If you’re delving into any type of sales process involving long-term sales cycles, you know it’s a tough game. Countless hours spent on solving complex problems, talking with decision-maker after decision-maker, only for a year-long deal cycle to end in a “closed-lost.”

But when you win a large enterprise deal? That rush is like none other. (And the commission ain’t bad either!)

So, how do you do it?

The pioneers of software sales designed a methodology called MEDDPICC to help you cut through the complexity of the enterprise sales cycle, qualify better, and win more deals. It’s another one of those great ’90s trends that’s coming back strong, and we’re about to give you the whole scoop on how to use it.

Let’s discuss the eight stages of MEDDPICC, and how to successfully qualify enterprise deals at each stage to win more deals down the road.

What is the MEDDPICC Methodology?

The acronym MEDDPICC stands for:

- Metrics: Measurable results your solution delivers

- Economic Buyer: The person who holds the budget and the final say

- Decision Criteria: Considerations that will influence the decision

- Decision Process: How the purchase decision is made

- Paper Process: Legal and administrative hurdles you’ll have to overcome

- Identify pain: Customer's pain points

- Champion: Influencer within the organization who will internally promote your solution

- Competition: Who you’re competing with (and how you can win)

|

What is the Purpose of MEDDPICC?

Want to break through a complex B2B sales process? Want to stop wasting time and making mistakes that cost your business? The MEDDPICC methodology can be your guide, helping you identify the right solutions and lay the stepping stones of a closed deal.

Some consider MEDDPIC as not just a qualification tool, but a methodology for the entire sales process.

What's the Difference between MEDDIC and MEDDPICC?

MEDDIC is the original concept that came before MEDDPICC. Invented in 1996 by Dick Dunkel and others at a software company called PTC, MEDDIC was designed to make it simpler for salespeople to qualify customers throughout complex deal cycles. Over time, the methodology evolved to include more parts of the sales process: Paper Process and Competition. From that, MEDDPICC was born.

Who Should Use the MEDDPICC Methodology (and Why)?

The MEDDPICC methodology is flexible, meaning you can adapt it to almost any sales organization and process. That said, it’s especially useful for certain groups—for example, it’s great for enterprise sales but might be overkill for selling used cars.

MEDDPICC can be a game-changer when qualifying leads for the following types of salespeople and teams.

Sales Teams Selling to Large Organizations

Selling to a large organization can feel like you’re selling the same thing over and over again to different people within the org (especially if you’re not nailing down who the key decision-makers are). MEDDPICC can help uncover key decision-makers out of a huge number of employees, identify the strongest pain points to focus on, and overcome the hurdles of long and complicated buying processes.

Using MEDDPICC can help you stop wasting time on unnecessary meetings and problem-solving and instead focus on what matters. It cuts through the complexity and helps salespeople gain the clarity they desperately need when working through a large organization’s buying process.

Reps with Deals Frequently Getting Caught Up in Paperwork

Paperwork shouldn’t be a salesperson’s worst enemy, but too often, it gets between a rep and their commission. If you find deals stalling due to red tape, the Paper Process section of the MEDDPICC model can help identify bottlenecks and streamline your process to close deals.

As you start to ask the right questions about procurement, contract terms, and legal requirements, you better uncover the issues you need to be aware of and prepare for. This can result in faster deals, reduced bottlenecks, happier customers, and a bigger paycheck.

Teams Selling a New Solution

When entering a new market with a fresh product, qualification is crucial. You don’t have as many real-world results and case studies to go on, so you need to follow a system that helps you understand your prospects and determine if your solution is indeed the right fit.

MEDDPICC helps you find that much-needed clarity when selling something that might not have product-market fit quite yet. You can use it to gain the insights you need to make the strongest possible case for a brand-new product.

Sales Managers Seeing Many Forecasted Deals Slip

Sales leaders who suffer from incorrect pipeline numbers have a problem with their reps not properly qualifying new leads (and likely inflating their pipeline). They clearly aren’t forecasting correctly, so implementing a system like MEDDPICC can correct that.

|

MEDDPICC provides a system for reps to get all the information they need to forecast a deal more accurately. By leaving no stones unturned, it reduces the guessing game and paints a more realistic picture. As a bonus, it helps reps better qualify customers and close more deals.

Implementing MEDDPICC: How to Use This 8-Step Sales Methodology to Crush Your Goals

The bases are loaded, and you’re up to bat. How do you put your best foot forward?

