Whether you’re a seasoned insurance agent or just starting out, knowing how to get life insurance leads is crucial for your success. With the high failure rate in this industry, it’s essential to master lead generation strategies.

The process of acquiring life insurance leads can seem daunting amidst the competitive market landscape. However, with tried and tested methods at your disposal, standing out from the crowd is achievable.

This post will provide insights on how to generate effective life insurance leads. It’s not just about uncovering potential customers; it’s also about developing those associations and transforming them into deals.

From understanding different types of leads to leveraging online platforms and referrals – mastering how to get life insurance leads can significantly boost your business growth. Let’s dive deeper into these proven techniques that will help you stay ahead in the game.

Table of Contents:

- Understanding Life Insurance Leads

- Types of Life Insurance Leads

- Effective Strategies for Generating Life Insurance Leads

- Harnessing Warm Internet Leads

- The Role Of Referrals In Lead Generation

- Importance Of A Specialized CRM In Managing Leads

- FAQs in Relation to How to Get Life Insurance Leads

- Conclusion

Understanding Life Insurance Leads

Navigating the cutthroat arena of life insurance sales necessitates understanding how to spot and link with potential purchasers. That’s where life insurance leads come in – these are individuals who have shown interest in purchasing life insurance products or services.

A startling statistic reveals that over 90% of new agents don’t make it past their first year. This high failure rate highlights just how crucial effective lead generation strategies are for survival and growth within this market.

The Significance of Life Insurance Leads

The value attached to a good lead can hardly be overstated, especially when selling something as important as life insurance policies. Unlike impulse purchases associated with other consumer goods, decisions about buying life insurance usually involve considerable research and deliberation.

This means that such leads represent people who’ve already made significant progress down the sales funnel; they’ve recognized their need for coverage and are actively seeking solutions. Your task then becomes convincing them your offerings best meet those needs.

Nurturing Your Leads: A Key To Success

Beyond merely identifying potential clients, nurturing relationships until they’re ready to buy from you holds immense value too. Your role here isn’t only limited to providing information on various plans available but also educating prospects about benefits tied up with having adequate protection against unforeseen circumstances through owning appropriate coverages based upon individual requirements and financial goals.

Types of Life Insurance Leads

In the realm of life insurance, leads are essentially potential customers who have shown an interest in purchasing a policy. These can be broadly categorized into two types: company-generated and third-party leads.

Company Life Insurance Leads

The first type to discuss is company-generated life insurance leads. These are created internally by organizations through their own marketing efforts like website inquiries or direct mail responses.

This exclusivity does come with its challenges though. Generating these internal prospects requires significant investment not only financially but also time-wise as it involves careful tracking and management so no opportunities slip through the cracks. This task may prove challenging for smaller businesses without dedicated marketing teams.

Third-Party Life Insurance Leads

Moving on from self-sourced contacts, we delve into third-party generated ones which open up a wider pool of potential clients beyond one’s immediate network.

A word of caution here; while this approach seems attractive at face value, quality assurance becomes paramount when dealing with external sources. Some providers might offer outdated information or even false contact details hence thorough vetting is required before making any purchase decisions.

Effective Strategies for Generating Life Insurance Leads

The life insurance market is a competitive one, and generating quality leads can be quite the challenge. But don’t worry. There are tried-and-true strategies that you can employ to effectively generate life insurance leads.

Networking and Professional Connections

To start off, let’s discuss networking. It might appear outmoded in this electronic era, but believe me when I say it still works wonders.

You see, building relationships with other professionals who interact regularly with potential clients – think lawyers or real estate agents – could lead them referring those individuals your way. Here’s an insightful guide on how to network without feeling awkward about it.

Utilizing Online Platforms

Moving onto online platforms; they’re pretty much indispensable these days if you want to reach out directly to potential customers.

Social media channels like Facebook and Twitter provide opportunities for engagement while LinkedIn allows sharing of industry-related content which helps establish authority. Moz provides great insights into implementing effective SEO tactics. Remember: visibility equals more generated leads.

The Power of Content Marketing

Blogs have become powerful tools in attracting prospective clients due to their informative nature regarding complex topics such as those found within the realm of life insurance products.

