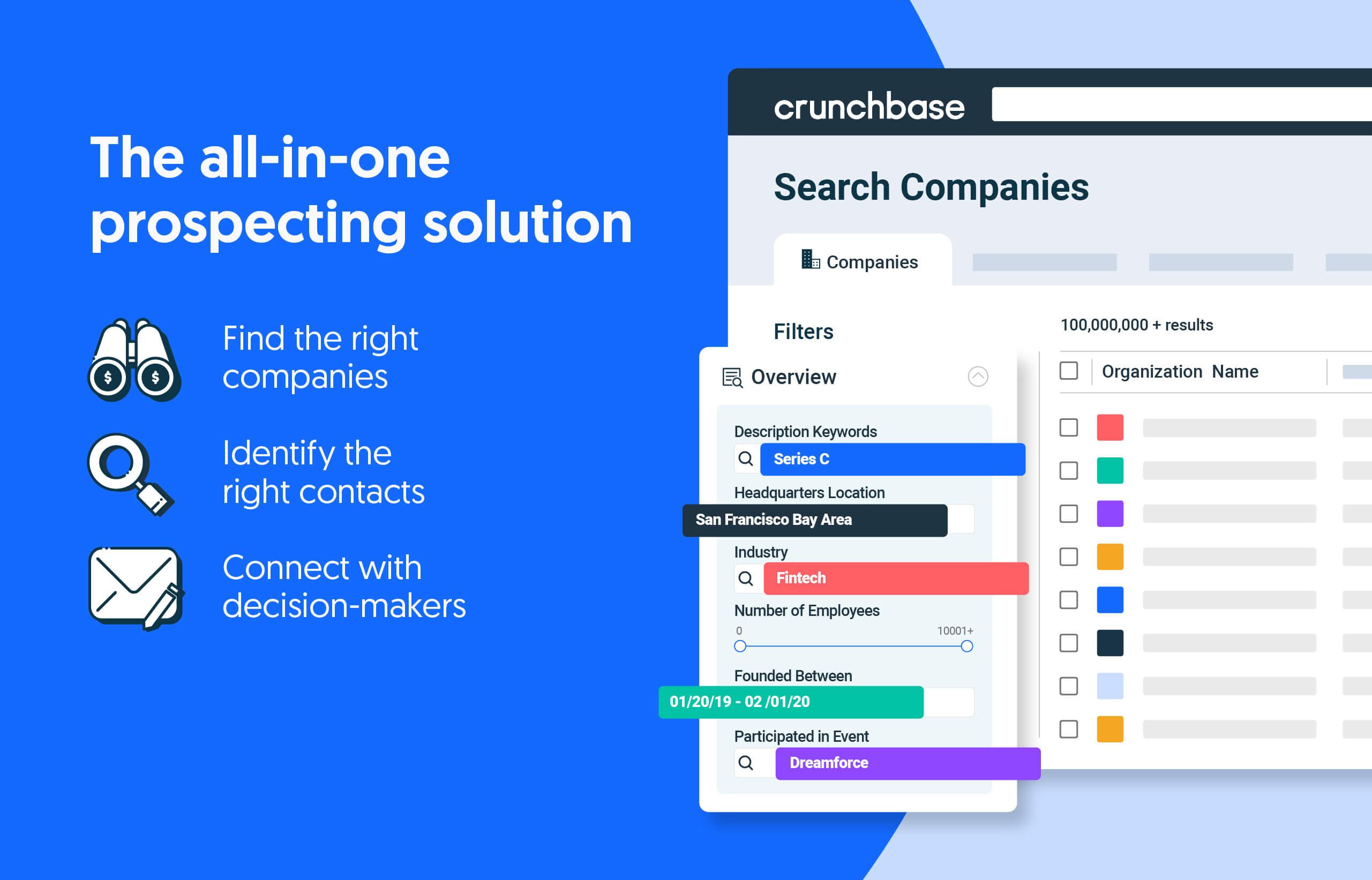

In The Lead List series, we highlight new additions to Crunchbase’s Emerging Unicorn Board, giving you essential information like relevant buy signals to help you fill your pipeline with new opportunities. In addition, we’ll walk you through how to use Crunchbase’s sales prospecting software to connect with decision-makers at these companies and close deals, all in one platform.

TL;DR: Emerging unicorn companies are ripe for sales outreach. In this series, we help you find them.