Whether you’re diving into enterprise sales or trying to get a new product off the ground, these eight steps will help you determine if a new lead is a good fit for your business. Plus, you’ll get all the info you need to close this deal, ASAP.

Let’s hit it out of the park.

1. Metrics

Most people will tell you to replace features with benefits in your sales pitch, but let’s go beyond that. Use real-world metrics to tie their pain points to the solution you’re offering.

For example, instead of: “Our CMS is easy to use, so you can publish content faster.”

Try this:

BOOM. Real numbers, real results, a way more convincing argument.

When you use metrics to contrast potential improvement to their current reality, you’re not just selling—you’re helping them improve their business in a real way that they can measure.

To really show that the grass is greener on your side of the fence, your metrics need to be credible. Rely on past success stories, predictive analysis, or even industry benchmark data. It’s about showcasing the potential transformation in numeric terms.

Qualifying questions to ask during the Metrics stage (these will help you understand what metrics to focus on):

- What financial impact do you hope to receive from our solution?

- If this problem was solved, how would it impact your KPIs?

- How much are the problems our product solves costing you this year?

2. Economic Buyer

The economic buyer at your prospect’s company controls the purse strings and the final decision on approving the purchase. In other words, they’re someone you’ve got to buddy up to.

The economic buyer isn't necessarily your main point of contact, but the person with enough authority to greenlight your proposal. Without their support, the deal fails.

Your goal is to pinpoint not just who the economic buyer is, but also their specific needs, priorities, concerns, and preferred communication methods. Build a proposal that hits all of their concerns at once—then, the second it lands on their desk, you’ve overcome every objection in advance.

Typically, this main stakeholder cares about:

- Getting a compelling return on investment

- Improving the bottom line

- Boosting efficiency and productivity

- Seeing clear savings

Thankfully, your work in the Metrics stage above has prepared you for this moment.

Start by finding out who the economic buyer is at your prospect’s organization. Then, make dang-well sure their needs are addressed before moving forward with anything else.

To uncover the economic buyer, be sure to ask early on in the sales process:

- Who in your organization has the final say in buying decisions?

- Who else is involved in making these kinds of purchases?

Once you find that out, ask that person questions like:

- Can we discuss your budget expectations and limits for this proposal?

- How can our solution provide meaningful ROI for your organization?

3. Decision Criteria

Many salespeople (myself included) have at one point been guilty of trying to sell their vision without first uncovering their customer’s actual needs. More often than not, they end up trying to stuff a square peg into a round hole.

The decision criteria stage fixes that. It provides crucial insights into the customer's needs, priorities, and risks, including factors such as:

- Budget thresholds

- Must-have features

- Delivery timelines

- After-sales support needs

- Brand reputation concerns

- Functionality and customization for specific needs

- Integrations

Use the information gathered here to (1) make sure your product really is a fit for their needs and (2) personalize your pitch to those needs. (Round peg, round hole.)

The better you understand their decision criteria, the more accurately you can tailor your approach. This stage is your chance to ask questions, listen carefully, take notes, and then use those notes to paint a picture (in their minds, not literally) of how your solution matches their criteria.

Qualifying questions to ask during the decision criteria stage include:

- What are the "non-negotiables" you’re looking for in a solution?

- Are there certain problems that are the most pressing for your company?

- How do you imagine our solution solving your biggest problems?

4. Decision Process

At large enterprises, the decision-making process can get quite complicated. Your job is to gather knowledge about who makes decisions and how they make them.

This stage includes pinpointing:

- Key decision-makers, including but not limited to the economic buyer

- Critical timelines, such as “we need to spend this excess budget by the end of Q3”

- Potential bottlenecks that could halt or alter the decision

- Internal processes that may impact the sale

Use the information you uncover here to create a decision roadmap. This roadmap will list the deciders within each department, factors that impact their decision, and a chronological order to the decision-making process. You can inject tailored guidance at each decision juncture along this roadmap and refer to your decision criteria checklist to help with that.

Once you understand how your prospect’s company moves through the purchase process, you’ll know which activities you’ll need to do to support them (and which ones aren’t worth your time). Knowing this in advance will help you set up the right meetings, product demonstrations, or Q&A sessions with the right people, at the right time.

Lots of decisions need to be made to get the outcome you want. Play the role of a guide that moves this deal forward through the maze of decisions to get there faster.

Qualifying questions to discover the decision process include:

- What departments will we need to get a "yes" from for this deal to move forward?

