The Funding Opportunities Your Business Is Missing Out On

Smooth Sale

MARCH 18, 2024

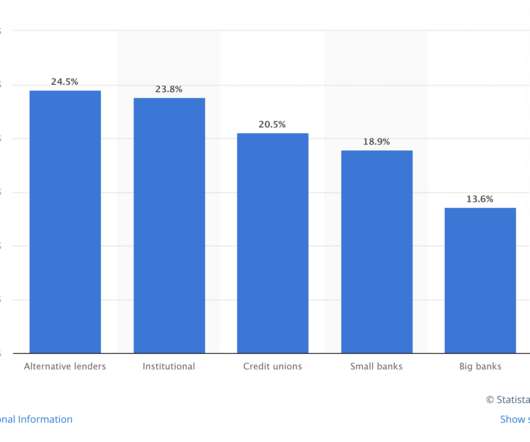

. __ The Funding Opportunities Business Loans/Grants Most business owners are aware of corporate loans. Going to a bank and applying for a business loan is one of the easiest and most successful ways to obtain funding. However, it’s best to remember that other loans exist for comparison. Celebrate Success!

Let's personalize your content