Add these rapidly growing companies to your CRM

Now Pro and Enterprise users can sync accounts directly from Crunchbase to Salesforce, speeding up their prospecting workflow, and reducing time spent on manual data entry. Check out this Crunchbase list and add these emerging unicorn companies to your CRM.

Methodology

This issue of The Lead List includes companies added to the Crunchbase Emerging Unicorn Board throughout April and are ordered based on their Crunchbase rank score (a proprietary, dynamic ranking that uses intelligent algorithms to score and rank companies) on May 1. An entity’s Crunchbase rank is fluid and subject to rise and fall over time due to time-sensitive events (i.e., product launches, funding events, and leadership changes), so the current rank score may not reflect the listed rank scores below.

The Emerging Unicorn Board is updated once a new company reaches a specific valuation range (companies valued between $500 million and less than $1 billion). Once a company reaches a valuation of $1 billion, it is classified as a “unicorn” and added to The Crunchbase Unicorn Board. Companies that exit are also removed from the Emerging Unicorn Board.

If you have any questions about companies on the board or this list, please contact us at support@crunchbase.com.

1. Rapido

Crunchbase Rank: 22

Post Money Valuation: $830M

Rapido is a mobile platform that enables people to book bike taxi services while traveling solo. The company recently closed on a $180 million Series D led by Swiggy, an India-based startup-delivery company, with participation from TVS Motor Company, and existing investors Westbridge Capital, Shell Ventures, and Nexus Ventures. According to Rapido, it will use its latest funding to strengthen its technology, grow its team and increase supply.

Why Rapido should be on your radar: Rapido was added to the Crunchbase Emerging Unicorn Board following its $180 million Series D. With the fresh funding, the company is actively looking to “create an enhanced consumer experience across a larger audience base in metropolitan cities,” according to The Tech Portal. This signals a focus on growth and expansion as it starts to scale up throughout the country.

Crunchbase User Tip: Want to find companies similar to Rapido? Let Crunchbase find hyper-targeted sales leads for you.

With similar companies, it’s easy to identify companies that resemble your recently closed deals. Crunchbase profiles now have a new tab called ‘similar companies’ that utilizes our unique machine learning model to automatically surface similar accounts and possible competitors for the profile you’re viewing. Similar companies makes it easier to discover and qualify accounts without interrupting your workflow.

2. Laiye

Crunchbase Rank: 99

Post Money Valuation: $900M

Laiye is a Beijing-based interactive platform that offers consumers and enterprises intelligent assistant products. The company debuted on the Crunchbase Emerging Unicorn Board in April following its $70 million Series C. The round was jointly led by HOPU Investment, Youshan Capital, and VMS Asset Management with participation from Lightspeed Venture Partners and Lightspeed China Partners.

Why Laiye should be on your radar: According to Finsmes, Laiye intends to use its funds to “accelerate international expansion in APAC, the Americas and EMEA.” The company is already making strides toward its international expansion with its recent acquisition of Mindsay, a leading European enterprise chatbot and voicebot platform. Its Crunchbase rank signals that its recent acquisition and new funding are drawing the attention of Crunchbase users. As the company continues to grow and approach unicorn status, Laiye could be your next big deal.

3. LinkSquares

Crunchbase Rank: 107

Post Money Valuation: $800M

LinkSquares is a computer software company that features AI-powered contract management and analytics tool for in-house legal and finance teams. The company recently closed on a $100 million Series C led by G Squared. With their fresh funds, LinkSquares looks to “help usher in a transformation, one that allows industry leaders to rid themselves of single-point products.”

Why LinkSquares should be on your radar: Due to the pandemic, the legal sector was left grappling with outdated solutions and is now turning to technology to fill the gaps. According to Crunchbase News, “technologies that help the legal wheels turn are likely to remain in demand—by both law firms and investors.” In other words, LinkSquares is a great company to keep on your radar. As the legal sector continues to be a hot topic in the venture capital world, it might be worth setting up alerts for LinkSquares and similar companies.

Crunchbase User Tip: Do you want to monitor LinkSquares’ activity?

With Crunchbase Starter and Pro, you can enable automatic alerts to stay up to date on key company news and buy signals. With automatic alerts, you can select what you want to be notified of (funding rounds, news, etc.) by designating either Daily or Weekly updates for that alert type. Learn more about automatic alerts.