- Who within those departments is responsible for making that decision?

- Is there a set timeline for when you intend to make a decision?

- What obstacles could get in the way of you making a decision?

5. Paper Process

I have to admit, I hate administrative stuff. It’s my least favorite part of sales, and it always seems to crop up right when I thought a deal was about to close. You can’t stop these things from appearing at the last second, but you can be prepared for them.

The paper process stage helps you uncover legal and administrative aspects of the sales process, like:

- Contractual agreements

- Terms and conditions

- Service level agreements

- Data protection terms

- Custom pricing

- Payment plans

- Regulatory or compliance requirements

- The legal process and legal approval

- Complex licensing agreements

Think of it as the "fine print." It might give you a headache, but it’s easier if you tackle it head-on.

First, find out what the administrative hurdles are. Then, find out how to fulfill each requirement, the paperwork turnaround time, and who needs to approve and sign what. Use resources at your own company, like the legal and finance teams, to get the best (and fastest) resolution for both sides.

It’s a drag, but trust me—you’ll be happy you handled this paper process proactively at the end of the deal cycle.

Qualifying questions during the paper process stage include:

- What can I provide to help you with the procurement process?

- Are there any legal or compliance requirements we should be aware of?

- What's the typical timeline for your procurement and contract review process?

6. Implicate the Pain

The deal isn’t closed-won yet. Now is the time to double down on everything you’ve uncovered. To do that, you implicate the pain.

You’ve already uncovered their main pain points—now, magnify how destructive these problems could be, and show how your solution solves them best.

The pain you identify at this point will be something like:

- Lost revenue

- Missed cost savings

- Wasted resources

- Overwhelmed staff

- Missed opportunities for growth

- Inefficient operations

After you’ve identified what’s causing pain, you need to show exactly how you’ll take that pain away. This might involve demonstrating certain product features, sharing testimonials from customers who've faced similar challenges, or showcasing the relevant value your solution brings.

Contrary to what it seems like, implicating the pain isn’t actually about selling. It’s about advising. By finding the pain points, you can offer empathy, understanding, and sincerity. You show that you care about the real problems they face and offer a practical solution. Your customer doesn’t want a product or a service—they want a solution to their problems.

Qualifying questions in the implicate the pain stage include:

- What issues that our solution could solve are affecting your bottom line the most?

- If you had a magic wand, what problem would you make go away first?

- What challenges are people most complaining about internally?

7. Champion

More often than not, you aren’t physically at your customer’s office (or house in the remote-first future we live in). To win deals at a large enterprise, you need someone who will ‘internally sell’ for you. Someone you can trust when you’re not around.

In MEDDPICC, your champion is more than just a casual supporter; they're someone who both loves your solution and holds enough sway to influence others to love it, too.

You’ll need to identify your champion and build a mutually beneficial relationship with them. Find out which person of influence is your biggest cheerleader, then provide them with the logic, data, and compelling arguments they need to tout your solution to their colleagues.

When identifying a champion, look for the following:

- Enthusiasm about your solution

- An understanding of the value you can provide

- A willingness to defend your solution

- Strategic influence over the decision process

To help your champion internally sell, share tailored use cases and solutions to anticipated concerns. You can even go further by partnering with them to conduct a workshop that helps their colleagues understand your product better.

Your relationship with your champion is an ongoing strategic alliance. Think of them less like a chess piece and more like a team member. They are putting themselves on the line for you, so you need to fulfill the promises you make to them.

Qualifying questions to discover your champion include:

- Who on your management team is most excited about our solution?

- Who has been most enthusiastic about our solution during internal meetings?

Qualifying questions to assist your champion could include:

- What barriers do you face when promoting our solution internally?

- How can I help you prove to your colleagues that our solution is necessary?

8. Competition

I’m going to let you in on a secret—your prospect is considering other solutions behind your back!

Actually, they’d be silly not to. But it means more work for you.

The last stage of the MEDDPICC method is to understand, analyze, and outmaneuver your competition. It’s about staying one step ahead and giving yourself a competitive advantage.

First, you must unearth as much information as possible about the competitors your prospects are considering. Try to find out:

- Who they are and what they offer

- Their pricing and pricing structures

- Their strengths and weaknesses

- What makes them unique in the marketplace

- What makes them different than your solution

Create a list of competitors alongside all the market insight and customer feedback you can gather. Also, analyze your work in the previous steps and find where you have a clear competitive advantage. Then, use that information to articulate why your solution offers superior value.

