What Is Revenue? A Quick Refresher

Hubspot Sales

DECEMBER 3, 2021

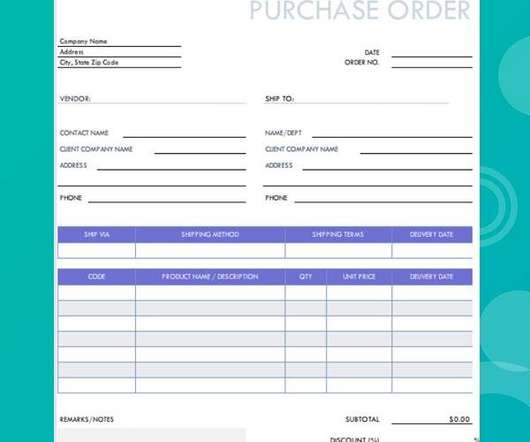

And does it guarantee positive cash flow? Let's get into the basics of revenue, how to calculate it, and how it differs from profit and cash flow. Does Revenue = Cash Flow? If you're generating revenue, you're also generating cold hard cash — right? What does (and doesn't) count as revenue?

Let's personalize your content