4. Replicant

Crunchbase Rank: 177

Post Money Valuation: $550M

Replicant is a contact center automation software that helps companies automate their most common customer service requests. The company recently raised a $78 million Series B in April, led by Stripes with participation from Salesforce Ventures, Omega Venture Partners, Norwest Venture Partners, Irongrey and Atomic.

Why Replicant should be on your radar: In addition to new funding, Ron Shah will also be joining Replicant’s board. Shah has been with Stripes since its inception and will focus on Replicant’s strategy and business development. The company intends to use its fresh funds to make investments in product, sales and marketing, according to Finsmes, signaling a focus on product growth and growing its revenue-generating teams.

5. Turtlemint

Crunchbase Rank: 188

Post Money Valuation: $900M

Turtlemint is an insurtech platform that identifies and purchases appropriate insurance policies for consumers. The company recently raised a $120 million Series E in April, co-led by

Nexus Venture Partners, Jungle Ventures and Amansa Capital with participation from Vitruvian Partners and Marshall Wace. According to YourStory, “The company intends to use the fresh funds to expand in new geographies, scale its leadership team and strengthen its product stack.”

Why Turtlemint should be on your radar: Turtlemint recently onboarded Mahendra Singh Dhon, a professional cricketer, as an official brand ambassador. Dhirendra Mahyavanshi, co-founder of Turtlemint told Business Insider India, “Millions look up to Dhoni to seek inspiration for a fit and active lifestyle. Hence, we are delighted to partner with him on our mission towards making insurance awareness an integral part of an active lifestyle.” With key brand ambassadors and the goal to achieve profitability before IPO, the company is already inching closer to unicorn status with a valuation of $900 million.

6. Mutiny

Crunchbase Rank: 209

Post Money Valuation: $600M

Mutiny offers a personalization website, advertising, account-based marketing and paid media optimization services. The company raised a $50 million Series B co-led by Tiger Global Management and Insight Partners at a $600 million valuation. Jaleh Rezaei, CEO and co-founder of Mutiny, plans to use their new funding to “enable us [Mutiny] to accelerate our roadmap and invest heavily in technology that we believe can help every company grow revenue faster.”

Why Mutiny should be on your radar: Some of the world’s fastest-growing companies such as Notion, Snowflake, Qualtrics, Dropbox, Carta, and Brex use Mutiny to convert their visitors into customers. In other words, Mutiny is well-positioned to become a high-growth company as some of Silicon Valley’s big players see it as a massive opportunity to change the way companies grow revenue. The company is actively hiring across product, sales, and recruiting, indicating a focus on company and product growth.

Crunchbase User Tip: Want to find more female-founded and/or female-led companies like Mutiny?

You can now view and search by diversity data in Crunchbase using our Diversity Spotlight feature. Entrepreneurs are now able to highlight diversity on their own company profiles. Investors are now able to create visibility into the diversity of their portfolios. Users are now able to analyze trends and search Crunchbase using diversity as a filter. Learn more about Diversity Spotlight.

7. Stenn Technologies

Crunchbase Rank: 290

Post Money Valuation: $912M

Stenn is the largest and fastest-growing online platform for financing small and medium-size businesses engaged in international trade. Founded by Andrey Polevoy, Greg Karpovsky, and Walter Colebatch, Stenn has been named as, “one of Europe’s top-ten fastest growing fintech businesses, consistently doubling revenues over recent years,” by the Financial Times.

Why Stenn Technologies should be on your radar: Since being founded in 2015, Stenn has invoiced $6 billion in financing to SMEs across 74 countries and is backed by financial giants like Citi, HSBC, Barclays Investment Bank, and Natixis. The company hit a post-money valuation of $912 million following its $50 million Series A earlier this year. With investments from big-name giants and rapid expansion, it would be smart to keep Stenn on your radar.

8. DigiLens

Crunchbase Rank: 398

Post Money Valuation: $530M

DigiLens is an innovator in holographic display and waveguide technology for extended reality (XR). The reality display company has raised a total of $160M in funding over seven rounds. Their latest funding was raised on April 7, from a $50 million Series D round and values the company at $530 million. DigiLens has a wide range of big-name investors backing them, such as Samsung Electronics, Dolby Family Ventures and Corning.

Why DigiLens should be on your radar: Total funding grew to companies providing wearable augmented reality products due to the Metaverse explosion late last year. According to the VC News Daily, “The [funding] round solidifies DigiLens’ waveguides as a de facto standard for smart glasses and allows the company to strengthen its licensing business model and extend its global offerings.” In addition to global expansion, DigiLens currently has a handful of open roles. The majority of these roles are for its engineering team, indicating a focus on product growth.

