Are You On Target to Achieve Your Financial Goals by Retirement?

Smooth Sale

SEPTEMBER 26, 2023

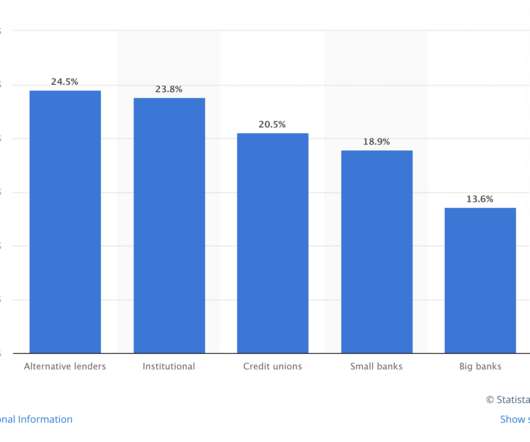

It may seem like a decent income, but preparing for retirement can be daunting when you factor in the myriad financial responsibilities such as student loans, mortgages, childcare, education costs, and healthcare expenses. Pay Down Debt Many Americans carry significant debts, such as student loans and mortgages. Celebrate Success!

Let's personalize your content