A comprehensive content marketing campaign not only helps position yourself as an expert but also allows maintaining engagement amongst existing clientele base thus aiding retention rates. Content Marketing Institute offers an extensive guide on developing successful campaigns. By leveraging these methods along with others mentioned above, you’re sure to increase overall efficiency and effectiveness in your efforts towards acquiring high-quality prospects ready to convert into policyholders. Persist in your efforts despite any challenges that may arise, for only consistent action can ensure long-term success.

Note: All these pieces should be inside your strategy, ensuring no important step gets left behind during operations procedures.

Generating life insurance leads can be a tough nut to crack in a competitive market, but with the right strategies such as networking, utilizing online platforms and content marketing, you’ll soon see your lead pool grow. Remember: consistency is key – keep plugging away.

Harnessing Warm Internet Leads

Generating life insurance leads is a multifaceted process, and one of the most effective methods to consider is harnessing warm internet leads. These are potential customers who have already shown an interest in purchasing a life insurance policy by conducting online searches or completing questionnaires.

The beauty of warm internet leads lies in their high close rate. When you engage with these prospects, they’re often ready to discuss options further because they’ve actively sought out information about your services.

The Power Of Search Engine Queries

A significant portion of warm internet leads comes from search engine queries. People looking for answers about life insurance policies frequently turn to Google or other search engines for help. They may be searching terms like ‘life insurance quote,’ ‘best life insurers,’ or even specific questions regarding coverage details and premiums.

By strategically optimizing your website with relevant keywords related to these queries, you can draw prospective clients directly onto your platform where they’ll find what they need and potentially become viable sales opportunities. Discover more on SEO here.

Leveraging Online Questionnaires

Beyond SEO tactics, another method that generates valuable warm internet leads involves utilizing online questionnaires across various platforms. These tools collect detailed data from individuals actively seeking quotes or wanting deeper knowledge about different plans offered by numerous insurers.

This approach not only provides direct contact information but also offers insights into each prospect’s unique needs concerning desired coverage level, budget constraints, health status, etc. This invaluable intel allows agents to tailor offerings accordingly, enhancing chances of securing a sale while delivering a superior customer service experience, thereby fostering loyalty among the clientele base.

Finding Reliable Lead Companies

In addition to leveraging organic strategies such as implementing robust SEO practices and deploying engaging interactive surveys, there are several reputable lead generation companies available that cater specifically to those operating within the realm of selling life insurance. A prominent example would be EverQuote.

These businesses specialize in connecting agents with highly qualified potential buyers, streamlining the entire process considerably and saving time and effort otherwise spent hunting down suitable candidates manually. They employ sophisticated algorithms to identify users exhibiting buying behavior patterns indicative of serious intent to purchase a policy, then pass this invaluable intel onto registered members.

While the cost associated with acquiring third-party generated leads might initially seem steep, considering the superior quality and nature of resulting interactions, the investment tends to prove well worth it in the long run, especially when viewed in the light of the overall improvement in conversion rates achieved following the adoption of this strategy.

Boost your life insurance sales by harnessing warm internet leads, optimizing SEO strategies, and leveraging online questionnaires. Don’t forget the value of reliable lead generation companies that can connect you with qualified buyers, saving time and effort while improving conversion rates.

The Role Of Referrals In Lead Generation

Referral marketing is a potent tool in the life insurance industry. Satisfied clients recommending your services to their network can be an effective way of generating exclusive leads.

However, it’s important to remember that while referrals often bring high-quality prospects into your pipeline, they may not always provide enough volume for consistent business growth. Therefore, balancing this strategy with other lead generation efforts is crucial.

Leveraging The Power Of Referrals

To leverage the power of referrals effectively, consider implementing a formal referral program within your agency. This could involve offering incentives such as discounts or rewards to current customers who refer new prospects – turning them into advocates for your brand and helping generate more warm online insurance lead companies.

A well-structured referral program encourages satisfied customers to actively promote you amongst their networks thereby increasing both visibility and credibility in the life insurance market. HubSpot suggests sending thank-you notes or small tokens of appreciation as effective ways of nurturing these valuable connections.

Maintaining Relationships With Your Advocates

Relationship management plays a key role in maximizing the benefits of customer advocacy. Regular communication ensures you stay top-of-mind when opportunities arise where they can recommend you again.

Additionally, expressing gratitude to each referrer, regardless of whether the recommendation results in a sale or not, fosters goodwill and potentially leads to further recommendations down the line.