9. Medikabazaar

Crunchbase Rank: 406

Post Money Valuation: $700M

Medikabazaar is India’s largest online B2B marketplace for medical supplies and equipment. The company was added to the Crunchbase Emerging Unicorn Board following their $65 million Series D. Medikabazaar told The Economic Times that it plans to use the funding to “strengthen its technological capabilities, bolster digital operating capabilities to help improve the efficiency of the healthcare sector in India and expand its global operations.”

Why Medikabazaar should be on your radar: According to Bloomberg, Medikabazaar “aims to hit a $1 billion valuation within the next three to six months as it taps into an e-commerce funding boom in the country.” This can well be achieved given that total funding raised by health care companies increased by 57 percent year-over-year. In addition, Medikabazaar was the only company in the health care sector to be added to the Emerging Unicorn Board in April. With a focus on expansion with their latest round of funding, Medikabazaar could hit unicorn status sooner rather than later.

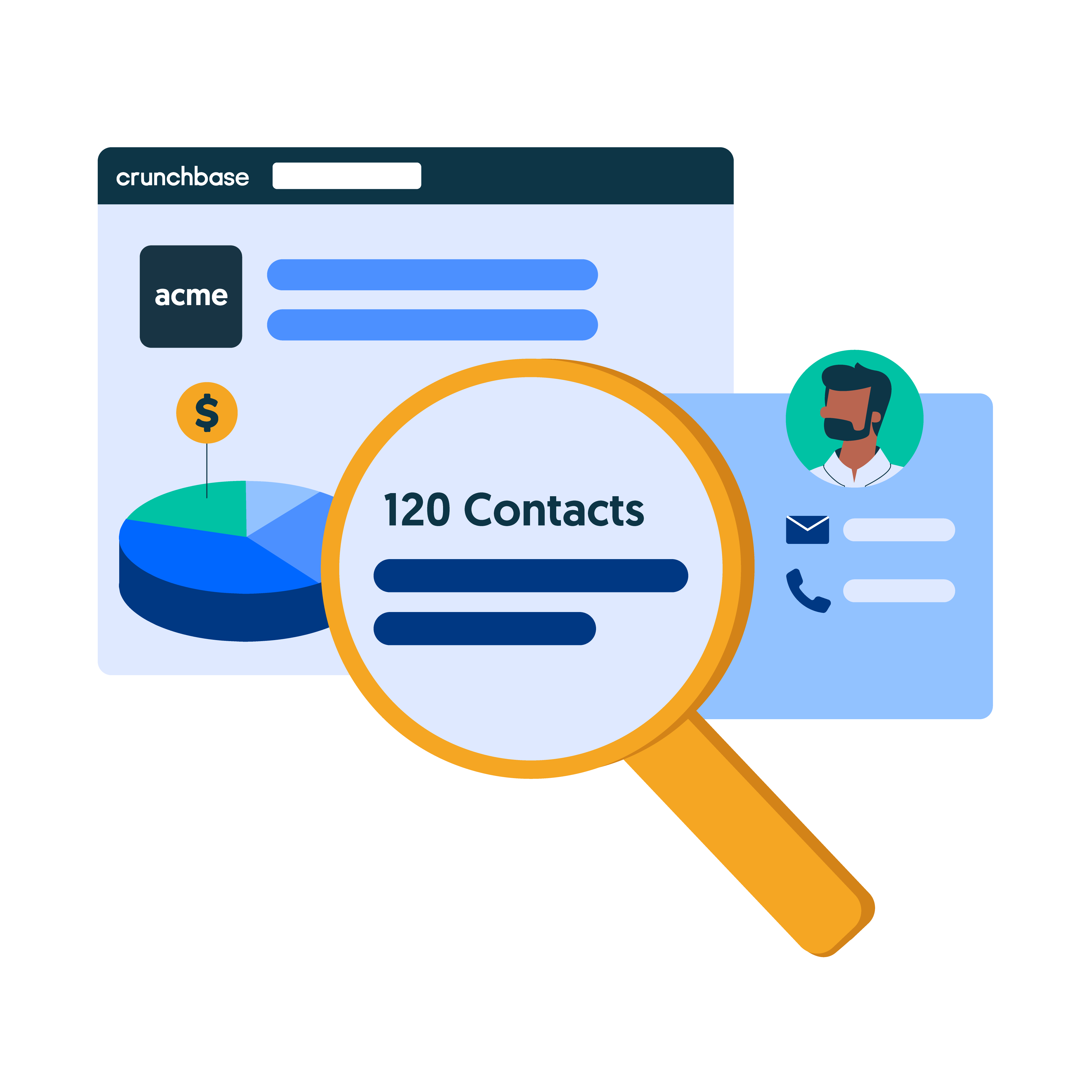

Crunchbase User Tip: Want to find and engage with decision-makers at Medikabazaar?