You can use unique selling propositions (USPs), case studies, testimonials, or direct comparisons. Focus more on propping yourself up over bashing the competition. You’ll fare better by actually providing value rather than just sh*t-talking.

Also, consider that your competition can be an existing solution, a homegrown solution, or no solution at all. Make sure you’re clear about why your offering is better than those options as well.

In many ways, your competition is your best teacher. They will show you the gaps in your own solution and how to best compensate for them. Use that to your advantage however you can.

Qualifying questions in the competition stage include:

- Apart from us, what solutions are you considering?

- What makes us stand out against other contenders? (Or vice versa, what makes the competition stand out against us?)

- What concerns do you have when comparing us with competitors?

Making MEDDPICC Work for You: Next Steps

MEDDPIC might seem like a complex process, but that’s because it solves complex problems. To handle it well, you need good tools, especially a CRM.

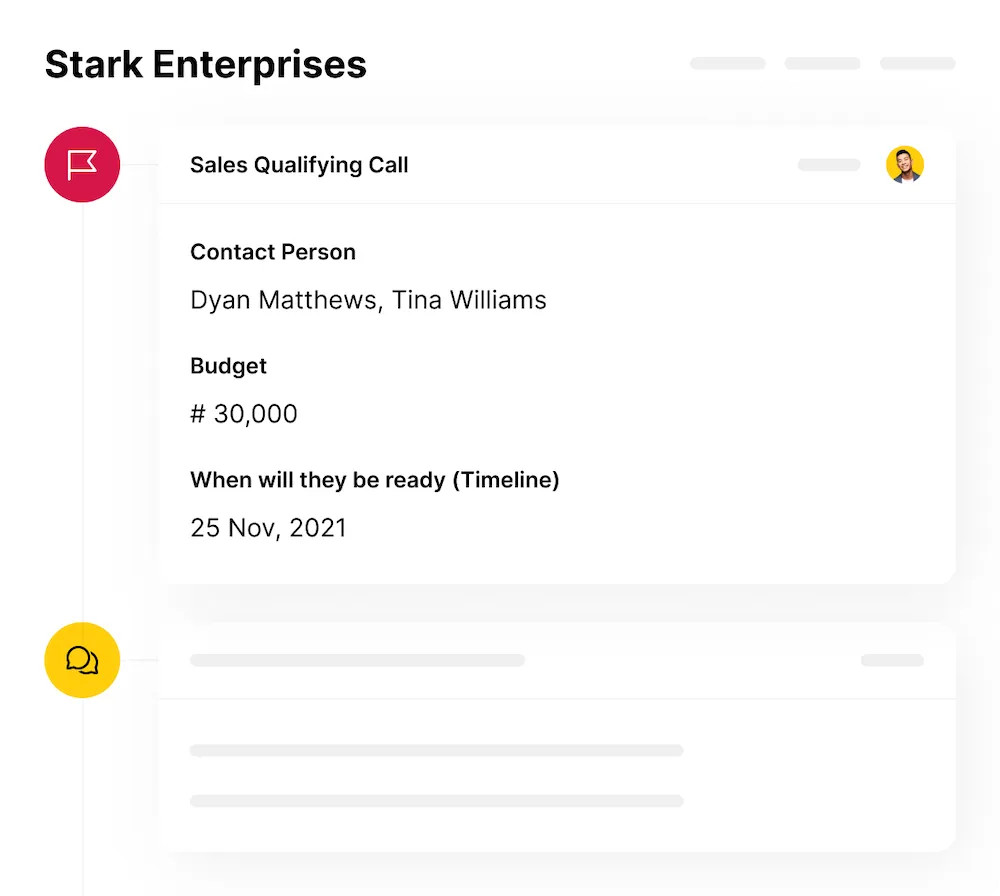

Throughout this long process, you’ll have countless contacts, conversations, and details to track. You’ll also come up with unique insights and data points you need to track and follow up on. The Close CRM system makes it easy to track all of it.

Beyond the typical fields and activities that most CRMs come with, Close allows you to create Custom Fields and Activities. This is critical for easily tracking all the details you’ll need during the MEDDPICC process.

|

Your team can keep the information they gather in a templated, structured place in your CRM. That way, everyone is always on the same page, and your MEDDPICC process flows seamlessly.

Watch our free, on-demand demo to learn how to use Close to organize your deals better, implement processes like MEDDPICC, and win more sales.