Balancing Quantity and Quality with Other Strategies

In addition to utilizing client referrals as part of your lead generation plan, it’s vital to balance quantity and quality by using diverse strategies. While personal endorsements tend to bring highly qualified potential clients into the fold, relying solely upon them can limit the overall number of leads generated.

This is why combining tactics like networking, professional connections, content marketing campaigns, and email outreach programs are critical to success in selling life insurance products.

For instance, tools such as “LeadFuze” offer automated prospecting solutions to help create a targeted list of contacts based on specific criteria set forth by the agent or recruiter, augmenting traditional methods like direct mailings.

By integrating multiple approaches, including the strategic use of testimonials and positive reviews on online platforms, you can enhance your reputation and ultimately increase conversions and sales performance.

To boost life insurance leads, harness the power of referral marketing by implementing a formal program and maintaining relationships with advocates. However, don’t solely rely on referrals; balance them with diverse strategies like networking, content marketing campaigns, and automated prospecting tools for consistent business growth.

Importance Of A Specialized CRM In Managing Leads

A specialized CRM system can be utilized to help streamline the management of leads and communication with potential clients. A CRM platform can be utilized to assist with overseeing contacts’ data productively and streamlining correspondence with potential customers.

With all relevant contact information at your fingertips, follow-ups become prompt and efficient—a key aspect in closing more successful sales.

The Benefits Of Using A Specialized CRM System

Beyond mere organization, a specialized CRM system brings an array of benefits for those involved in generating life insurance leads. For instance:

- Data-driven insights about customer behavior patterns allow agents selling life insurance products to understand their audience better—this knowledge helps tailor offerings accordingly.

- A modern-day feature-rich platform enables team collaboration—sales reps can share notes about specific leads or accounts making coordination smoother while ensuring everyone is on the same page regarding client relationships.

- The automation features save time and ensure consistency when reaching out to prospective clients—they also make sure no lead falls through due to oversight or miscommunication.

Finding The Right Fit: Choosing Your CRM Tool

- Evaluate different options based on unique industry-specific challenges faced by those involved in generating life insurance leads.

- Pick a tool tailored towards meeting these needs—for example, InsuredMine comes highly recommended as it has been designed keeping insurance agents’ needs front-and-center, thus providing them with robust solutions catering specifically towards enhancing lead generation efforts significantly while aiding retention strategies too.

FAQs in Relation to How to Get Life Insurance Leads

How can I get better life insurance leads?

Focusing on effective networking, utilizing online platforms, and implementing content marketing strategies can help improve the quality of your life insurance leads.

How do you prospect insurance leads?

You can prospect insurance leads by leveraging social media, running a referral program, using Google Search Ads, or email marketing campaigns. A specialized CRM system also aids in managing these prospects effectively.

How do I find someone who is looking for life insurance?

To find potential clients interested in life insurance, consider harnessing warm internet leads generated through search engine queries and online questionnaires. Platforms like EverQuote are useful resources.

How much does it cost to buy life insurance leads?

The cost of buying life insurance leads varies depending on the source and type of lead. It’s crucial to balance costs with lead quality for optimal return on investment.

Conclusion

You’ve learned the importance of these leads in the industry, they’re your potential customers after all.

We’ve delved into different types – company generated or sourced from third parties. Each has its own advantages and disadvantages.

A multitude of strategies exist for generating these valuable contacts. Networking with professionals, leveraging online platforms, content marketing – it’s about finding what works best for you.

Warm internet leads have been highlighted as particularly effective due to their high close rate. They’re worth considering!

Don’t forget referrals too! A happy customer can lead to more business through word-of-mouth recommendations.

Last but not least, managing your leads effectively is crucial. Using specialized CRM systems could be just what you need to seal those deals successfully!

Need Help Automating Your Sales Prospecting Process?