Crunchbase Pro customers can leverage Crunchbase contact data to find verified contact information and use filters like job title, level, department, and name to find company decision-makers most relevant to you. Customers can also access the Crunchbase engagement suite to send intelligent email templates tailored specifically to your contacts.

10. Parallel Finance

Crunchbase Rank: 443

Post Money Valuation: $500M

Parallel Finance is a decentralized finance (DeFi) protocol that offers lending and staking services. The company raised a total of $29 million in funding over three rounds and its latest funding was a $5 million funding round raised on April 2. The funding round was led by Coinbase Ventures, StarkWare Industries, and Section 32, a San Diego-based, venture capital fund that invests in the cutting edge of technology, healthcare, and life sciences.

Why Parallel Finance should be on your radar: Parallel Finance recently rolled out six products in one day, including Liquid Staking, Farming, and Crowdloans. Parallel Finance currently has 26 open roles. The majority of these roles are for its engineering, marketing, and product team, signaling a focus on company expansion and product growth as it continues to roll out new offerings.

11. Coro

CB Rank: 636

Post Money Valuation: $500M

Coro is an all-in-one platform for mid-market organizations that protects the cloud from unauthorized access, prevents data leakage and mitigates cloud threats. Rana Yared, General Partner at Balderton Capital told Globe Newswire, “Coro is poised to dominate this immense and hugely underserved segment of the market [mid-market sector], and we believe that their growth will continue at an exponential rate.”

Why Coro should be on your radar: Coro first launched in 2015 as part of the Disrupt Battlefield competition in New York City. Since then, the company has “stepped up to protect the millions of companies neglected by the cyber security industry by removing the three barriers inherent to the status quo: price, complexity, and the need for a dedicated cyber security team.” In addition to positioning itself as a critical product in the mid-market sector, Coro plans to use its fresh funding to triple its global team and build on the 300 percent year-over-year growth it experienced in the past three years.

12. Rimac Group

CB Rank: 1,290

Post Money Valuation: $922M

Rimac Group brings together advanced hypercars and high-performance electrification technologies for the world’s largest original equipment manufacturer. Built upon the vision of the company’s founder and CEO, Mate Rimac, the company has become a globally recognized technology leader and continues to challenge the status-quo with the idea to revolutionize and reinvent the sports car with its unique technology. The company recently raised a €120 million funding round in April, led by InvestIndustrial Holdings.

Why Rimac Group should be on your radar: In July of last year, Rimac Group announced that it would be officially joining forces with Bugatti Automobiles under the new company name, Bugatti Rimac. A few months before that announcement, Porsche invested an additional €70 million investment in Rimac—bringing its 15.5 percent stake in the company up to 24 percent. The company, since then, has grown its global dealership network and is actively hiring for 252 roles, mainly in engineering, signaling a focus on product growth and expansion.

13. Stark Bank

CB Rank: 1,466

Post Money Valuation: $500M

Stark Bank is a fintech company that provides technology for ventures to scale their operations, allowing them to execute more transfers, payments and charges. Their platform is prepared for companies of any size, from startups to large corporations. The company was added to the Crunchbase Emerging Unicorn Board following their $45 million Series B in April, co-led by Ribbit Capital and Bezos Expeditions–Jeff Bezos‘ personal venture capital investment firm.

Why Stark Bank should be on your radar: As a company looking to make strides toward creating innovative solutions for companies in Brazil, Stark Bank is an emerging unicorn to look out for. Founder and CEO, Rafael Stark founded Stark Bank to focus on high-growth startups and enterprises in Brazil. “Everything we do is to empower companies and entrepreneurs to challenge the status quo and change Brazil for the better through technology,” Stark said in an interview with Fintech Futures. In addition, the company is also hiring for multiple engineering and marketing positions, signaling a focus on company and product growth.