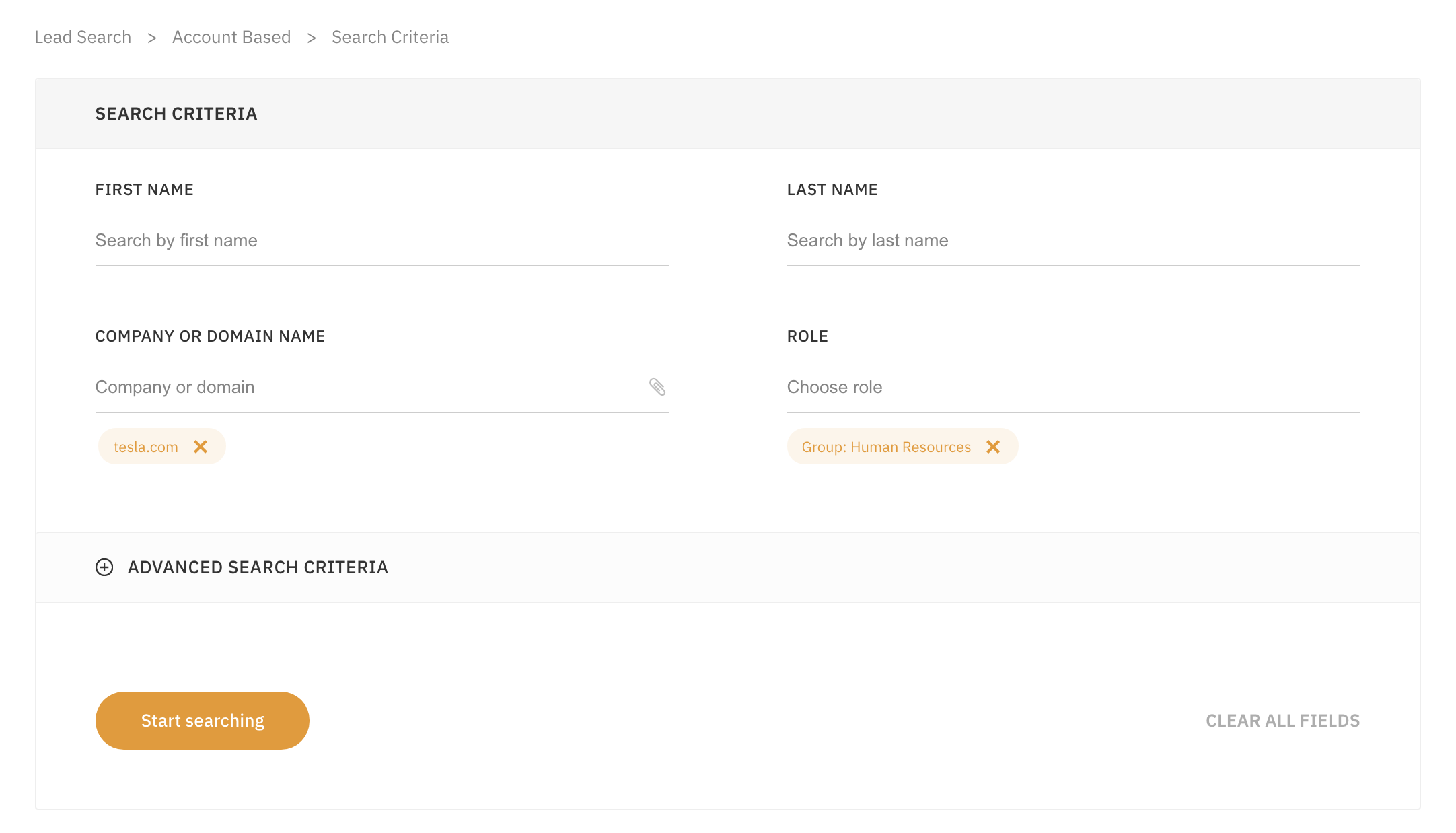

LeadFuze gives you all the data you need to find ideal leads, including full contact information.

Go through a variety of filters to zero in on the leads you want to reach. This is crazy specific, but you could find all the people that match the following:

- A company in the Financial Services or Banking industry

- Who have more than 10 employees

- That spend money on Adwords

- Who use Hubspot

- Who currently have job openings for marketing help

- With the role of HR Manager

- That has only been in this role for less than 1 year

Or Find Specific Accounts or Leads

LeadFuze allows you to find contact information for specific individuals or even find contact information for all employees at a company.

You can even upload an entire list of companies and find everyone within specific departments at those companies. Check out LeadFuze to see how you can automate your lead generation.

Want to help contribute to future articles? Have data-backed and tactical advice to share? I’d love to hear from you!

We have over 60,000 monthly readers that would love to see it! Contact us and let's discuss your ideas!